Key 2026 Valuation Figures - Agreeable For Now

European equities opened 2026 at 15.6x 2026 earnings, when 2025 traded at an average of 16.1x. 2025 effectively closed at 17.3x, coming from 13.7x at the beginning of 2025. The surge in PE is derived from a collapse in 2025 earnings growth from 6.5% to 1.8%, and risk happy investors pushing prices higher. There was no point worrying about Trump's absurd initiatives after all.

European equities valuation essentials

European equities valuation essentials

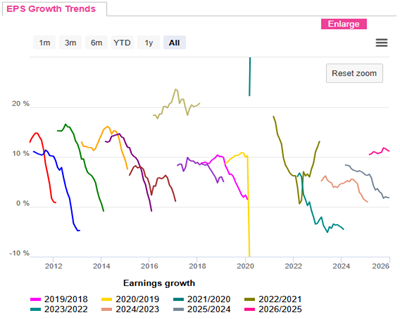

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be trimmed as the year unfolds. The following chart shows a different pattern (2026 in pink) for now with fairly resilient ambitions so far, where previous years' expectations capitulated more quickly.

European eps growth tends to be trimmed sharply

Dividend projections imply a 3.2% yield, which is good to have. As a reminder Banks, Insurance, Oils, Telecoms, Real Estate will happily deliver 4.5% with no risk of an accident. Therefore, cautious money can be parked there for longer.

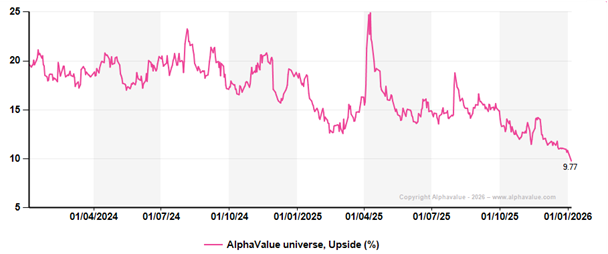

Decent fundamentals do not unlock attractive potential. Over the last 2 years, the bottom-up combined upside of the AlphaValue coverage (€14bn market cap and 534 stocks) has been halved. As a reminder all AlphaValue stocks are valued on the same comparable methodologies, so that there is no sentiment in this assessment of the upside potential.

AlphaValue universe upside potential halved over the last 2 years

In all, it is tempting to conclude that 2026 is off to a good start, but that is well discounted.

Dividend projections imply a 3.2% yield, which is good to have. As a reminder Banks, Insurance, Oils, Telecoms, Real Estate will happily deliver 4.5% with no risk of an accident. Therefore, cautious money can be parked there for longer.

Decent fundamentals do not unlock attractive potential. Over the last 2 years, the bottom-up combined upside of the AlphaValue coverage (€14bn market cap and 534 stocks) has been halved. As a reminder all AlphaValue stocks are valued on the same comparable methodologies, so that there is no sentiment in this assessment of the upside potential.

AlphaValue universe upside potential halved over the last 2 years

In all, it is tempting to conclude that 2026 is off to a good start, but that is well discounted.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.