What's Happening in the Payments Sector?

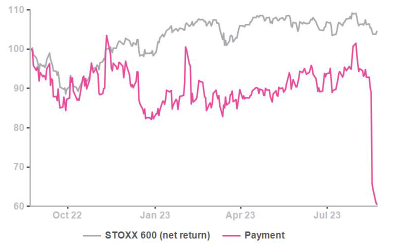

Over the last week, the demise of Adyen (-48%) in the Payment industry has had a big collateral impact for the small sector which lost … 37% due to Adyen’s dominant weight. The silver lining is that the small European payment sector is now better balanced as a listed industry.

Payment gravity

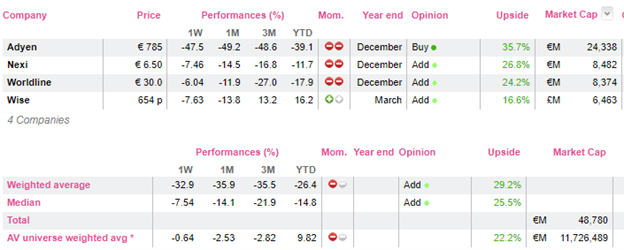

The above stocks fall into three categories: aggregators of legacy payment operations bought out from banks (Nexi and Worldline), money transfers (Wise) and a new entrant with proprietary, leading software in Adyen. Presumably investors were happy to value at 50x or more the underlying potential of Adyen’s software suite, whilst the Nexi and Worldline would trade within the 20-30x bracket.

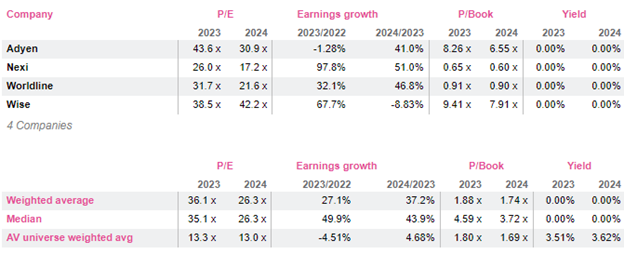

Looking at the 2023-24 multiples, a valuation convergence has been reached.

Payment sector valuation essentials

The crux of the Adyen’s valuation halving is why have investors reacted so negatively to the software development costs. Adyen had made it clear that it was on a hiring binge to expand its software leadership and that it would weigh on its margins. It also was shrewd enough to time its recruitments when the US fintechs had started to unload excess baggage, i.e. at more acceptable wages. And Adyen has considerable leeway to spend on its future as it basically kept hoarding €1-2bn of annual FCF with no acquisitions or dividend planned. What’s not to like for genuine investors? The H1 top-line miss, while marginal, may eventually have been a bigger factor on sentiment with an industry-wide echo. There are still concerns about when the company will deliver the operational leverage that the market was anticipating. Nevertheless, the company's overall health remains intact. We are still talking about 21% revenue growth and a 43% EBITDA margin (vs. PayPal 19.2%). Moreover, the company boasts the most cost-effective ownership structure compared to its peers in the US (the region where the company has encountered heightened competition). This translates into a safety cushion for investors. Should the deceleration of growth persist, the company can shift its attention towards processing increased volumes and temporarily reducing charged fees. Implementing this strategy would strategically position the company to regain any market share that had been lost in the region.

Anyway, the dressing down of the sector leaves a considerable upside potential. We would seize the opportunity.

Payment gravity

The above stocks fall into three categories: aggregators of legacy payment operations bought out from banks (Nexi and Worldline), money transfers (Wise) and a new entrant with proprietary, leading software in Adyen. Presumably investors were happy to value at 50x or more the underlying potential of Adyen’s software suite, whilst the Nexi and Worldline would trade within the 20-30x bracket.

Looking at the 2023-24 multiples, a valuation convergence has been reached.

Payment sector valuation essentials

The crux of the Adyen’s valuation halving is why have investors reacted so negatively to the software development costs. Adyen had made it clear that it was on a hiring binge to expand its software leadership and that it would weigh on its margins. It also was shrewd enough to time its recruitments when the US fintechs had started to unload excess baggage, i.e. at more acceptable wages. And Adyen has considerable leeway to spend on its future as it basically kept hoarding €1-2bn of annual FCF with no acquisitions or dividend planned. What’s not to like for genuine investors? The H1 top-line miss, while marginal, may eventually have been a bigger factor on sentiment with an industry-wide echo. There are still concerns about when the company will deliver the operational leverage that the market was anticipating. Nevertheless, the company's overall health remains intact. We are still talking about 21% revenue growth and a 43% EBITDA margin (vs. PayPal 19.2%). Moreover, the company boasts the most cost-effective ownership structure compared to its peers in the US (the region where the company has encountered heightened competition). This translates into a safety cushion for investors. Should the deceleration of growth persist, the company can shift its attention towards processing increased volumes and temporarily reducing charged fees. Implementing this strategy would strategically position the company to regain any market share that had been lost in the region.

Anyway, the dressing down of the sector leaves a considerable upside potential. We would seize the opportunity.

Subscribe to our blog

Green splurge keeping BP in the slow lane

A deep dive into French state listed assets worth c.€78bn

From losing ~6% in a single day to outperforming a weak sector, know why the stock is still worth a ...