ESG Deep Dive: ABB vs. Schneider Electric vs. Siemens

AlphaValue produces written equity research on its 551 stocks. Our data is transparent, validated by the analyst and has an impact on our valuation.

Fact

We use a simple rating system to compare the three capital goods pioneers in their reporting with the aim to also provide investors an insight into ESG reporting.

Rating system

Note: This analysis is based on the latest full year ESG reports (2022 for ABB and Schneider Electric, FY22 for Siemens)

Analysis

The following analysis provides data on key ESG parameters as provided in the respective ESG reports. We have divided this analysis into five sections and have assigned a rating to each category on the basis on granularity, disclosure, and ambition of these targets relative to each other.

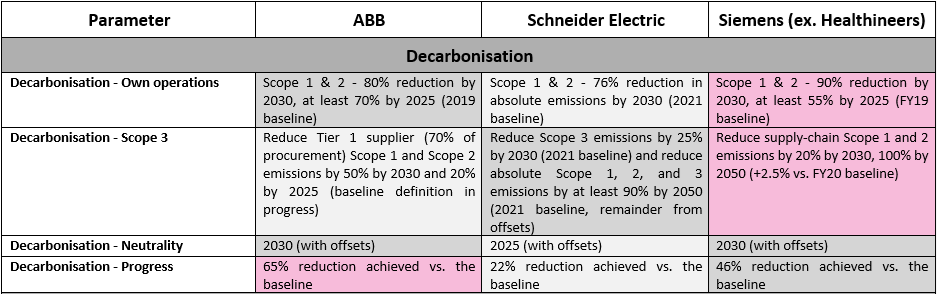

Decarbonisation

To look at decarbonisation, we took into account four parameters – Emissions in own operations (also known as Scope 1 and 2 emissions), Emissions in the supply chain (scope 3), Carbon neutrality, and Progress towards ambitions. Based on our analysis of these four parameters in conjunction with the absolute levels of emissions of each of the companies, we ascertain that Siemens comes out ahead, followed by ABB and Schneider Electric.

Energy & Waste

To evaluate this section, we use three parameters – Energy mix, Energy targets, and Waste reduction policies. Here we find that Schneider Electric is the cumulative leader, followed by ABB and Siemens.

Diversity, Pay Equality & Safety

In this section, we look at three parameters – Gender diversity, Pay equality, and Employee safety. Here Schneider Electric clearly stands out as the company that provides more detailed targets on increasing the participation of women across various hierarchical levels and the pay gap between women and men within the company. ABB is next, followed by Siemens.

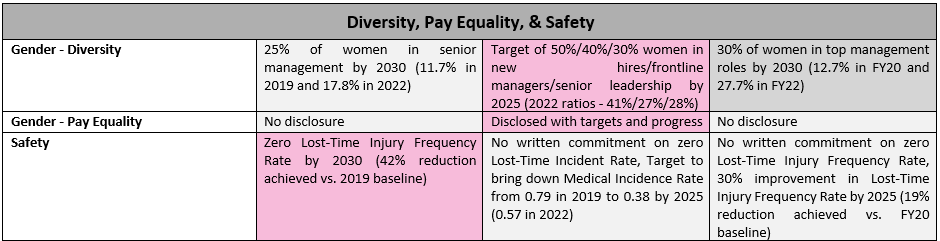

ESG in Management Compensation

Here, we look at two parameters – the inclusion of ESG criteria and its weightage in management compensation, and the details of these criteria. After scrutinising the management compensation across the three companies, we find ABB’s policies to be the most forward, followed by Siemens and then Schneider Electric.

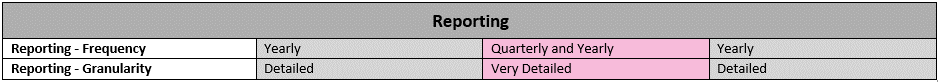

Reporting

In this last section, we evaluate two very simple things – Reporting Frequency and Reporting Granularity. Here, on both factors, we find Schneider Electric is ahead of ABB and Siemens.

Conclusion

Taking the five sections together, we observe that all three companies carry in one way or another the industry standard for ESG reporting. Also, we find that there is little to separate the companies on their overall ESG strategies (ABB scores 29, Schneider Electric scores 28 and Siemens scores 27). Nevertheless, we consider these companies crucial in helping the world to decarbonise by enhancing electrification, efficiency and automation.

Fact

We use a simple rating system to compare the three capital goods pioneers in their reporting with the aim to also provide investors an insight into ESG reporting.

Rating system

Note: This analysis is based on the latest full year ESG reports (2022 for ABB and Schneider Electric, FY22 for Siemens)

Analysis

The following analysis provides data on key ESG parameters as provided in the respective ESG reports. We have divided this analysis into five sections and have assigned a rating to each category on the basis on granularity, disclosure, and ambition of these targets relative to each other.

Decarbonisation

To look at decarbonisation, we took into account four parameters – Emissions in own operations (also known as Scope 1 and 2 emissions), Emissions in the supply chain (scope 3), Carbon neutrality, and Progress towards ambitions. Based on our analysis of these four parameters in conjunction with the absolute levels of emissions of each of the companies, we ascertain that Siemens comes out ahead, followed by ABB and Schneider Electric.

Energy & Waste

To evaluate this section, we use three parameters – Energy mix, Energy targets, and Waste reduction policies. Here we find that Schneider Electric is the cumulative leader, followed by ABB and Siemens.

Diversity, Pay Equality & Safety

In this section, we look at three parameters – Gender diversity, Pay equality, and Employee safety. Here Schneider Electric clearly stands out as the company that provides more detailed targets on increasing the participation of women across various hierarchical levels and the pay gap between women and men within the company. ABB is next, followed by Siemens.

ESG in Management Compensation

Here, we look at two parameters – the inclusion of ESG criteria and its weightage in management compensation, and the details of these criteria. After scrutinising the management compensation across the three companies, we find ABB’s policies to be the most forward, followed by Siemens and then Schneider Electric.

Reporting

In this last section, we evaluate two very simple things – Reporting Frequency and Reporting Granularity. Here, on both factors, we find Schneider Electric is ahead of ABB and Siemens.

Conclusion

Taking the five sections together, we observe that all three companies carry in one way or another the industry standard for ESG reporting. Also, we find that there is little to separate the companies on their overall ESG strategies (ABB scores 29, Schneider Electric scores 28 and Siemens scores 27). Nevertheless, we consider these companies crucial in helping the world to decarbonise by enhancing electrification, efficiency and automation.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.