A Jolly Nasty Mess Is Unfolding

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhyme with what Anthropic says. The hit on Relx, as markets wonder about Anthropic’s Claude Cowork, was particularly ugly. It was not alone.

The list of stocks, on suspicions of AI triggered change of paradigm in their business model, is detailed here: AlphaValue - Tools - Company Finder

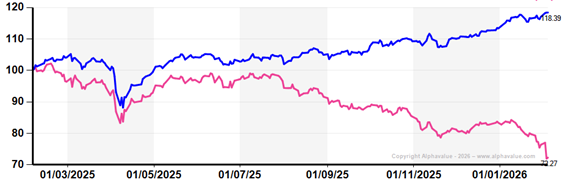

Their 1-year performance is there:

Ouch! (in pink, AI impacted stocks; 29; equal weighting… Stoxx600 in blue)

Ytd this list of 29 stocks with a spot market cap at €630bn, has lost 14%. This may not matter next to the 19% gain of the Metals sector to a joint market cap of €640bn, or the Banks’ 7% gain to €2 200bn.

The gap with stocks positively impacted by AI (we spotted 25 with a gain of 18% : AlphaValue - Tools - Company Finder), is nevertheless a red hot alert about a major sentiment driven divide gaining momentum amongst European equities.

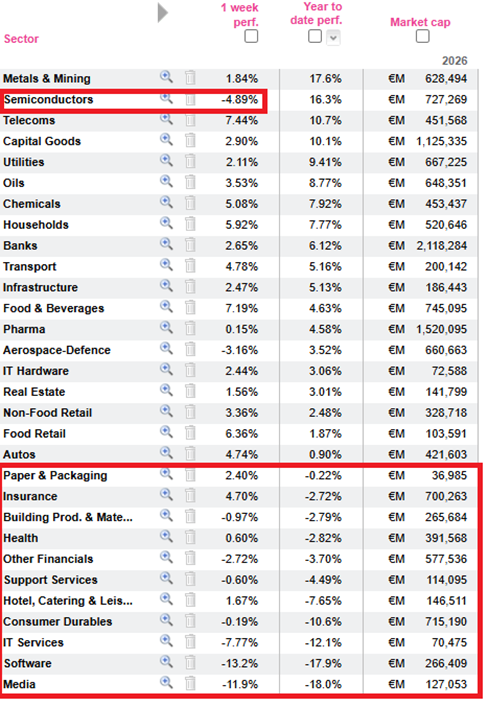

The following simple ytd sector performance table shows that the pain is spreading. What the table does not spell out are the last few days second round effects, where safe sectors are challenged: typically Semiconductors may suffer from the Software industries’ drumming down. It thus looks harder to hide from a likely day of reckoning. Say thanks to Dario Amodei of Anthropic for pricking those excesses.

European sector performances ytd (04-02 close)

The list of stocks, on suspicions of AI triggered change of paradigm in their business model, is detailed here: AlphaValue - Tools - Company Finder

Their 1-year performance is there:

Ouch! (in pink, AI impacted stocks; 29; equal weighting… Stoxx600 in blue)

Ytd this list of 29 stocks with a spot market cap at €630bn, has lost 14%. This may not matter next to the 19% gain of the Metals sector to a joint market cap of €640bn, or the Banks’ 7% gain to €2 200bn.

The gap with stocks positively impacted by AI (we spotted 25 with a gain of 18% : AlphaValue - Tools - Company Finder), is nevertheless a red hot alert about a major sentiment driven divide gaining momentum amongst European equities.

The following simple ytd sector performance table shows that the pain is spreading. What the table does not spell out are the last few days second round effects, where safe sectors are challenged: typically Semiconductors may suffer from the Software industries’ drumming down. It thus looks harder to hide from a likely day of reckoning. Say thanks to Dario Amodei of Anthropic for pricking those excesses.

European sector performances ytd (04-02 close)

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.