A Fettered Hikma Needs Biosimilar Wings

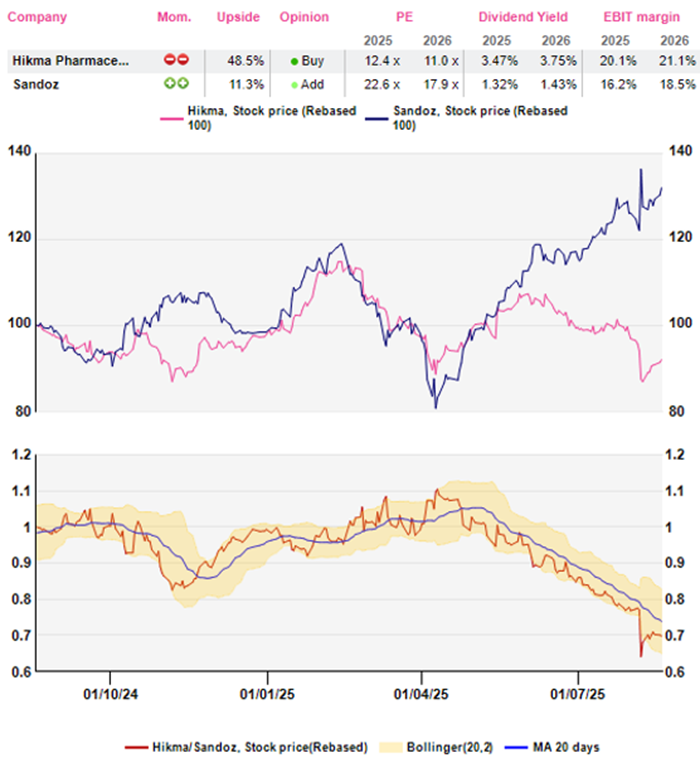

Following Donald Trump’s tariff threats and given the generic/biosimilar medicine makers’ relatively thin profitability, the markets were quick to bash the generic drugmakers, including Hikma (Buy; UK) and Sandoz (Add; Switzerland). While Sandoz’s shares have flown very far from their April 2025 lows, Hikma is still languishing at around the same levels.

Similar business, diverse expectations

An interesting case of Hikma’s undervaluation vs. Sandoz

At first glance, the c.45% discount of the Hikma 2025e P/E to that of Sandoz comes as a big surprise given that Hikma 1/ generates better operating margins (average c.21% over 2020-24 vs. c.16% for Sandoz); 2/ is targeting higher top-line growth for 2024-27 (6-8% for Hikma vs. mid-single digit for Sandoz); and 3/ is anticipated to clock a similar return on capital employed in the mid-term (c.14% average over 2025-27 vs. c.15% for Sandoz).

So what is Sandoz’s secret sauce? Its dominant position in biosimilars which not only adds a high-speed top-line engine but is also more profitable, selling at a 15-35% discount to original drugs vs. the generics’ up to 80-85% discounts. With the growing adoption of biologic (i.e. made from living cells) medicines, biosimilar sales should gallop at nearly +20% pa over the medium-to-long run vs. just c.+4% for generics. Biosimilars contribute c.30% of Sandoz’s sales, a figure not reported by Hikma, but which is likely lower.

Hikma’s better operating profitability is partly owed to its greater sales exposure to the US (c.60% vs. c.18% for Sandoz), where medicines sell for better prices than in the rest of the world. For now. However, we foresee Sandoz’s operating margins gradually converging towards those of Hikma.

Lastly, Sandoz spends c.9% of its sales on R&D vs. c.6% for Hikma, clearly an edge in terms of developing new complex generics/biosimilars and reaching first to the market – two crucial factors in this industry.

Thus, Sandoz commanding a relative valuation premium over Hikma is somewhat justified.

So, what is Hikma’s path forward?

Hikma can take a leaf out of Sandoz’s book and start investing materially in biosimilar development to prop up its shares. Note that Hikma’s shares have remained range-bound over the last 10 years, despite its adjusted attributable net profit expanding by c.89% over 2016-24.

Nonetheless, Hikma has been making efforts to bring in more defensibility to its portfolio exposed to the intensely competitive generics/biosimilars market. Its R&D to sales ratio increased from an average of c.3% over 2007-15 to average c.6% over 2016-24. Also, despite the persistent pricing pressure in this industry, the firm’s underlying operating margin (average: c.20%) has been resilient over 2016-24.

Biosimilars and complex Injectable products: In the near term, Hikma’s sales are likely to receive a shot in the arm from the addition of two biosimilars, Ustekinumab (originator immunology drug Stelara clocked $10.9bn sales in 2023) and Denosumab (for osteoporosis; Amgen’s originator drugs, Prolia and Xgeva, generated $6.6bn sales in 2024). Hikma’s ability to launch newer products is corroborated by its 128 new injectable medicine launches over 2016-24. Among the >100 generic injectable medicine suppliers in the US, Hikma now ranks no.3 (in volume terms), behind only Pfizer and Fresenius. Injectables are Hikma’s largest sales (c.42% of total) and profitability (c.56% of ‘core’ operating profit; COP) contributor.

Also, in the medium-to-long term, the industry should receive a huge boost from the patent expiries of the currently booming GLP-1 weight-loss treatments (original drugs’ market size anticipated to reach $80-100bn by 2030).

Within non-injectable generics (Hikma Rx; c.33% of sales; includes tablets, capsules, etc.) as well, Hikma is a top-two supplier for 57% of its US portfolio. Given the persistent pricing pressure on simple generics, Hikma aims to increase the share of specialty and complex generic medicines in its portfolio, including those for cancer and cardiovascular ailments. The respiratory medicines in the firm’s pipeline – including the asthma and COPD treatments, Ellipta and Respimat, and climate-friendly metered dose inhalers – address a market worth billions of dollars. Also, the firm’s efforts to expand its contract manufacturing (CMO) business cannot be overlooked, since the management expects the CMO business to account for 20% of Hikma Rx sales by 2030. The firm’s manufacturing strength becomes crucial, especially when the US tariff threats loom over the industry.

Interestingly, Hikma is relatively shielded from severe US tariffs, as the majority of its US sales are supplied from its US manufacturing base.

Branded medicines in MENA (24% of sales): Hikma’s strategy to expand its presence in chronic ailments, including cancer, diabetes, cardiovascular diseases and neuroscience has made it the second largest firm in the MENA region. The near-term performance in MENA should be driven by new launches, including the breast cancer treatment palbociclib (a generic version of Pfizer’s Ibrance; >$5bn peak sales in 2021). Importantly, it is hard to ignore the Darwazah family’s (controlling c.27% stake) political connections, which should remain a strong support in expanding operations in this region.

Medium-term outlook better than expectations

Backed by the above-discussed factors, Hikma is targeting sales and COP to grow at respective CAGRs of 6-8% and 7-9% over 2024-27, and $5bn of sales by 2030, implying an c.8% CAGR since 2024. This outlook exceeds the street’s expectations of sales and COP CAGRs of <6% and <7%, respectively, over 2024-27 – which reinforces the case for Hikma’s re-rating, provided execution remains solid.

Hikma deserves better recognition

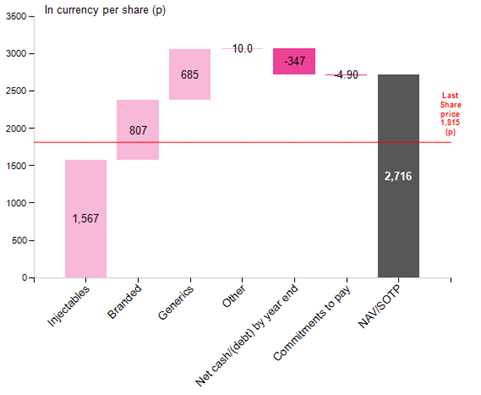

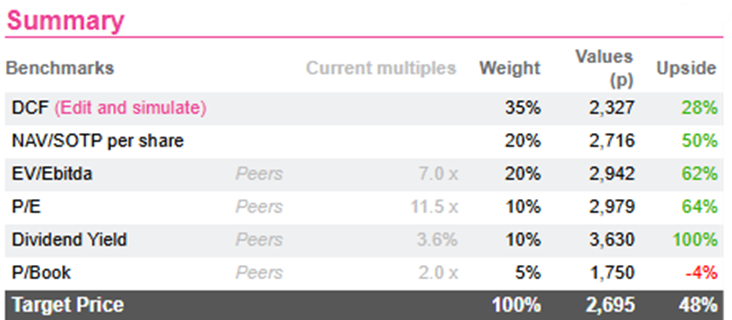

Hikma’s shares trade at a 2025e EV/sales multiple of <2x which, in our view, does not imply any upside from the increasing adoption of biosimilars. Note that we have assigned an EV/sales multiple of 4x to Sandoz’s biosimilar business in our SOTP valuation. Interestingly, as per our SOTP valuation (see chart below) for Hikma, its current market capitalisation is largely equivalent to the value of just the ‘Injectables’ and ‘Branded’ segments minus the net debt – implying that the non-injectable ‘Generics’(c.21% of COP) business comes as a complementary service.

Hence, with much of Sandoz’s upside already captured, betting on Hikma’s (albeit still nascent) growth in its biosimilar wings may not hurt.

Similar business, diverse expectations

An interesting case of Hikma’s undervaluation vs. Sandoz

At first glance, the c.45% discount of the Hikma 2025e P/E to that of Sandoz comes as a big surprise given that Hikma 1/ generates better operating margins (average c.21% over 2020-24 vs. c.16% for Sandoz); 2/ is targeting higher top-line growth for 2024-27 (6-8% for Hikma vs. mid-single digit for Sandoz); and 3/ is anticipated to clock a similar return on capital employed in the mid-term (c.14% average over 2025-27 vs. c.15% for Sandoz).

So what is Sandoz’s secret sauce? Its dominant position in biosimilars which not only adds a high-speed top-line engine but is also more profitable, selling at a 15-35% discount to original drugs vs. the generics’ up to 80-85% discounts. With the growing adoption of biologic (i.e. made from living cells) medicines, biosimilar sales should gallop at nearly +20% pa over the medium-to-long run vs. just c.+4% for generics. Biosimilars contribute c.30% of Sandoz’s sales, a figure not reported by Hikma, but which is likely lower.

Hikma’s better operating profitability is partly owed to its greater sales exposure to the US (c.60% vs. c.18% for Sandoz), where medicines sell for better prices than in the rest of the world. For now. However, we foresee Sandoz’s operating margins gradually converging towards those of Hikma.

Lastly, Sandoz spends c.9% of its sales on R&D vs. c.6% for Hikma, clearly an edge in terms of developing new complex generics/biosimilars and reaching first to the market – two crucial factors in this industry.

Thus, Sandoz commanding a relative valuation premium over Hikma is somewhat justified.

So, what is Hikma’s path forward?

Hikma can take a leaf out of Sandoz’s book and start investing materially in biosimilar development to prop up its shares. Note that Hikma’s shares have remained range-bound over the last 10 years, despite its adjusted attributable net profit expanding by c.89% over 2016-24.

Nonetheless, Hikma has been making efforts to bring in more defensibility to its portfolio exposed to the intensely competitive generics/biosimilars market. Its R&D to sales ratio increased from an average of c.3% over 2007-15 to average c.6% over 2016-24. Also, despite the persistent pricing pressure in this industry, the firm’s underlying operating margin (average: c.20%) has been resilient over 2016-24.

Biosimilars and complex Injectable products: In the near term, Hikma’s sales are likely to receive a shot in the arm from the addition of two biosimilars, Ustekinumab (originator immunology drug Stelara clocked $10.9bn sales in 2023) and Denosumab (for osteoporosis; Amgen’s originator drugs, Prolia and Xgeva, generated $6.6bn sales in 2024). Hikma’s ability to launch newer products is corroborated by its 128 new injectable medicine launches over 2016-24. Among the >100 generic injectable medicine suppliers in the US, Hikma now ranks no.3 (in volume terms), behind only Pfizer and Fresenius. Injectables are Hikma’s largest sales (c.42% of total) and profitability (c.56% of ‘core’ operating profit; COP) contributor.

Also, in the medium-to-long term, the industry should receive a huge boost from the patent expiries of the currently booming GLP-1 weight-loss treatments (original drugs’ market size anticipated to reach $80-100bn by 2030).

Within non-injectable generics (Hikma Rx; c.33% of sales; includes tablets, capsules, etc.) as well, Hikma is a top-two supplier for 57% of its US portfolio. Given the persistent pricing pressure on simple generics, Hikma aims to increase the share of specialty and complex generic medicines in its portfolio, including those for cancer and cardiovascular ailments. The respiratory medicines in the firm’s pipeline – including the asthma and COPD treatments, Ellipta and Respimat, and climate-friendly metered dose inhalers – address a market worth billions of dollars. Also, the firm’s efforts to expand its contract manufacturing (CMO) business cannot be overlooked, since the management expects the CMO business to account for 20% of Hikma Rx sales by 2030. The firm’s manufacturing strength becomes crucial, especially when the US tariff threats loom over the industry.

Interestingly, Hikma is relatively shielded from severe US tariffs, as the majority of its US sales are supplied from its US manufacturing base.

Branded medicines in MENA (24% of sales): Hikma’s strategy to expand its presence in chronic ailments, including cancer, diabetes, cardiovascular diseases and neuroscience has made it the second largest firm in the MENA region. The near-term performance in MENA should be driven by new launches, including the breast cancer treatment palbociclib (a generic version of Pfizer’s Ibrance; >$5bn peak sales in 2021). Importantly, it is hard to ignore the Darwazah family’s (controlling c.27% stake) political connections, which should remain a strong support in expanding operations in this region.

Medium-term outlook better than expectations

Backed by the above-discussed factors, Hikma is targeting sales and COP to grow at respective CAGRs of 6-8% and 7-9% over 2024-27, and $5bn of sales by 2030, implying an c.8% CAGR since 2024. This outlook exceeds the street’s expectations of sales and COP CAGRs of <6% and <7%, respectively, over 2024-27 – which reinforces the case for Hikma’s re-rating, provided execution remains solid.

Hikma deserves better recognition

Hikma’s shares trade at a 2025e EV/sales multiple of <2x which, in our view, does not imply any upside from the increasing adoption of biosimilars. Note that we have assigned an EV/sales multiple of 4x to Sandoz’s biosimilar business in our SOTP valuation. Interestingly, as per our SOTP valuation (see chart below) for Hikma, its current market capitalisation is largely equivalent to the value of just the ‘Injectables’ and ‘Branded’ segments minus the net debt – implying that the non-injectable ‘Generics’(c.21% of COP) business comes as a complementary service.

Hence, with much of Sandoz’s upside already captured, betting on Hikma’s (albeit still nascent) growth in its biosimilar wings may not hurt.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.