VALUATION WISE: Buy call on quality year-to-date losers

Completed on 21 February 2024

We went through the worst-performing decile to date within the AlphaValue coverage universe. This is 52 stocks with a combined 19% correction ytd in a market up 3%.

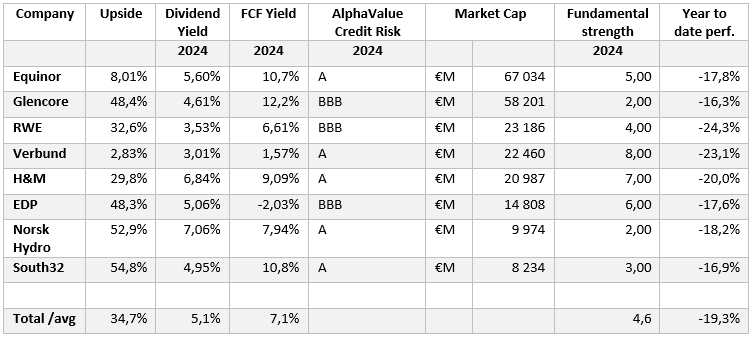

It is easy then to select the largest market caps, a good proxy for quality, and cross-check with AlphaValue’s own metrics for robustness (Fundamental strength score and rating). Narrowing down to the stocks with at least an €8bn market cap, here is a selection of eight stocks with 35% upside potential.

This is not rocket-science but, since none of these stocks belongs to fashionable investment themes (AI, Luxury, China on-off, weight loss drugs, etc.), it is likely that they will not crash further and would rebound at some stage, when the AI prop to risk-taking eventually dies down. Not being fashionable is obviously the case for the four Deep Cyclicals that populate this universe.

Should things get delayed, there is always a good dividend to rely on (5% yield), which is unlikely to be cut as it is well covered by a 7% FCF.

Quality at a considerable discount

We went through the worst-performing decile to date within the AlphaValue coverage universe. This is 52 stocks with a combined 19% correction ytd in a market up 3%.

It is easy then to select the largest market caps, a good proxy for quality, and cross-check with AlphaValue’s own metrics for robustness (Fundamental strength score and rating). Narrowing down to the stocks with at least an €8bn market cap, here is a selection of eight stocks with 35% upside potential.

This is not rocket-science but, since none of these stocks belongs to fashionable investment themes (AI, Luxury, China on-off, weight loss drugs, etc.), it is likely that they will not crash further and would rebound at some stage, when the AI prop to risk-taking eventually dies down. Not being fashionable is obviously the case for the four Deep Cyclicals that populate this universe.

Should things get delayed, there is always a good dividend to rely on (5% yield), which is unlikely to be cut as it is well covered by a 7% FCF.

Quality at a considerable discount

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.