Can The Telcos Epiphany Last?

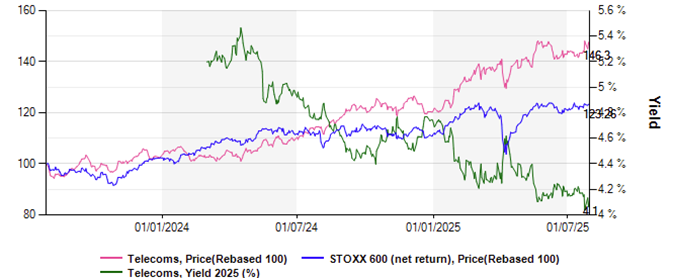

Since March 2025, European Telcos have exhibited strong momentum. So much so that their prime attraction, their yield return, has dropped from 5% to 4.1%. That is no longer enough to attract income investors. They have been replaced by risk takers whose agenda may be fragile.

European Telcos are an unhappy lot. Their shareholders have had less credence than their subscribers since the TMT bubble burst, 25 years ago. In addition, their pipe lines, improved at great cost as fiber, are considered a public infrastructure which pipes for free, all digital services, rather than a monopoly asset, that could be made to sweat. Throw in continuing competition in mobile services, with European prices roughly 7x lower than the US ones.

It is only recently that the Brussels stance has shifted to give more leeway (very little) to European incumbents. It now sees a leverage in European telcos as an effective way to slow down the US digital services onslaught. So far, no action has been taken, but the background noise remains that action could be taken in the course of trade talks.

Weaponizing telcos is not enough to turn them into a growth proposition. A more likely trigger is the European rearmament idea. After all, if war needs to be prepared for, the digital communication side is a priority and may already be at war if increased hacking is regarded as war type aggression.

National telcos have a mandate to defend the integrity of telecom services and may develop business models around that, such as, for example, extra secure corporate networks. Why not? Their expertise in spying is as old as telco services have been in place, and may be ever more in demand.

The issue with that Defence opportunity angle is that it is unlikely ever to be backed by hard numbers, as is the case with most defence related businesses: confidentiality is of the essence. In this respect, valuations may well turn out to be inflated if top line growth does not accelerate.

The following chart shows that it takes a big heart to foresee more than 2% top line growth looking forward.

Telcos’ top line growth. Say -2% to +2%

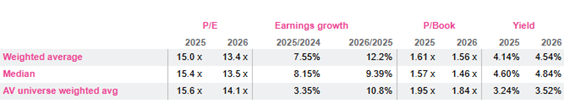

All of a sudden Telcos are as expensive as the broader market (see next table). This is news. One may not exclude a situation whereby multiplying defence thematic funds have ended up parking their excess cash in telcos, to at least get the dividends. This would be a case of excess money chasing assets, not the hope of a better business model. Only momentum investors may try their luck.

Telcos valuation essentials

European Telcos are an unhappy lot. Their shareholders have had less credence than their subscribers since the TMT bubble burst, 25 years ago. In addition, their pipe lines, improved at great cost as fiber, are considered a public infrastructure which pipes for free, all digital services, rather than a monopoly asset, that could be made to sweat. Throw in continuing competition in mobile services, with European prices roughly 7x lower than the US ones.

It is only recently that the Brussels stance has shifted to give more leeway (very little) to European incumbents. It now sees a leverage in European telcos as an effective way to slow down the US digital services onslaught. So far, no action has been taken, but the background noise remains that action could be taken in the course of trade talks.

Weaponizing telcos is not enough to turn them into a growth proposition. A more likely trigger is the European rearmament idea. After all, if war needs to be prepared for, the digital communication side is a priority and may already be at war if increased hacking is regarded as war type aggression.

National telcos have a mandate to defend the integrity of telecom services and may develop business models around that, such as, for example, extra secure corporate networks. Why not? Their expertise in spying is as old as telco services have been in place, and may be ever more in demand.

The issue with that Defence opportunity angle is that it is unlikely ever to be backed by hard numbers, as is the case with most defence related businesses: confidentiality is of the essence. In this respect, valuations may well turn out to be inflated if top line growth does not accelerate.

The following chart shows that it takes a big heart to foresee more than 2% top line growth looking forward.

Telcos’ top line growth. Say -2% to +2%

All of a sudden Telcos are as expensive as the broader market (see next table). This is news. One may not exclude a situation whereby multiplying defence thematic funds have ended up parking their excess cash in telcos, to at least get the dividends. This would be a case of excess money chasing assets, not the hope of a better business model. Only momentum investors may try their luck.

Telcos valuation essentials

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...