IMI's Compelling Case As A Dependable B&H Pick

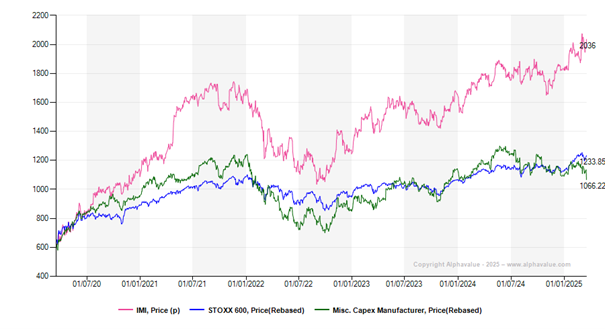

To the keen and discerning eye, IMI has been a valuable lesson in strategic clarity and its reliable execution over the last 5 years. Not to forget patience, for which shareholders have been well rewarded as each £1 invested into IMI has today turned into £3.3 vs. £2.0 for the Stoxx 600. A noteworthy outperformance. What started as a strategic overhaul in 2019, has been more than that. Five years later, the IMI we see has revitalised organic growth, solidified its business model and unlocked sustainable profitability that have gone in tandem with decent shareholder returns. Now, as it embarks on the next phase of its strategy, we believe that IMI makes a compelling case for a place in Buy & Hold portfolios.

Reignited organic growth complemented by prudent inorganic pursuits

A key highlight of the group’s previous 5-year strategy has been a revival in organic revenue growth. This revival has been partially sparked by a targeted use of innovation to address unsolved customer needs that leverage the group’s technical expertise i.e. the Growth Hub in IMI’s parlance. A solution thus developed has not only opened adjacent end-markets but also afforded IMI pricing power and margin accretion. Additionally, the success of this initiative is visible in orders that have grown from £7m in 2020, to £52m in 2022 and to £149m in 2024. Thus, the Growth Hub has improved the quality of IMI’s organic growth and, with the rest of the business areas exposed to resilient end-markets (automation, energy efficiency and healthcare), the group expects organic revenue growth of 5% through the cycle.

On the inorganic front, IMI has pursued its strategy to acquire targets that address growth markets with scalable products and an acceptable moat at reasonable valuations. Importantly, these acquisitions have been done after re-establishing the core of each business area. With 4 bolt-ons – Adaptas (Life Science & Fluid Control), Bahr (Industrial Automation), Heatmiser (Climate Control), and TWTG (Process Automation) – in the last 4 years, IMI has been steadfast in its capital allocation and rationale. Going forward, we expect more of the same.

Unlocked profitability improvements are sustainable

Another key feature of the IMI story has been the steady and noticeable improvement in its adjusted operating margins brought about by a targeted shift towards the margin-accretive aftermarket business and an effective restructuring programme. The former’s operating margins are nearly double those of new equipment with retention rates upwards of 90%. So, with a targeted approach to augment its serviceable base, the share of Aftermarket has risen from 35% of group sales in 2014 to 45% in 2024, thus, reducing the cyclicality of the business and boosting margins. As to the latter, the group has over the last 5 years reduced its footprint and taken extra costs out of the business. This has been done by investing £240m and deriving incremental benefits of £119m. These measures coupled with a better-quality organic growth have helped unlock a 450bps improvement in margin from 14.2% in 2019 to 19.7% in 2024. From this point IMI expects margins to remain above 20% and could see further incremental expansion on a better expected drop-through on its organic growth from here.

Organic growth and adjusted operating margin (%)

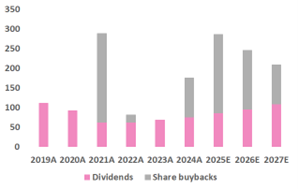

Balance sheet strength could result in additional buybacks

IMI ended 2024 with robust FCF generation and a net debt/adjusted EBITDA of 1.0x, the lower end of its target range. Also, IMI expects to generate more than £1.0bn in FCF over the next 3 years supported by an end to its restructuring programme and a normalised working capital position. This will bolster IMI’s already-good balance sheet. With the management committed to its rigorous approach to M&A, we see further scope for buybacks in the next 3 years, in addition to progressively increasing dividends (c. 30% pay-out ratio, c.2% forward dividend yield). In our opinion, these decent shareholder returns add more allure to the story.

Shareholder returns (£m)

Optionalities on the table

For 2025, IMI’s outlook does not include any recovery in the Industrial Automation or the Life Sciences businesses. On the other hand, Process Automation, with its sturdy order book, and Climate Control, with its 75-80% exposure to the retrofit market, will once again be the cornerstones of IMI’s end-market resilience. Our view is that, beyond 2025 as the Industrial Automation and Life Sciences markets recover, IMI’s revenue growth will show an uptick. Additionally, the group has opened the Hydrogen market through one of its Growth Hub initiatives and has exposure to a potentially resurgent Nuclear market (c. 8-10% of Process Automation sales). thus putting interesting growth options on the table for the medium-term.

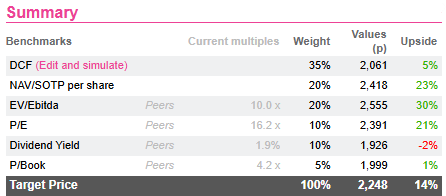

The valuation still has re-rating potential

When we look at IMI’s transformation over the last 5 years, we see i) quality organic growth, ii) sustainable profitability that could further improve, iii) sensible capital allocation, and iv) growth optionality. Qualities that, in our view, are in keeping with a good Buy & Hold story. Crucially, for investors, these qualities are still available at a discount to IMI’s historical PE multiple of 19x and EV/EBIT multiple of 15x, despite a YTD return of 10%. Finally, with IMI’s critical transformation now in the rear-view mirror, we also believe there is a case for a re-rating of IMI’s multiples vs. its peers. Something that we expect to play out over the medium-term.

Reignited organic growth complemented by prudent inorganic pursuits

A key highlight of the group’s previous 5-year strategy has been a revival in organic revenue growth. This revival has been partially sparked by a targeted use of innovation to address unsolved customer needs that leverage the group’s technical expertise i.e. the Growth Hub in IMI’s parlance. A solution thus developed has not only opened adjacent end-markets but also afforded IMI pricing power and margin accretion. Additionally, the success of this initiative is visible in orders that have grown from £7m in 2020, to £52m in 2022 and to £149m in 2024. Thus, the Growth Hub has improved the quality of IMI’s organic growth and, with the rest of the business areas exposed to resilient end-markets (automation, energy efficiency and healthcare), the group expects organic revenue growth of 5% through the cycle.

On the inorganic front, IMI has pursued its strategy to acquire targets that address growth markets with scalable products and an acceptable moat at reasonable valuations. Importantly, these acquisitions have been done after re-establishing the core of each business area. With 4 bolt-ons – Adaptas (Life Science & Fluid Control), Bahr (Industrial Automation), Heatmiser (Climate Control), and TWTG (Process Automation) – in the last 4 years, IMI has been steadfast in its capital allocation and rationale. Going forward, we expect more of the same.

Unlocked profitability improvements are sustainable

Another key feature of the IMI story has been the steady and noticeable improvement in its adjusted operating margins brought about by a targeted shift towards the margin-accretive aftermarket business and an effective restructuring programme. The former’s operating margins are nearly double those of new equipment with retention rates upwards of 90%. So, with a targeted approach to augment its serviceable base, the share of Aftermarket has risen from 35% of group sales in 2014 to 45% in 2024, thus, reducing the cyclicality of the business and boosting margins. As to the latter, the group has over the last 5 years reduced its footprint and taken extra costs out of the business. This has been done by investing £240m and deriving incremental benefits of £119m. These measures coupled with a better-quality organic growth have helped unlock a 450bps improvement in margin from 14.2% in 2019 to 19.7% in 2024. From this point IMI expects margins to remain above 20% and could see further incremental expansion on a better expected drop-through on its organic growth from here.

Organic growth and adjusted operating margin (%)

Balance sheet strength could result in additional buybacks

IMI ended 2024 with robust FCF generation and a net debt/adjusted EBITDA of 1.0x, the lower end of its target range. Also, IMI expects to generate more than £1.0bn in FCF over the next 3 years supported by an end to its restructuring programme and a normalised working capital position. This will bolster IMI’s already-good balance sheet. With the management committed to its rigorous approach to M&A, we see further scope for buybacks in the next 3 years, in addition to progressively increasing dividends (c. 30% pay-out ratio, c.2% forward dividend yield). In our opinion, these decent shareholder returns add more allure to the story.

Shareholder returns (£m)

Optionalities on the table

For 2025, IMI’s outlook does not include any recovery in the Industrial Automation or the Life Sciences businesses. On the other hand, Process Automation, with its sturdy order book, and Climate Control, with its 75-80% exposure to the retrofit market, will once again be the cornerstones of IMI’s end-market resilience. Our view is that, beyond 2025 as the Industrial Automation and Life Sciences markets recover, IMI’s revenue growth will show an uptick. Additionally, the group has opened the Hydrogen market through one of its Growth Hub initiatives and has exposure to a potentially resurgent Nuclear market (c. 8-10% of Process Automation sales). thus putting interesting growth options on the table for the medium-term.

The valuation still has re-rating potential

When we look at IMI’s transformation over the last 5 years, we see i) quality organic growth, ii) sustainable profitability that could further improve, iii) sensible capital allocation, and iv) growth optionality. Qualities that, in our view, are in keeping with a good Buy & Hold story. Crucially, for investors, these qualities are still available at a discount to IMI’s historical PE multiple of 19x and EV/EBIT multiple of 15x, despite a YTD return of 10%. Finally, with IMI’s critical transformation now in the rear-view mirror, we also believe there is a case for a re-rating of IMI’s multiples vs. its peers. Something that we expect to play out over the medium-term.

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...