Insurance High P/Book Reflects Risk Transfer

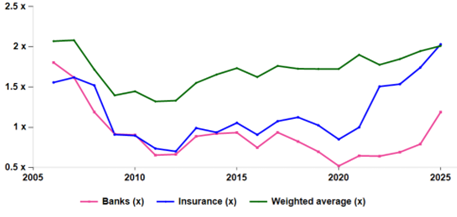

Banks have experienced a massive rerating since their 2020 Covid lows. Their P/Book ratios attest to that. At 1.18x they are vastly higher in 2025 than the 0.52x last seen in 2020 (see chart, Banks in pink). However, nobody hopes to see Banks at their 2026 ludicrous valuations (1.8x!!). At these levels, the only outcome is a crash.

Banks weigh c. €1.4Tn. They are more visible than Insurers and their combined €0.7Tn. It is, however, with Insurers that the valuation enthusiasm has reached breathtaking levels. Their P/Book low was in 2012, their high is now at 2x, which is well above the 1.5x reached before the Great Financial Crisis (GFC).

Even more intriguing, Insurers are now trading at market average P/Book.

P/Book 2006-2025: Banks (pink) vs. Insurers (blue ) and market (green)

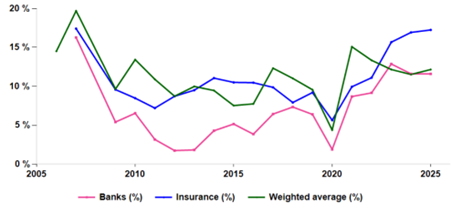

For good measure, we looked at the RoE dynamic of Banks, Insurance and wider markets, respectively. RoE are the alternative face to a P/book. While Banks have not yet reverted to their pre GFC absurdly high RoEs, Insurers have.

RoEs (2006-2025) reverting back to pre GFC levels?

The rising P/Book multiples of Insurers are consistent with their recovered profitability (dependent on where one assigns the cost of equity, of course). They also reflect a favourable technical accounting effect, stemming from the transition to IFRS17, which generally lowered equity due to the recognition of the Contractual Service Margin and the Risk Adjustment.

Still, the surge in Insurers RoEs raises question marks. Is it reasonable for a semi-public service (the heavy handed regulation attests to that) to collect such returns? At whose expense? How long can it last? As a reminder when Banks in pre GFC world were accounting for 18% of listed earnings, the music suddenly stopped, as those gains were at the expense of the wider economy.

Is there enough competition? Are Insurers overreaching under the umbrella of excess regulation, leaving no room for new entrants? Alternatively, are insurers taking too many risks?

Insurers seem to be in a position to pay out ever more, and in spite of increasingly demanding prudential ratios, they are actually heading towards a capital light(er) model and can distribute their capital excesses.

Shifting risk takes convoluted turns

This is a crude way of referring to their increased propensity to shift risk off their balance sheet, as bankers did and still do. In Life (it is not really possible in non-Life), policyholders are increasingly investors in insurance saving products with no performance guarantee. Life insurers are de facto fund managers with a tax edge. Derisking has been a first step to lightening up capital obligations. However, it may encompass more subtle moves that distort the risk picture.

There emerges an increasing risk of conflict of interest when savings are invested in products designed to promote returns for shareholders, rather than for policyholders. This is the case when private equity owned insurers are promoting PE funds and private debt products, designed by their shareholders to cater for their own private market funding needs. This is a deplorable dynamic in the US, which has yet to cross the Atlantic in a significant way. The point is that this dynamic is one where the risk is squarely transferred onto the unaware policyholder, so that the insurer can be run on thin risk-absorbing capital, as policyholders hold the hot potato.

The FSB, BIS and other global observers of financial markets have raised the alarm repeatedly on this unsavoury development. In essence, Insurers are transferring their risks to the wider savings market with systemic implications. They can thus afford to pay out more.

Shareholders in listed European insurers need not harbour such concerns, even if accidents in financial markets would not be contained at the border, and would impact them.

Banks weigh c. €1.4Tn. They are more visible than Insurers and their combined €0.7Tn. It is, however, with Insurers that the valuation enthusiasm has reached breathtaking levels. Their P/Book low was in 2012, their high is now at 2x, which is well above the 1.5x reached before the Great Financial Crisis (GFC).

Even more intriguing, Insurers are now trading at market average P/Book.

P/Book 2006-2025: Banks (pink) vs. Insurers (blue ) and market (green)

For good measure, we looked at the RoE dynamic of Banks, Insurance and wider markets, respectively. RoE are the alternative face to a P/book. While Banks have not yet reverted to their pre GFC absurdly high RoEs, Insurers have.

RoEs (2006-2025) reverting back to pre GFC levels?

The rising P/Book multiples of Insurers are consistent with their recovered profitability (dependent on where one assigns the cost of equity, of course). They also reflect a favourable technical accounting effect, stemming from the transition to IFRS17, which generally lowered equity due to the recognition of the Contractual Service Margin and the Risk Adjustment.

Still, the surge in Insurers RoEs raises question marks. Is it reasonable for a semi-public service (the heavy handed regulation attests to that) to collect such returns? At whose expense? How long can it last? As a reminder when Banks in pre GFC world were accounting for 18% of listed earnings, the music suddenly stopped, as those gains were at the expense of the wider economy.

Is there enough competition? Are Insurers overreaching under the umbrella of excess regulation, leaving no room for new entrants? Alternatively, are insurers taking too many risks?

Insurers seem to be in a position to pay out ever more, and in spite of increasingly demanding prudential ratios, they are actually heading towards a capital light(er) model and can distribute their capital excesses.

Shifting risk takes convoluted turns

This is a crude way of referring to their increased propensity to shift risk off their balance sheet, as bankers did and still do. In Life (it is not really possible in non-Life), policyholders are increasingly investors in insurance saving products with no performance guarantee. Life insurers are de facto fund managers with a tax edge. Derisking has been a first step to lightening up capital obligations. However, it may encompass more subtle moves that distort the risk picture.

There emerges an increasing risk of conflict of interest when savings are invested in products designed to promote returns for shareholders, rather than for policyholders. This is the case when private equity owned insurers are promoting PE funds and private debt products, designed by their shareholders to cater for their own private market funding needs. This is a deplorable dynamic in the US, which has yet to cross the Atlantic in a significant way. The point is that this dynamic is one where the risk is squarely transferred onto the unaware policyholder, so that the insurer can be run on thin risk-absorbing capital, as policyholders hold the hot potato.

The FSB, BIS and other global observers of financial markets have raised the alarm repeatedly on this unsavoury development. In essence, Insurers are transferring their risks to the wider savings market with systemic implications. They can thus afford to pay out more.

Shareholders in listed European insurers need not harbour such concerns, even if accidents in financial markets would not be contained at the border, and would impact them.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...