Telecoms Inch Higher

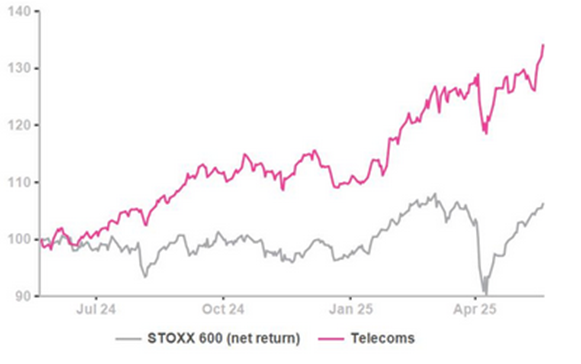

Two months ago (25-03: Telcos have their epiphany moment) we expressed surprise at the then-ytd performance of the sector. At the time, markets still had a positive mindset about the Trump policies meaning that there was no real case to go for defensive stocks. After the bust and boom related to the on-off tariff posturing of the US administration, Telcos are aiming for the sky and even happen to be the best performers of the last week of trading.

Telcos on fire?

For once it is not Deutsche Telekom (roughly a third of the sector's market cap, 6% up over the week) but more minor players running the show: United Internet (up by 16%, pulled up by the Ionos acceleration), Vodafone (up by 13% in spite of mediocre achievements in Germany) and Orange (up by 8%, for no good reason). In effect the better sentiment is across the board with only Hellenic Telekom lagging. Ytd the sector is up by … nearly 22%.

So what has been driving this rebirth? Two months ago, we suggested that regulators would be somewhat more amenable to sector consolidation: Vodafone has its UK merger with Three, SFR/Altice is on the block and quite possibly likely to end up in the hands of the other 3 French players, UI is building up its stake in 1&1, Xavier Niel is building up a small cross border empire (Free in France, Tele2 in Sweden, Millicom in Colombia, Iliad Italia) thereby forcing hitherto-inward-looking European telcos to think again and grow through acquisition.

It may also be that the European regulators are willing to support European telcos in their battle for eyeballs against the US big tech players as linear TV is gone, and media consumers have moved on to TikTok and streaming. If the tariff crisis prospers, it is not inconceivable that Europe will be more demanding about respect of its DMA/DSA regulation thus keeping at bay some of the US data/media services and opening business options for European players. This is speculative thinking.

Is it worth taking the risk?

The sector is no longer dirt cheap, i.e. the risk premium has tightened. As a dividend-paying sector, 2025 yields have retreated to 4.2% from 5%+ not so long ago. The relative erosion is quite clear (see next chart). Telcos are clearly competing with the huge pay-outs from Financials. From an earnings growth perspective though, the sector is comparably attractive.

Telcos valuation essentials

Telcos’ yield is less impressive

Further investor interest in the sector may thus soon see it arrive in expensive territory. AlphaValue still sees an enticing 19% combined upside potential but this is largely owed to DCFs that fail to capture the lag of the sector when it comes to effectively booking the positive jaw effect of lower capex and firming up prices. The renewed price competition in France (4 players of which one, SFR, cannot pay its debtors) may be construed as a first warning.

Telcos on fire?

For once it is not Deutsche Telekom (roughly a third of the sector's market cap, 6% up over the week) but more minor players running the show: United Internet (up by 16%, pulled up by the Ionos acceleration), Vodafone (up by 13% in spite of mediocre achievements in Germany) and Orange (up by 8%, for no good reason). In effect the better sentiment is across the board with only Hellenic Telekom lagging. Ytd the sector is up by … nearly 22%.

So what has been driving this rebirth? Two months ago, we suggested that regulators would be somewhat more amenable to sector consolidation: Vodafone has its UK merger with Three, SFR/Altice is on the block and quite possibly likely to end up in the hands of the other 3 French players, UI is building up its stake in 1&1, Xavier Niel is building up a small cross border empire (Free in France, Tele2 in Sweden, Millicom in Colombia, Iliad Italia) thereby forcing hitherto-inward-looking European telcos to think again and grow through acquisition.

It may also be that the European regulators are willing to support European telcos in their battle for eyeballs against the US big tech players as linear TV is gone, and media consumers have moved on to TikTok and streaming. If the tariff crisis prospers, it is not inconceivable that Europe will be more demanding about respect of its DMA/DSA regulation thus keeping at bay some of the US data/media services and opening business options for European players. This is speculative thinking.

Is it worth taking the risk?

The sector is no longer dirt cheap, i.e. the risk premium has tightened. As a dividend-paying sector, 2025 yields have retreated to 4.2% from 5%+ not so long ago. The relative erosion is quite clear (see next chart). Telcos are clearly competing with the huge pay-outs from Financials. From an earnings growth perspective though, the sector is comparably attractive.

Telcos valuation essentials

Telcos’ yield is less impressive

Further investor interest in the sector may thus soon see it arrive in expensive territory. AlphaValue still sees an enticing 19% combined upside potential but this is largely owed to DCFs that fail to capture the lag of the sector when it comes to effectively booking the positive jaw effect of lower capex and firming up prices. The renewed price competition in France (4 players of which one, SFR, cannot pay its debtors) may be construed as a first warning.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...