Davide Campari

Note: This is a daily stock update and the information stands true as of 05/03/25, 09:00 CET.

Company Update:

Expert Opinion:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

FY sales were up 2.4% organic to €3070m, marginally better than the €3027m of the consensus.

Adjusted EBITDA was €733m, reflecting a 0.1% organic increase, surpassing the expected €709m.

Net Income was also better than expected at €376m (down 3.7% yoy) vs €360m expected.

FCF Was in the black at €173m (vs a negative €180m last year)

Guidance 25: Moderate organic full-year top-line growth, with an improving trend in H2 25.

EBIT to be flat due to increased A&P investments and with a 50 bps benefit from cost reduction in SG&A.

The potential €90m-100ml impact of tariffs in the US isn’t included in the guidance.

Expert Opinion:

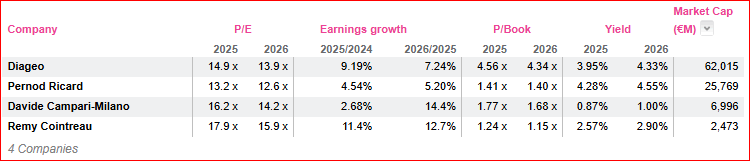

These are encouraging results. The guidance 25 is a bit soft to our analyst liking but we don’t think anyone was expecting a V Shape recovery in demand. We believe that we have seen the worst of the slump in demand and that recovery is around the corner. Obviously, the uncertainty on a potential trade war is lowering the visibility on the extent and timing of the recovery but we believe we have bottomed out and the trend is improving. Campari is a bit expensive and we believe Diageo or Pernod now offers a better risk reward profile. We would start building a position with a long term view on the sector.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog