Novo Nordisk

Note: This is a daily stock update and the information stands true as of 23/12/25, 09:00 CET.

Company Update:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Novo Nordisk’s oral Wegovy, which is set to become the first pill amongst the latest generation GLP-1 weight-loss drugs, has been approved by the US FDA, and the firm expects to launch the pill in early January 2026.

While Eli Lilly is not far behind with its own Orforglipron pill, Novo’s oral Wegovy (15-16% weight-loss potential) is apparently more efficacious than Orforglipron (12.4% average weight-loss in phase III trials), and this should be capitalized well by Novo in its marketing campaign. Oral obesity drugs are the new frontier in the battle between Novo and Lilly, and a lot of investors should be watching the early uptake of Novo’s oral pill, since a favorable result on this front could be a huge sentiment booster for Novo. Pills are easier to manufacture and scale for the pharma companies, and convenient (vs. injections) for quite a lot of patients, which is why they are envisioned to provide a massive push to the obesity market expansion.

Novo’s US-listed shares were up c.9% in the after-hours of trading, and we expect a similar reaction for the Denmark-listed shares.

Expert Opinion:This could be a game-changer for Novo, if only on perception. If indeed its pill is more efficient than that of Eli Lilly, the group could gain back some of the market shares it lost in the US, especially since they may have a 3-month head start. Obviously, the addressable market for a pill rather than for an injectable product is massively larger. Note that the margin of the oral product could be lower than that of the injectable products despite the lack of a syringe ($2 to 4 per unit) because the amount of Semaglutide needed is significantly higher. Yet the boost in volumes could be massive as

1/ needle phobia is massive and a hurdle to acceptance and

2/ Syringe filling lines is currently the bottleneck.

Now, the execution of the commercial rollout of this new product will be key. Will the new management be able to do that smoothly? One can hope so especially as they have demonstrated a willingness to do things better.

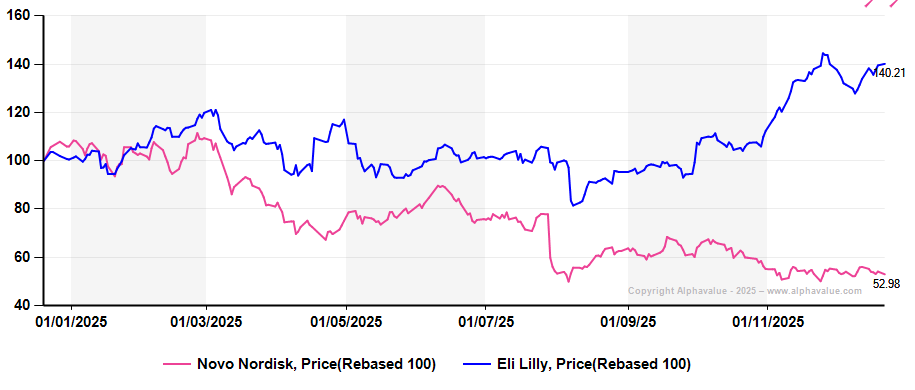

Our expert still believes the Novo's share price is staggeringly low considering its potential. There was excess on the way up but the current valuation is excessively discounted. Novo Nordisk trades with a PE of 12x for 2025 vs 47.1x for Eli Lilly. The performance gap between the shares is massive (see graph below). While he doesn't expect the gap to close overnight, he expects it will massively narrow in 2026 and Novo is in his view a must-have stock in Q1 26.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog