Euronext, desperately looking for growth

Last time we wrote a teaser on Euronext was nearly four years ago in March 2015. At that time, we were very enthusiastic about Euronext as many stars were aligned for the company to take off following its listing in July 2014. We mentioned, then, cyclical reasons with European capital markets supported by the ECB and structural factors such as the implementation of new regulations (MIFID II or EMIR).

Its share price gained 50% since, in line with the sector (even if the sector is mainly distorted by the London Stock Exchange Group’s strong performance) but much better than the market (as evidenced by the graph below).

While that side of the story has proved correct, Euronext has also been much supported by its ability to crush costs since 2014. That has been true in its first phase post-IPO between 2014 and 2016 and again since Euronext’s first three-year strategic plan in May 2016.

In a fast-changing world and an economy that tends to move tasks from humans to computers, Euronext, which has long boiled down to a plain platform where sellers and buyers would meet, has mechanically benefited from digital transformation.

This ability to transform each additional revenue into cash has pleased investors through a solid balance sheet (net debt is expected to be nil in 2019) and a sustainable and high dividend (minimum pay-out ratio at 50%).

This dividend-paying capability has led to a sharp rerating to about 15x Euronext’s net profit in 2019 versus 11x in 2014.

Behold! That number is still light years away from that of Deutsche Boerse (Reduce, Germany) and above all the LSEG whose P/E stands at c. 25x (and that is with the Brexit shadow on top).

The nutshell of it is that Euronext cannot spin a potential growth story while it does not benefit from any M&A call such as the LSEG or Deutsche Boerse…and, more paradoxically, BME. Hence, we have not been that enthusiastic over the last year (no BUY recommendation since then).

…still looking for growth momentum

While the business mix is slowly evolving towards more stable revenues, volatile income (cash trading) still represents the bulk of Euronext’s revenues, warranting even more the discount vs. peers. Euronext’s market share in cash equity trading on its market remains high but margins and growth are past their prime (competition from alternative platforms regulate pricing discipline).

Euronext is still looking to diversify away from such volatile revenues but is facing quite a harsh reality. Its three-year strategic plan had the ambition to generate €35m additional EBITDA via bolt-on acquisitions and organic growth. That target was lowered at the beginning of 2018 and we expect it to be decreased again (we now forecast only €10m additional EBITDA).

There is certainly no financial brake given Euronext’s low level of debt (nil in 2019).

We estimate indeed it could raise about €1.2bn debt (3.5x EBITDA) which is a conservative number given market venues’ ability to generate cash. Growth in the sector exclusively comes from the growth of new solutions for the sell-side (via innovation solutions in clearing to reduce capital requirements for banks) and the buy-side (develop or propose global indices to be part of the ETF and smart beta’s exponential growth).

Euronext cannot yet build its own post-trading business from scratch and the sole possibility is about purchasing an established business. Unfortunately, scarce assets are … expensive and Euronext may have missed the boat when it comes to expand in the very lucrative business of post-trading compared to its competitors. DB or the LSEG are better positioned to purchase overpriced assets, extracting value through cost synergies with their current assets...

For instance, Euronext once considered purchasing IHS Markit’s derivatives processing unit, MarkitSERV, but the mooted transaction price was over the top. We bet that the LSEG will be the acquirer eventually.

Being rather small compared to the global venues (LSEG, DB, CME, ICE or the Hong Kong stock exchange), Euronext is not of great interest to these same mastodons either, since it is not a game-changer as it has a focus on the thin margins of the efficient equity markets. It is therefore even more fundamental to grow a business with a systemic impact and barriers of entry to justify its listed raison d’être.

We do not expect indeed a business, which exclusively relies on a platform and a simple product (cash equity trading), to navigate quietly throughout our current fast-changing digital world.

An avoidable reunification with its Spanish counterpart…

One has to mention BME when mentioning Euronext (and vice versa). Whereas we have at some moments been buying Euronext, we have (and we will) always advise investors to stay away of BME. In a global financing industry, we do not see how local companies can survive. Local market venues have been surviving so far thanks to solid geographical/regulatory barriers to entry. Both technology and regulators are now changing that.

BME’s cash equity trading market share has collapsed in the last few years and we expect its business in both clearing and settlement to stall at some time in the future, as giants Clearstream or Euroclear will soon compete on the Spanish market.

However, it owns the expertise in the post-trading at a time when Euronext, despite its relative small size, owns many big European clients (both sell-side and buy-side ones).

Combining the two of them would resolve each other’s issue as Euronext would gain the post-trading expertise and BME would get beyond its Spanish borders.

While investors believe that this will not happen, we are still comfortable with our long-time scenario of a long-short Euronext/BME (buy Euronext and sell BME).

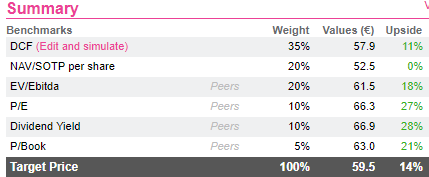

Valuation-wise, it is no surprise then that our peers-based multiples are pointing towards roughly a 20% upside (equivalent to a buy recommendation) as the LSEG or DB are among these peers. That could make sense once Euronext shows investors credible growth levers.

Our DCF-based valuation is giving roughly a fair valuation, as we do not see the case to revise upwards expected EBITDA growth out-years (currently at 2%).

Whereas we do not buy today Euronext for capital appreciation, investors are looking for sustainable dividends. That would pay for the time factor before they make a break or are broken.

While that side of the story has proved correct, Euronext has also been much supported by its ability to crush costs since 2014. That has been true in its first phase post-IPO between 2014 and 2016 and again since Euronext’s first three-year strategic plan in May 2016.

In a fast-changing world and an economy that tends to move tasks from humans to computers, Euronext, which has long boiled down to a plain platform where sellers and buyers would meet, has mechanically benefited from digital transformation.

This ability to transform each additional revenue into cash has pleased investors through a solid balance sheet (net debt is expected to be nil in 2019) and a sustainable and high dividend (minimum pay-out ratio at 50%).

This dividend-paying capability has led to a sharp rerating to about 15x Euronext’s net profit in 2019 versus 11x in 2014.

Behold! That number is still light years away from that of Deutsche Boerse (Reduce, Germany) and above all the LSEG whose P/E stands at c. 25x (and that is with the Brexit shadow on top).

The nutshell of it is that Euronext cannot spin a potential growth story while it does not benefit from any M&A call such as the LSEG or Deutsche Boerse…and, more paradoxically, BME. Hence, we have not been that enthusiastic over the last year (no BUY recommendation since then).

…still looking for growth momentum

While the business mix is slowly evolving towards more stable revenues, volatile income (cash trading) still represents the bulk of Euronext’s revenues, warranting even more the discount vs. peers. Euronext’s market share in cash equity trading on its market remains high but margins and growth are past their prime (competition from alternative platforms regulate pricing discipline).

Euronext is still looking to diversify away from such volatile revenues but is facing quite a harsh reality. Its three-year strategic plan had the ambition to generate €35m additional EBITDA via bolt-on acquisitions and organic growth. That target was lowered at the beginning of 2018 and we expect it to be decreased again (we now forecast only €10m additional EBITDA).

There is certainly no financial brake given Euronext’s low level of debt (nil in 2019).

We estimate indeed it could raise about €1.2bn debt (3.5x EBITDA) which is a conservative number given market venues’ ability to generate cash. Growth in the sector exclusively comes from the growth of new solutions for the sell-side (via innovation solutions in clearing to reduce capital requirements for banks) and the buy-side (develop or propose global indices to be part of the ETF and smart beta’s exponential growth).

Euronext cannot yet build its own post-trading business from scratch and the sole possibility is about purchasing an established business. Unfortunately, scarce assets are … expensive and Euronext may have missed the boat when it comes to expand in the very lucrative business of post-trading compared to its competitors. DB or the LSEG are better positioned to purchase overpriced assets, extracting value through cost synergies with their current assets...

For instance, Euronext once considered purchasing IHS Markit’s derivatives processing unit, MarkitSERV, but the mooted transaction price was over the top. We bet that the LSEG will be the acquirer eventually.

Being rather small compared to the global venues (LSEG, DB, CME, ICE or the Hong Kong stock exchange), Euronext is not of great interest to these same mastodons either, since it is not a game-changer as it has a focus on the thin margins of the efficient equity markets. It is therefore even more fundamental to grow a business with a systemic impact and barriers of entry to justify its listed raison d’être.

We do not expect indeed a business, which exclusively relies on a platform and a simple product (cash equity trading), to navigate quietly throughout our current fast-changing digital world.

An avoidable reunification with its Spanish counterpart…

One has to mention BME when mentioning Euronext (and vice versa). Whereas we have at some moments been buying Euronext, we have (and we will) always advise investors to stay away of BME. In a global financing industry, we do not see how local companies can survive. Local market venues have been surviving so far thanks to solid geographical/regulatory barriers to entry. Both technology and regulators are now changing that.

BME’s cash equity trading market share has collapsed in the last few years and we expect its business in both clearing and settlement to stall at some time in the future, as giants Clearstream or Euroclear will soon compete on the Spanish market.

However, it owns the expertise in the post-trading at a time when Euronext, despite its relative small size, owns many big European clients (both sell-side and buy-side ones).

Combining the two of them would resolve each other’s issue as Euronext would gain the post-trading expertise and BME would get beyond its Spanish borders.

While investors believe that this will not happen, we are still comfortable with our long-time scenario of a long-short Euronext/BME (buy Euronext and sell BME).

Valuation-wise, it is no surprise then that our peers-based multiples are pointing towards roughly a 20% upside (equivalent to a buy recommendation) as the LSEG or DB are among these peers. That could make sense once Euronext shows investors credible growth levers.

Our DCF-based valuation is giving roughly a fair valuation, as we do not see the case to revise upwards expected EBITDA growth out-years (currently at 2%).

Whereas we do not buy today Euronext for capital appreciation, investors are looking for sustainable dividends. That would pay for the time factor before they make a break or are broken.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...