Momentum Winners/Losers In Size

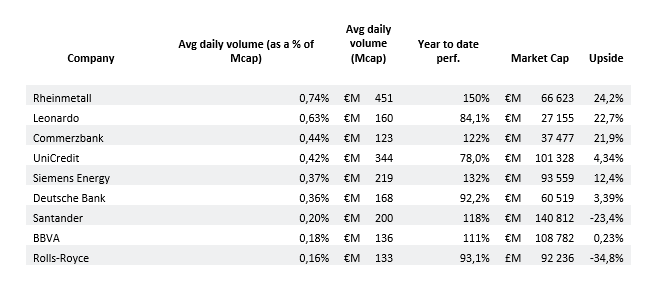

The table below is crossing the highest decile of the ytd performers in AlphaValue European coverage with the highest decile for daily volumes expressed in €M.

The finding is quite striking, with Banks and Aerospace Defence running the entire show, with the exception of Siemens Energy, a 2023 near death experience resuscitated by the virtues of AI demand.

Up in style (ranked by daily transactions as a% of mkt cap)

The above table confirms that ytd performers have not shone in a void. It is astounding to read that the banking music has really been centered on only five banks, with one, Commerzbank, rotating its capital as if it were punching in the big boys’ league. As a matter of fact, with Unicredit breathing down CBK’s neck, its share could only rotate at supersonic speed.

If CBK is a remarkable market animal, it is a profile shared with Rheinmetall which acted as the Defence sector de facto proxy. Leonardo too has donned a Defence proxy cap, which is a clear and welcome departure from its dusty conglomerate profile of yore.

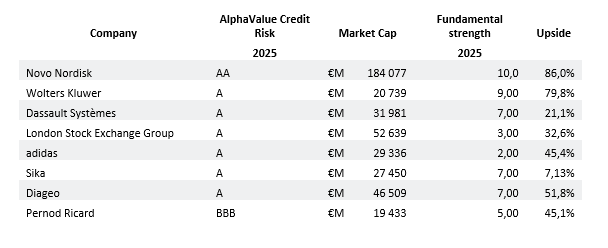

Now turn to 2025 ytd losers with volumes attached

One needs to skew a bit the extraction to daily volumes above €50M to find 8 candidates worth speaking about. There is clearly more diversity in that cohort, as no one would have expected Wolters or Sika to show up in that league of bereaved stories. The descent to hell is less noisy as a proportion of market cap, than the rise to the sky of the first table. However, it remains huge volumes for quality names that have lost 25% or more.

Down with a bang (ranked by daily transactions as a% of mkt cap)

As contrarian born market participants, we would buy into this quality universe (see next table, balance sheet rating and business model strength) with closed eyes. However Dassault Systèmes would be best avoided, up until governance clarity is provided.

The finding is quite striking, with Banks and Aerospace Defence running the entire show, with the exception of Siemens Energy, a 2023 near death experience resuscitated by the virtues of AI demand.

Up in style (ranked by daily transactions as a% of mkt cap)

The above table confirms that ytd performers have not shone in a void. It is astounding to read that the banking music has really been centered on only five banks, with one, Commerzbank, rotating its capital as if it were punching in the big boys’ league. As a matter of fact, with Unicredit breathing down CBK’s neck, its share could only rotate at supersonic speed.

If CBK is a remarkable market animal, it is a profile shared with Rheinmetall which acted as the Defence sector de facto proxy. Leonardo too has donned a Defence proxy cap, which is a clear and welcome departure from its dusty conglomerate profile of yore.

Now turn to 2025 ytd losers with volumes attached

One needs to skew a bit the extraction to daily volumes above €50M to find 8 candidates worth speaking about. There is clearly more diversity in that cohort, as no one would have expected Wolters or Sika to show up in that league of bereaved stories. The descent to hell is less noisy as a proportion of market cap, than the rise to the sky of the first table. However, it remains huge volumes for quality names that have lost 25% or more.

Down with a bang (ranked by daily transactions as a% of mkt cap)

As contrarian born market participants, we would buy into this quality universe (see next table, balance sheet rating and business model strength) with closed eyes. However Dassault Systèmes would be best avoided, up until governance clarity is provided.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.