European Steel's Remarkable Resilience

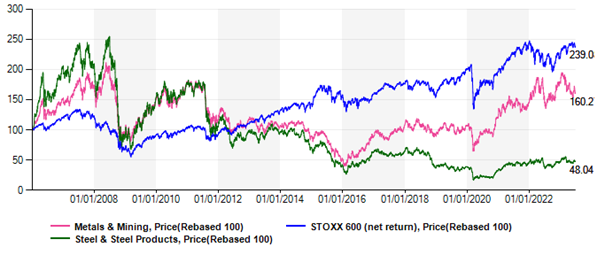

Performance charts can be made to tell all sorts of contradictory truths, notably centred on the black hole of COVID-19 March 2020 which acted as a reset to essentially all equities. But look at the Steel stocks performance with 01-01-2020 as a starting point. This is when the sector stopped destroying value in relation to the main European index. And this miracle seems to be continuing.

From 01-01-2020: Steel vs. Stoxx600

Admittedly, investing in Miners would have netted another 20% extra performance but this is not the point. The point is that Steel stocks look like bottoming out from a decline that started in summer … 2007 with the GFC. There was a first bottoming out initiated in early 2016 (remember ZIRP?) that petered out in mid 2018 when the Fed brandished the threat of higher rates (see chart below).

18 years of Steel underperformance (green)

The Steel sector's recent solid performance happens in a context of higher cost of money, weak Chinese GDP growth, massive capex to green up processes, still hurting power prices and the possibility of a European GDP contraction (postponed for now).

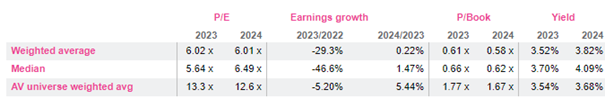

Obviously, such a difficult background does show up in the sector's modest valuations: nobody believes that earnings can be sustained (-29% this year) but this does not tell us what makes the sector tick.

Steel's valuation essentials

Answers could include falling iron ore prices, the perspective of a carbon border tax for European players providing them with significant protection, spending on heavy artillery, still strong demand from the car sector (high value added steels), the dash for green energies that eat up a lot of concrete and steel bars (back of the envelope calculations show that erecting wind turbines alone accounts for close to 0.5% of the 2023 world steel output).

As can be seen from the following chart the sector stopped losing money (FCF wise) a long time ago and tends to cover its Wacc (8.4%) in recent years. It may do so for longer as it supplies the planet in its steel-intensive green shift.

From 01-01-2020: Steel vs. Stoxx600

Admittedly, investing in Miners would have netted another 20% extra performance but this is not the point. The point is that Steel stocks look like bottoming out from a decline that started in summer … 2007 with the GFC. There was a first bottoming out initiated in early 2016 (remember ZIRP?) that petered out in mid 2018 when the Fed brandished the threat of higher rates (see chart below).

18 years of Steel underperformance (green)

The Steel sector's recent solid performance happens in a context of higher cost of money, weak Chinese GDP growth, massive capex to green up processes, still hurting power prices and the possibility of a European GDP contraction (postponed for now).

Obviously, such a difficult background does show up in the sector's modest valuations: nobody believes that earnings can be sustained (-29% this year) but this does not tell us what makes the sector tick.

Steel's valuation essentials

Answers could include falling iron ore prices, the perspective of a carbon border tax for European players providing them with significant protection, spending on heavy artillery, still strong demand from the car sector (high value added steels), the dash for green energies that eat up a lot of concrete and steel bars (back of the envelope calculations show that erecting wind turbines alone accounts for close to 0.5% of the 2023 world steel output).

As can be seen from the following chart the sector stopped losing money (FCF wise) a long time ago and tends to cover its Wacc (8.4%) in recent years. It may do so for longer as it supplies the planet in its steel-intensive green shift.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...