Utilities' Paradoxical Run

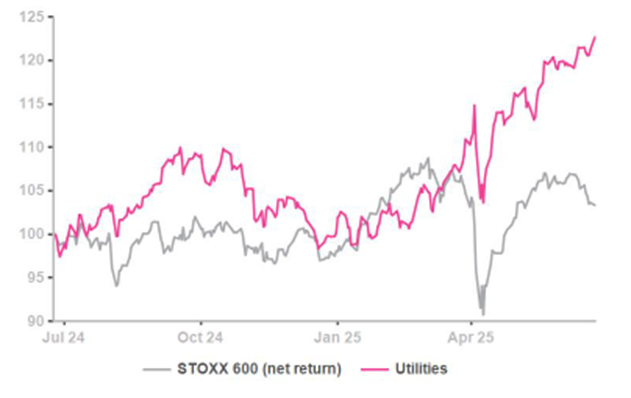

Utilities have enjoyed their ‘Anti-Trump’ moment as they are the third-best-performing sector ytd after Banks and Aerospace-Defence.

The rationale is straightforward enough: limited exposure to the US, not exporting anything, inward-looking, reassuring and boring RAB based-economics. One might add that, with the greening-up fashion past its peak, Utilities are possibly spending less on low-return projects.

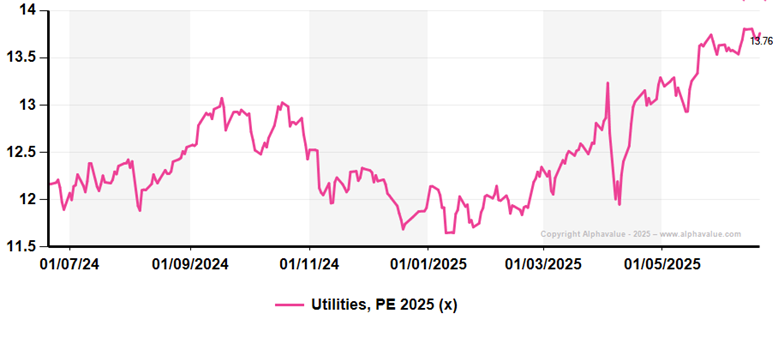

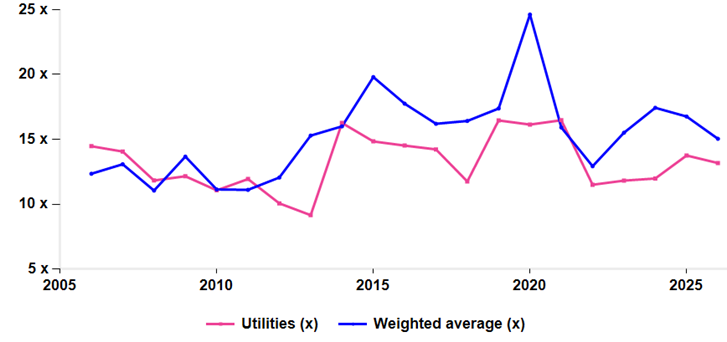

So far the recent surge has not led to extravagant valuations. The current 2025 PE is close to 14x but above all the long term history of the sector has been to trade at higher multiples.

2025 PE – 1 year high…

… but by no means stretched from a historical perspective (Utilities PE in pink 2006-26; market PE in blue)

European Utilities cannot bank on a European macro recovery and are still battling with tough environmental regulations, complex primary energy supply deals and a prospective mess about how to reengineer the marginal power pricing anchor, now mostly devolved to gas. This is not a minor subject as Utilities are essentially deregulated businesses facing steep competition in their power generation segment where it exists.

Utilities are at the centre of hitherto discrete domestic efforts to lower energy prices to both consumers and companies while politicians also want them to raise all sorts of green taxes, get out of (cheaper) fossil fuels and avoid paying dividends that are likely to irritate voters.

In short, Utilities are at the epicentre of multiple conflicts between stakeholders. They are not a great business as they can only move slowly to meet all the contradictory demands. Reverting to a nuclear power generation base may ultimately give them more weight but this will not happen for another 10 years. In between, the hideously expensive capital cost of nuke will push them into more political storms.

The good news is that Utilities near-term earnings are robust. 2025 forecasts have been marginally raised over the last 12 months. The same can be said of dividends.

The point is clear. The Utilities sector may be a port of call while Trump shakes up conventions (to be polite) but presumably this is not where the long term money is to be made.

Utilities valuation essentials

The rationale is straightforward enough: limited exposure to the US, not exporting anything, inward-looking, reassuring and boring RAB based-economics. One might add that, with the greening-up fashion past its peak, Utilities are possibly spending less on low-return projects.

So far the recent surge has not led to extravagant valuations. The current 2025 PE is close to 14x but above all the long term history of the sector has been to trade at higher multiples.

2025 PE – 1 year high…

… but by no means stretched from a historical perspective (Utilities PE in pink 2006-26; market PE in blue)

European Utilities cannot bank on a European macro recovery and are still battling with tough environmental regulations, complex primary energy supply deals and a prospective mess about how to reengineer the marginal power pricing anchor, now mostly devolved to gas. This is not a minor subject as Utilities are essentially deregulated businesses facing steep competition in their power generation segment where it exists.

Utilities are at the centre of hitherto discrete domestic efforts to lower energy prices to both consumers and companies while politicians also want them to raise all sorts of green taxes, get out of (cheaper) fossil fuels and avoid paying dividends that are likely to irritate voters.

In short, Utilities are at the epicentre of multiple conflicts between stakeholders. They are not a great business as they can only move slowly to meet all the contradictory demands. Reverting to a nuclear power generation base may ultimately give them more weight but this will not happen for another 10 years. In between, the hideously expensive capital cost of nuke will push them into more political storms.

The good news is that Utilities near-term earnings are robust. 2025 forecasts have been marginally raised over the last 12 months. The same can be said of dividends.

The point is clear. The Utilities sector may be a port of call while Trump shakes up conventions (to be polite) but presumably this is not where the long term money is to be made.

Utilities valuation essentials

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...