Generali, Mediobanca, Bolloré, now del Vecchio

After the recent €580m investment made by the Italian veteran entrepreneur Leonardo Del Vecchio in Mediobanca, speculation about the capital of Generali has re-surfaced. As ever, the shadow of Bolloré reappears as still the second largest shareholder of Mediobanca. This may have implications for Vivendi, Telecom Italia, and Mediaset.

The Italian businessman Leonardo Del Vecchio (84 years old) is preparing a strategic move in both Mediobanca (Reduce, Italy) and Generali (Add, Italy). Del Vecchio, who has a 4.87% stake in Generali, now plans to increase his stake in Mediobanca to above 10%. In September, he surprisingly invested €580m in the bank, acquiring 6.94% of its capital. Sources told Reuters that the CEO of the bank, Alberto Nagel, was informed of this move just a few hours before the release of the statement announcing the transaction.

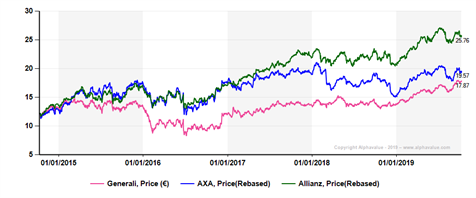

Del Vecchio’s target is to put pressure on Nagel to have more control over the future of the insurer, including through possible cross-border deals. People close to the Italian veteran said that he believes Mediobanca “could be managed better” and that he wants to change its governance rules to ensure he will have a say in the choice of the next CEO when Nagel’s mandate comes up for renewal in 2020. The CEO of Generali, Philippe Donnet, is also blamed by Del Vecchio because of the poor share price performance of the insurer compared to its main rivals Allianz (Add, Germany) and AXA (Add, France). Generali still lags its peers

Our take

The recent event shows that nothing works between Del Vecchio and the two French CEOs. The Ray-Ban billionaire has previously worked closely with Nagel and Mediobanca, mainly when Luxottica merged with Essilor last year. However, the relationship was deeply affected by the decision by the bank to block a planned €500m investment by Del Vecchio in the European Institute of Oncology, despite the support of Jean Pierre Mustier, the CEO of Unicredit (Buy, Italy), which holds 8.5% of Mediobanca.

Since then, Del Vecchio has changed tactics, and the context seems to be in his favour. Indeed, in October 2018, Bolloré Group (Reduce, France) decided to withdraw from the Mediobanca shareholders’ pact, leading to its de facto end. The consequences for Generali were evident as the bank, which controls 13% of the insurer, warrants being involved in the internal power balance within the insurer. At that time, Generali was facing serious issues. Mediobanca was planning to reduce its stake to below 10% for regulatory reasons and the process of renewing the Board had just been launched.

All these problems are resolved today after the approval of amendments to the articles of association and the annulment of the age limit for members of the Board of Directors, the Chairman and CEO. This allows Gabriele Galateri di Genola to retain his position of Chairman and to preserve the equilibrium of interests within the insurer. In addition, the Danish compromise will continue to run until 2024. Thus, Mediobanca is allowed to include the value of Generali’s equity in its RWA, boosting its CET1 ratio. Currently, the Italian insurer has a stable management and clear guidelines, which are on the right track to being achieved.

In reality, the war concerning Generali never ended. Now, Del Vecchio is focusing on Mediobanca, the principal gateway to the insurer. With Unicredit (8.5%) and Berlusconi (3.3% through Mediolanum), c. 21% of the capital of the bank may be under Del Vecchio’s influence. The veteran wants to have a say in the coming strategy of the bank, to be revealed in November. He would prefer to see the bank being less dependent on its consumer credit business and…Generali. There are rumours around that Del Vecchio intends to repeat the Generali scenario, i.e. go for a change in the bank’s bylaws to garner more freedom in the selection of a new CEO next year. The article of associations states that the CEO must be nominated by managers who have been with the bank for at least three years, effectively excluding outsiders. Although deadlines cannot be met, the pressure on Nagel has just begun.

The Del Vecchio saga doesn’t exclude another key person in Italian affairs: Vincent Bolloré. The French manager has stakes in both Mediobanca and Generali. Despite his plan not to join forces with Del Vecchio, things could still change if one takes into consideration another factor: Telecom Italia (Buy, Italy) and the conflict concerning its future Chairman. For Bolloré, this is crucial as he would then be able to rebuild his relations with the Italian government through two priorities: fibre and 5G. This will also certainly influence Mediaset (Add, Italy) and the legal battle with Fininvest (the Berlusconi family) and their contested project MediaForEurope. The ultimate key in the hands of Bolloré is his 7.9% stake in Mediobanca. However, the Italian government cannot allow Generali to pass into foreign hands.

Again, speculation about the capital of the main players of the Italian financial system will be determinant for investors. The General Meeting of Mediobanca at the end of this month does matter.

Learn more : click here