AI European Dividing Line

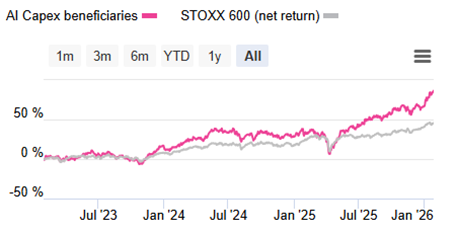

Four months ago we brought together European issuers enjoying the AI capex ride. That list (AlphaValue - Tools - Company Finder) goes from strength to strength against all reasonable expectations.

AI capex providers: ever higher with no ceiling in sight

Today we bite the bullet and regret not to have issued earlier, a mirror list of stocks suspected of suffering from AI disruptions, even though they claim otherwise and convincingly so. Here is the trashed lot performance (detailed list below):

We hold negative recommendations for the AI capex beneficiaries (-4% combined downside on an equal weighting), while their prices go up relentlessly.

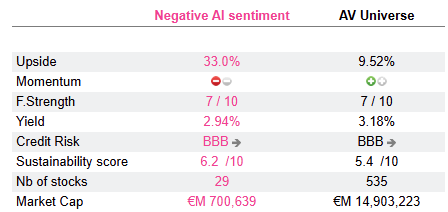

Unsurprisingly, we have positive fundamental recommendations on the AI bashed stocks with a combined 33% upside potential, here again on an equal weighting basis.

Clearly momentum chasers won the AI game to date, on either the long side or the short side. This may last a while as hot money seems to not be in short supply. The interesting point made by the following chart is less the enormous performance gap than the fact that the divergence really started at the same moment in last August.

AI beneficiaries vs. AI losers: a 70% performance gap in 12 months

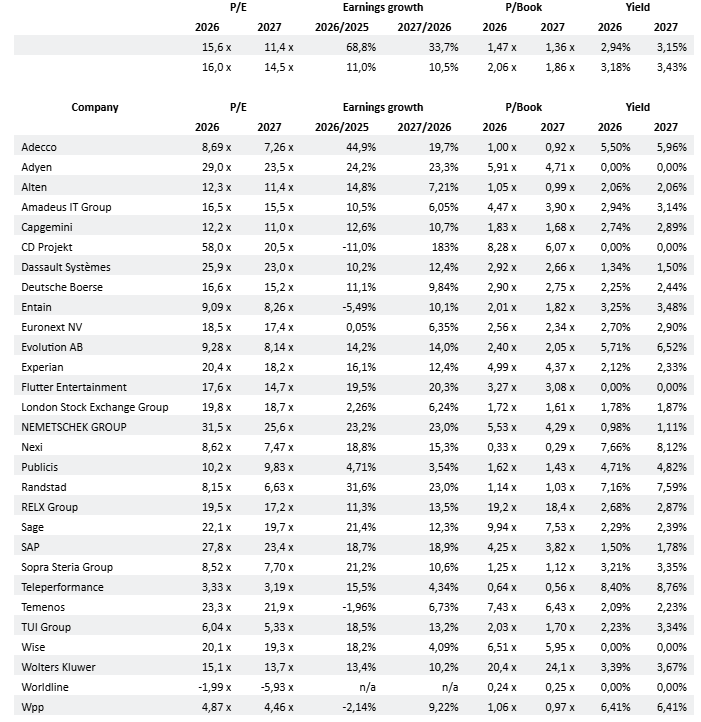

Momentum buyers may be right to still board the ‘Long’ train. We are not sure about the ‘short’ side. Valuations are certainly very attractive now. If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressure will abate a bit.

Essential aggregated data

Stocks under AI pressure (so says sentiment)

AI capex providers: ever higher with no ceiling in sight

Today we bite the bullet and regret not to have issued earlier, a mirror list of stocks suspected of suffering from AI disruptions, even though they claim otherwise and convincingly so. Here is the trashed lot performance (detailed list below):

We hold negative recommendations for the AI capex beneficiaries (-4% combined downside on an equal weighting), while their prices go up relentlessly.

Unsurprisingly, we have positive fundamental recommendations on the AI bashed stocks with a combined 33% upside potential, here again on an equal weighting basis.

Clearly momentum chasers won the AI game to date, on either the long side or the short side. This may last a while as hot money seems to not be in short supply. The interesting point made by the following chart is less the enormous performance gap than the fact that the divergence really started at the same moment in last August.

AI beneficiaries vs. AI losers: a 70% performance gap in 12 months

Momentum buyers may be right to still board the ‘Long’ train. We are not sure about the ‘short’ side. Valuations are certainly very attractive now. If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressure will abate a bit.

Essential aggregated data

Stocks under AI pressure (so says sentiment)

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.