Nearly 5 years after Covid, some unexpected sector winners

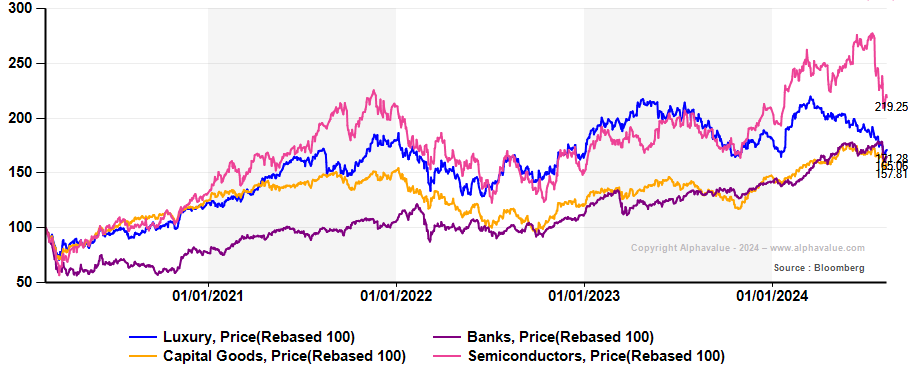

Time is a great leveller. Look at the sector performance since the onset of Covid (late February 2022) and a hard-to-believe trio emerges that no one would have proposed as winners: Banks, Capital Goods and Luxury. Interestingly only Semiconductors have done better over the same period and not by a wide margin after their correction of the last month. Excluding ASML, however, the sector would have been a dog.

Nearly 5 years after the Covid-triggered turmoil and a rates-driven bull sentiment up to 2022, followed by a more difficult 2023, the sector performance pecking order is clearly not where it was expected to be.

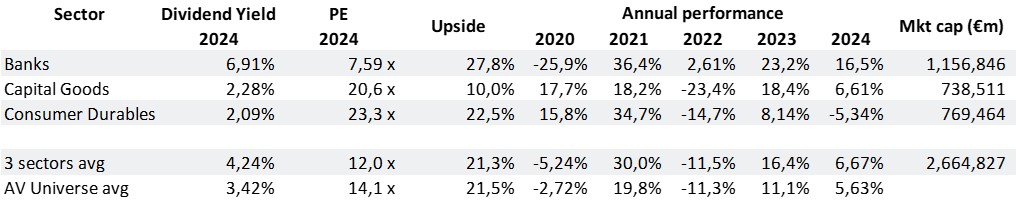

Here is a summary table of the €3Tn in market cap that led the post-Covid show. This covers about 20% of the coverage universe and offers 21% spot upside.

Over such a long investment period, it is hard to conclude that this performance reflects an accident. Capital Goods do surf on the green capex wave, Banks on the higher interest rate cycle and Consumer Durables (aka Luxury) on the Chinese enduring appetite for foreign luxury. Obviously Banks look more fragile than the two other sectors as their recent wealth has been decided by the Central Banks but they may well have restructured in depth their business models. Market doubts are clearly being relayed by the low PEs.

Capital Goods are dear as they are seen as capturing the endless spending by corporates to deliver on their green grail. The unanswerable question mark remains Luxury as a first equipment market such as China is unlikely to be found twice even if India comes to mind.

We would keep our exposure to Capital Goods (at least for the largest caps) and to a lesser extent to Banks.

Nearly 5 years after the Covid-triggered turmoil and a rates-driven bull sentiment up to 2022, followed by a more difficult 2023, the sector performance pecking order is clearly not where it was expected to be.

Here is a summary table of the €3Tn in market cap that led the post-Covid show. This covers about 20% of the coverage universe and offers 21% spot upside.

Over such a long investment period, it is hard to conclude that this performance reflects an accident. Capital Goods do surf on the green capex wave, Banks on the higher interest rate cycle and Consumer Durables (aka Luxury) on the Chinese enduring appetite for foreign luxury. Obviously Banks look more fragile than the two other sectors as their recent wealth has been decided by the Central Banks but they may well have restructured in depth their business models. Market doubts are clearly being relayed by the low PEs.

Capital Goods are dear as they are seen as capturing the endless spending by corporates to deliver on their green grail. The unanswerable question mark remains Luxury as a first equipment market such as China is unlikely to be found twice even if India comes to mind.

We would keep our exposure to Capital Goods (at least for the largest caps) and to a lesser extent to Banks.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...