Sanofi

Note: This is a daily stock update and the information stands true as of 24/10/25, 09:00 CET.

Company Update:

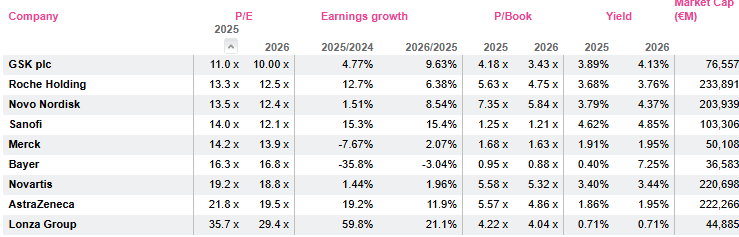

Momentum remains strong and the performance in Q3 is good news. As the beat comes partially from Dupixent, the market reaction may be more muted. Sanofi needs to demonstrate its pipeline can generate more blockbusters to offset the drop in Dupixent sales once its patents expire. Our expert still likes Roche at these levels, which offers in his opinion the most favorable risk-reward profile in the sector.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Q3 sales came in in line with expectations, up 7% lfl at €12.4bn (2.3% reported due to forex)

Operating profit was 7% at €4.45bn vs consensus at €4.15bn

Net income at €2.8bn.

The quarter was boosted by the strong performance of Dupixent (+26.2% to €4bn sales ow €3bn in the US) and rare disease drugs.

FY Guidance is maintained but bear in mind it had been upgraded in Q2.

Expert Opinion: Momentum remains strong and the performance in Q3 is good news. As the beat comes partially from Dupixent, the market reaction may be more muted. Sanofi needs to demonstrate its pipeline can generate more blockbusters to offset the drop in Dupixent sales once its patents expire. Our expert still likes Roche at these levels, which offers in his opinion the most favorable risk-reward profile in the sector.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog