New entrant puts pressure on European gas markets

Additional gas supply coming from the US distorts an already tight summer market. Norway and Russia are not inclined to let go market share, leading gas spot prices to reach new lows in Europe. Equinor is the most exposed to European gas markets under AV’s coverage. We expect the other European oil & gas integrated companies to mitigate partially this decline

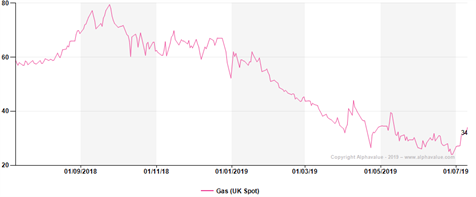

European spot prices are down 30-35% qoq, with Dutch TTF trading at around €10/MWh (c. $3.5/mmbtu) and UK NBP at around 34p/therm (c. $4.5/mmbtu):

No cartel in this price war

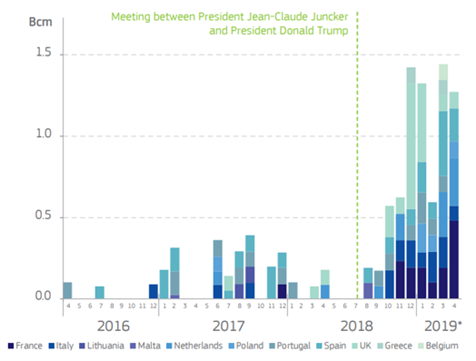

Europe is spoilt with gas this summer as US LNG is ramping up:

Source: European Commission

Exporting less than 15bcm this year, the US is small compared to Russia, which remains the market leader with flows of around 160bcm of gas to Europe, followed by Norway with around 120bcm in 2018 (according to Norsk Petroleum).

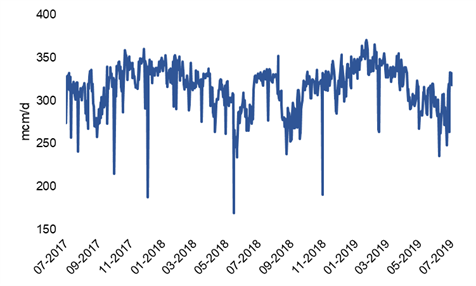

Nonetheless, in what looks like a price war, Russia and Norway are testing US breakeven prices. Note, for instance, that Norwegian flows to Europe are back up at the beginning of this month:

Source: Gassco, Bloomberg

Europe consumes around 475bcm of gas per year and short-term demand is not stretchable as gas power plants are running at full capacity and a mild winter gave healthy storage levels with limited room to inject.

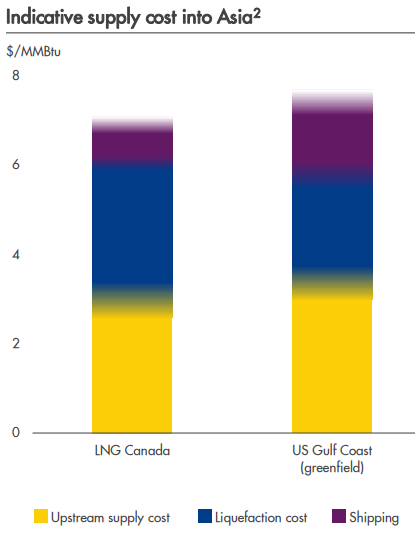

Below €10/MWh (c. $3.5/mmbtu), we reckon US LNG is hardly profitable, as we estimate shipping at c. $1-1.5/mmbtu from the US Gulf of Mexico and gas supply at c. $2-2.5/mmbtu. In any case, LNG carriers should be directed towards Asia as this region currently offers more upside (JKM spot prices at c. $4.5/mmbtu).

Persistent low prices in Europe is bad news for the next wave of US LNG projects. With the need of securing long-term contracts and the ongoing trade war with China, it leaves Japan as the best buyer.

For reference, Shell saw US Gulf Coast projects slightly below $8/mmbtu:

Source: Shell company presentation

Realisation prices are a mix of several factors

We believe the most sensitive to lower European gas prices is Equinor. Around 75% of the gas production is produced in Norway and therefore directed to Europe, on which realised prices track TTF closely:

Source: company reports, Bloomberg

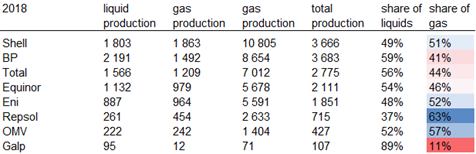

Other oil & gas integrated companies will be less impacted. Companies extract gas far off the old continent, and we estimate that around 10-15% of their gas production is sold in Europe on a spot basis.

Integrated companies’ production breakdown only tells part of the story:

Source: company reports, AV estimate

The gas produced either flows via pipelines or is liquefied and exported via LNG carriers.

30% of the LNG is imported on a short-term basis, leaving the vast majority priced on oil as long-term contracts. Some optimisation is done on a spot basis but this can go two ways and benefits global LNG players with flexibility such as Shell and Total. LNG books are therefore partly protected. On a long-term basis though, there is always the risk of seeing contract renegotiations if the gap between spot prices and contract prices persists.

Pipeline gas still has liquids-based prices, especially in markets where gas trading is not developed. Gas is often sold on domestic markets at lower prices than in Europe (e.g. Galp in Brazil, OMV in Russia, Eni in Libya, Repsol in Venezuela), on which pricing can be oil-indexed or fixed.

European integrated companies report realisation prices that are lower than European spot prices and higher than Henry Hub, which reflect the sales mix and volumes sold on domestic markets. Average realisation prices are also less volatile than spot prices, which confirms the use of long-term contracts.

Despite having the largest share of gas in its production, Repsol seems rather insulated from European spot, with part of its production sold at fixed prices, and more dependent to US gas prices (with around 30% of gas production in North America).

Lastly, note some portfolio effects that can mitigate temporary weakness. OMV, for instance, has reported a 12% decline in realised gas prices in Q2 (compared to a 30% decline for TTF), as volumes sold in Russia are seasonally low (hence raising the share of more expensive gas sold in Europe).

Request full report : click here