Glencore

Note: This is a daily stock update and the information stands true as of 04/12/25, 09:00 CET.

Company Update:

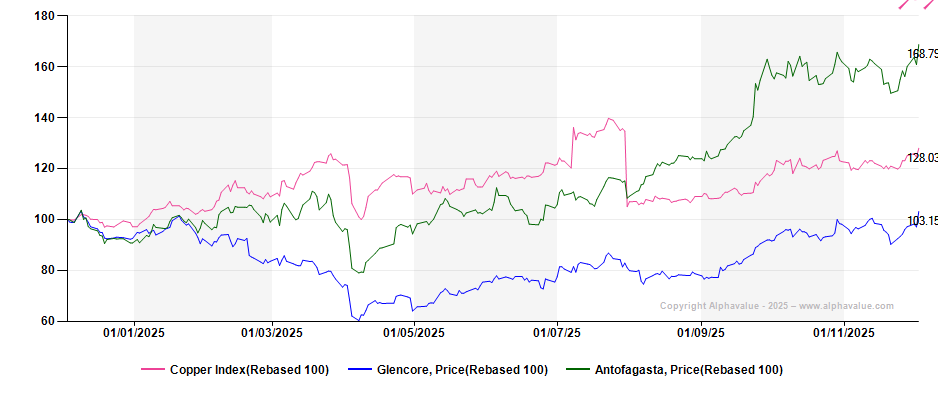

Glencore remains our favorite play in the sector even though copper is only 25% of its gross assets. It is still valued attractively in our opinion, very much unlike Antofagasta which trades at an all-time high and on valuation ratios that make it very risky. A long Glencore with a short Antofagasta looks like a good way to play the difference in valuation while edging the risk of a pullback on Copper. Indeed, while we are positive on the long run for copper, we see room for a pullback over the short term as the red metal is trading close to an all-time high, which we believe is decorrelated from fundamentals.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

At its CMD (first since 2022), held yesterday, Glencore - part of AV’s Active List - unveiled its ambition to become one of the world’s largest copper producers. By de-risking its copper portfolio, the firm targets to produce 1mt of red metal by 2028 and via aggressive growth bets, 1.6mt by 2035. The firm also plans to start a dormant copper mine (i.e. Alumbrera) in Argentina.

Markets seemed to have liked this messaging from the Swiss trader-miner – with the stock ending the day with c.7% gains, more so when copper prices have again hit record-highs due to persistent supply risks and there are timely opinion pieces in the FT like “The hunt for copper to wire the AI boom”, which help explain a sustained dash for the red metal.

Glencore remains one of our preferred and affordable copper bets.

Expert Opinion:Glencore remains our favorite play in the sector even though copper is only 25% of its gross assets. It is still valued attractively in our opinion, very much unlike Antofagasta which trades at an all-time high and on valuation ratios that make it very risky. A long Glencore with a short Antofagasta looks like a good way to play the difference in valuation while edging the risk of a pullback on Copper. Indeed, while we are positive on the long run for copper, we see room for a pullback over the short term as the red metal is trading close to an all-time high, which we believe is decorrelated from fundamentals.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog