Concrete Dreams

Over the last 5 trading days, the Building Materials sector has led the European sector performance. This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not everyone has closed the bet on demand driven by mushrooming giant datacenters.

We are dubious about this latest bout of enthusiasm as the funding of the datacenter bubble is an improbable exercise, an understatement. Equally so, Ukrainian hopes can be dashed by a single Lavrov sentence.

Building Materials (understand Cement and building parts of all sorts) are trading at a premium. This is news to market old hands and implies superior growth, when the planet itself is no longer growing in population terms.

Of course everyone wants better shelter and corporates will always invest in new plants, not to mention grandiose HQs. Ever tighter regulations (safety, emissions) and global warming related demand, make a case for surging mix effects. Still a lot of those megatrend effects seem to be discounted in an 18x 2025 PE.

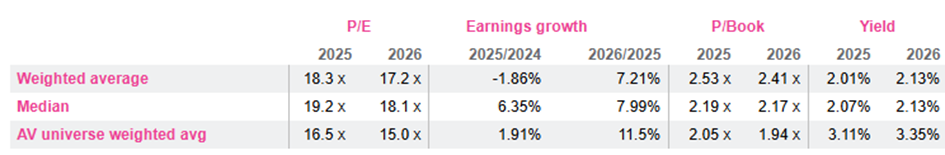

Building Materials valuation essentials

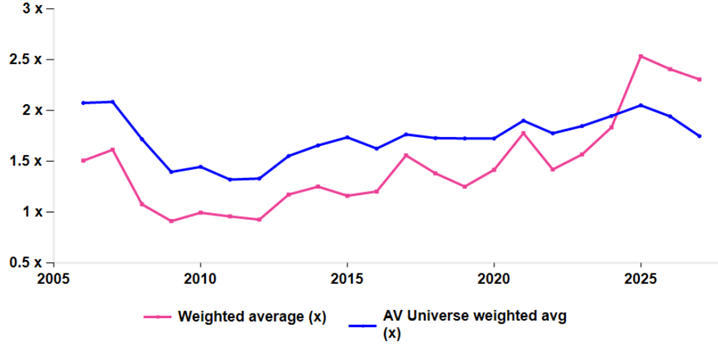

The following PE trend chart makes it clear that bulls have only recently entered the Building Materials sector, which should warrant caution.

Building Materials multiple jump in 2025

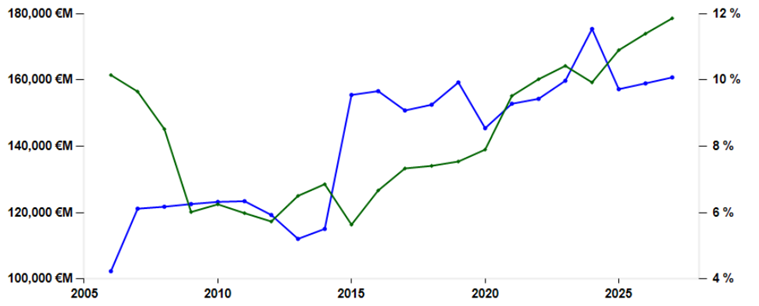

The striking observation though is that while the business has grown by acquisition as it pivoted away from cement to enter into more valued added products such as construction chemicals, it has not been at its ROCE expense.

Building Materials ROCE (in green, rhs) vs. its capital employed (in blue; lhs)

On that most essential metric, ROCEs are getting close to 12%, and amply covering the sector Wacc (9% or more), investors have been right to board that train.

Do we have doubts? Yes

The ride is likely to be shaky. One obvious aspect is that everyone is chasing the same growth, through higher value added products. What was a Sika’s differentiation factor, is now mainstream, so that the relative multiple may just level down. The other point is that the real world demand, ex datacenters, is not that bright. Most end users have been priced out by overregulation, which allows for climate concerns. More stealthily, the good ROCEs are also a reflection of capital subsidies to cut carbon emissions at cement plants. This is akin to pointing out a temporary windfall.

We are dubious about this latest bout of enthusiasm as the funding of the datacenter bubble is an improbable exercise, an understatement. Equally so, Ukrainian hopes can be dashed by a single Lavrov sentence.

Building Materials (understand Cement and building parts of all sorts) are trading at a premium. This is news to market old hands and implies superior growth, when the planet itself is no longer growing in population terms.

Of course everyone wants better shelter and corporates will always invest in new plants, not to mention grandiose HQs. Ever tighter regulations (safety, emissions) and global warming related demand, make a case for surging mix effects. Still a lot of those megatrend effects seem to be discounted in an 18x 2025 PE.

Building Materials valuation essentials

The following PE trend chart makes it clear that bulls have only recently entered the Building Materials sector, which should warrant caution.

Building Materials multiple jump in 2025

The striking observation though is that while the business has grown by acquisition as it pivoted away from cement to enter into more valued added products such as construction chemicals, it has not been at its ROCE expense.

Building Materials ROCE (in green, rhs) vs. its capital employed (in blue; lhs)

On that most essential metric, ROCEs are getting close to 12%, and amply covering the sector Wacc (9% or more), investors have been right to board that train.

Do we have doubts? Yes

The ride is likely to be shaky. One obvious aspect is that everyone is chasing the same growth, through higher value added products. What was a Sika’s differentiation factor, is now mainstream, so that the relative multiple may just level down. The other point is that the real world demand, ex datacenters, is not that bright. Most end users have been priced out by overregulation, which allows for climate concerns. More stealthily, the good ROCEs are also a reflection of capital subsidies to cut carbon emissions at cement plants. This is akin to pointing out a temporary windfall.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.