Amundi

Note: This is a daily stock update and the information stands true as of 03/02/26, 09:00 CET.

Company Update:

Net revenue came in 5% better than expected (adjusted net revenues up 8.2% to €899m) thanks to higher management fees owing to stronger AuM, higher performance fees and higher technology revenue. Costs were in line but declined strongly, resulting in a 10pp positive jaws effect and a 50% C/I ratio, below the group’s 2025 target (53%). Adjusted net income was a 8% beat at €376m (vs €377m last year).

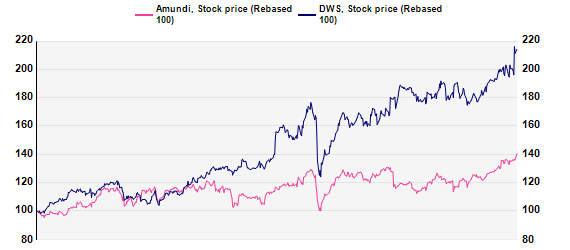

Good numbers and while the stock had a strong run, we still have c25 % upside. Amundi is still very late vs DWS. Still a long in our expert's opinion.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Net revenue came in 5% better than expected (adjusted net revenues up 8.2% to €899m) thanks to higher management fees owing to stronger AuM, higher performance fees and higher technology revenue. Costs were in line but declined strongly, resulting in a 10pp positive jaws effect and a 50% C/I ratio, below the group’s 2025 target (53%). Adjusted net income was a 8% beat at €376m (vs €377m last year).

Amundi announced a €4.25 per share dividend for FY-25 results and complemented with a €500m buyback as the AM returned excess capital to shareholders after the ICG deal in private assets. This provides shareholders with a 9% total yield which makes the stock attractive in our view. We expect a slight positive reaction at the open on the back of the beat although we note that the stock already reacted positively in the past few weeks to the French budget adoption. In addition to that, uncertainties linger regarding market risk for 2026 with the group trading at around 10x its 2027 earnings in the scenario of a Unicredit exit, making the stock relatively fairly valued in this scenario and vulnerable to some profit-taking.

Expert Opinion:Good numbers and while the stock had a strong run, we still have c25 % upside. Amundi is still very late vs DWS. Still a long in our expert's opinion.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog