Household Or Cosmetics/Reckitt Or L'Oréal

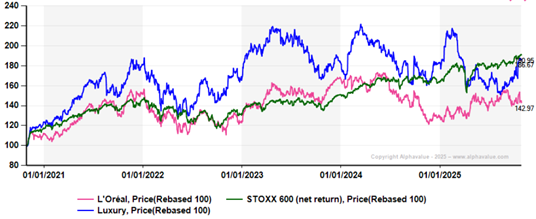

Sector wise, Cosmetics are widely associated with Luxury. Cosmetics by that definition, are a by-word for L’Oréal, which has been in sync with Luxury over the last five years. L’Oréal has actually underperformed, including vs. the Stoxx600 (see chart). From late summer 2025, L’Oréal also seems to have disconnected from Luxury. This mediocre 5 years showing was not expected.

L'Oréal (in pink) lost contact with Luxury(blue) and the Stoxx600 (green)

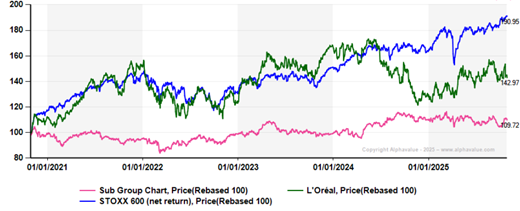

If one dares classify L’Oréal as a Household-type stock with volume personal care offerings, it may be not that different from what is available at Henkel or Reckitt. The performance picture (next chart), is one where L’Oréal does better than Households ex L’Oréal, but both have been a waste of time over the last 5 years. L’Oréal lost contact with the Stoxx600 from mid 2024, when Households became a bit more robust.

L’Oréal (green) vs. Households ex l’Oréal (pink) vs. Stoxx600 (blue)

L'Oréal (in pink) lost contact with Luxury(blue) and the Stoxx600 (green)

If one dares classify L’Oréal as a Household-type stock with volume personal care offerings, it may be not that different from what is available at Henkel or Reckitt. The performance picture (next chart), is one where L’Oréal does better than Households ex L’Oréal, but both have been a waste of time over the last 5 years. L’Oréal lost contact with the Stoxx600 from mid 2024, when Households became a bit more robust.

L’Oréal (green) vs. Households ex l’Oréal (pink) vs. Stoxx600 (blue)

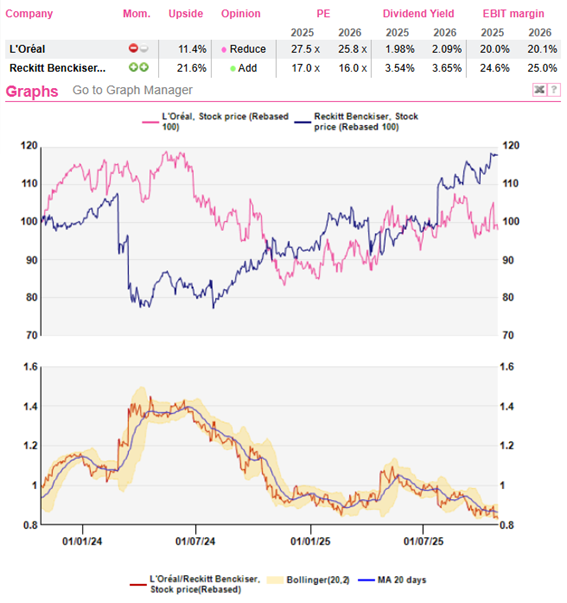

An even more provocative chart would compare mighty L’Oréal with humbled Reckitt, and tell a story whereby the 4-times smaller UK company, is outperforming and looks comparably quite attractive, even on the Ebit margin front. It is much cheaper too, in PE and yield terms.

L’Oréal vs. Reckitt valuation essentials

Quite a while ago, Reckitt made its Mead Johnston strategic mistake, a painful one by any corporate standard. That is now behind them, but triggered healthy adjustments with a streamlining of product lines, cost cutting and bumping up shareholders returns. Interestingly, Reckitt shows that one can successfully clean up a vast stable of consumer brands, and make the survivors sweat substantially more. While Veet, Detol, Durex or Nurofen are likely to be seen by Cosmetics pundits as very distant cousins of skin creams and capillary products, the tightened brand management of Reckitt, looking for profitable volumes rather than chasing up-market quasi luxury consumer health brands, is worth pondering as an effective strategy.

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oréal saw growth in Gucci perfumes. Enough said.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...