Capgemini

Note: This is a daily stock update and the information stands true as of 13/02/26, 09:00 CET.

Company Update:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

FY Revenue reached €22.5bn (+1.7% reported / +3.4% cc), largely driven by the full consolidation of WNS and Cloud 4C was c 0.7% above expectations (implying a very decent beat in Q4).

Supported by the strategic consolidation of WNS and Cloud 4C in Q4, combined with accelerating demand for generative AI (now >10% of Q4 mix), order intake reached €24.4bn (+3.9%), with a book-to-bill of 1.08 for the year.

Operating margin remains robust at 13.3%. However, due to additional restructuring charges, net profit decreased by 4.2% to €1.6bn, while normalized EPS increased by 5.8% (12,95 €). In all, net profit came in 4% better than expected.

The proposed dividend stands at €3.40 per share.

26 guidance: lfl growth expected between 6.5% and 8.5%. Operating margin to improve towards 13.6%-13.8%.

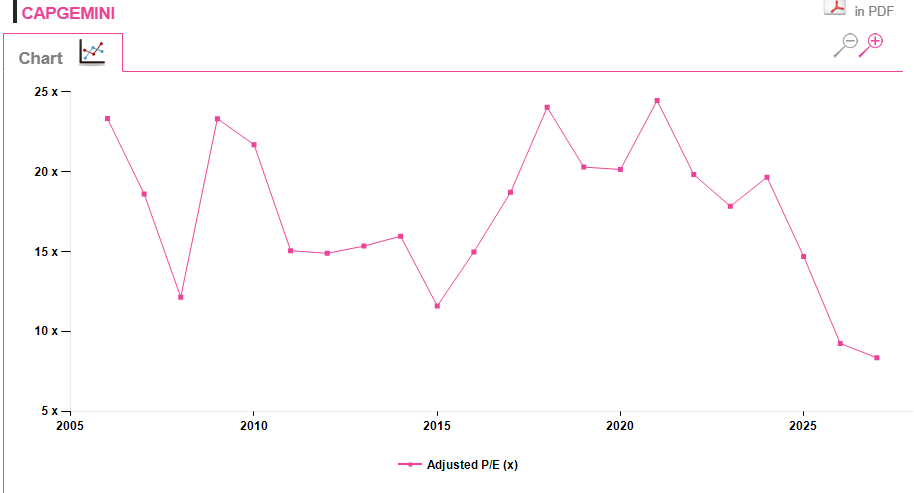

Expert Opinion:Valuation is now dirt cheap with PE now below 10x. But there is an ongoing concern that AI will kill those companies or at least contract their topline and margins very significantly. The drop in share price was sentiment-driven, not financial analysis-driven as no one yet is pricing such a substantial drop in topline (at least that we know of).

AI will apparently kill all companies: software, payment and even logistics, which looks like a bit weird to our expert.

Conference call at 8am this morning.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...