Carrefour

Note: This is a daily stock update and the information stands true as of 08/07/25, 09:00 CET.

Company Update:

Expert Opinion:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Carrefour and Système U (#1 and #4 in France) announced the creation of a JV called Concordis to strengthen their bargaining powers. The JV will be created for 6 years and will start buying goods as early as 2026. The goal is to catch up with Leclerc but also with AURA, the new procurement JV set by Intermarché, Auchan and Casino. Other members may eventually join Concordis in order to gain more in size and bargaining power (currently €95bn).

Separately, Stephane Maquaire, the CEO of Carrefour Brazil is stepping down and will be replaced by the COO Pablo Lorenzo.

The announcement of the JV in procurement is good news. However, please bear in mind that Carrefour and Système U were once partner in procurement and the last attempt ended in discontent. Hopefully, the outcome will be better this time. The departure of the Carrefour Brazil is more puzzling. However, our expert wouldn't read necessarily too much into it. With the takeover of Carrefour Brazil, the position of CEO is now less attractive, and it can very well be that Stephane Maquaire is seeking new alternatives.

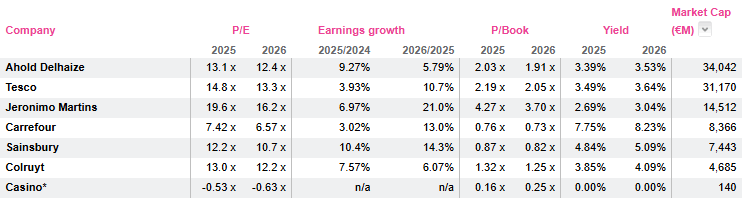

In all, he still views Carrefour as massively undervalued. The stock still trades at a massive discount to its peers in Europe. Yet, this has been true for a (too long) while, and it is hard to find catalysts to unlock this value. He can see two:

1- Carrefour gaining French market share on a lfl basis to Leclerc, which could revive the equity story;

2- A takeover by a third party wishing to expand in France. As a reminder, in January 2021, Couche Tard offered $16.2bn to takeover Carrefour (€20 per share). Yet the deal was blocked by the government citing food security concerns (????).

1- Carrefour gaining French market share on a lfl basis to Leclerc, which could revive the equity story;

2- A takeover by a third party wishing to expand in France. As a reminder, in January 2021, Couche Tard offered $16.2bn to takeover Carrefour (€20 per share). Yet the deal was blocked by the government citing food security concerns (????).

Low valuation and fat dividend yield (7-8%) are reasons enough to keep buying the name and pray for a catalyst to occur.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog