Inventories Look Up

In a recent short paper(16-01) about the unimpressive ROCEs of European equities over 2006-2026, we touched upon the fact that the rising capital employed was partly driven by rising inventories.

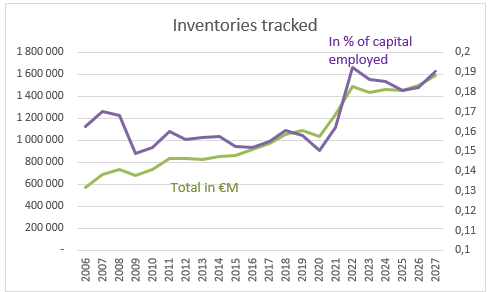

We address the subject below with the observation that total inventories in the coverage universe have risen by €500bn between 2020 and 2025, and that as a proportion of capital employed, this is a regime change vs. earlier years, as inventories jumped to 18% of capital employed from 2020 vs. 16% before. 1% of capital employed is worth c. €80bn these days for the total coverage ex Financials.

What are rising inventories telling us?

Piling up inventories is an indication of limited confidence … and low cost of capital and/or speculative dispositions about future prices/costs.

The first part of the proposition matters most. Corporates will accumulate pre-emptively when visibility collapses. That was the Covid-19 outcome. Interestingly 2020 shortage fears have not entirely disappeared /have morphed into speculative stances about prices/costs, while inflation went through the roof in 2022. Subsequent higher rates did not seem to kill this taste for more current assets. Still high 2025 inventories as a proportion of capital employed, may be explained by pre-emptive stockpiling as Trump went tariff berserk.

Rising inventories – absolute and relative – match lasting concerns about operating conditions at large. Remember too that firms under review are very large (average market cap at €30bn), and are ever more global. More geographic exposures presumably trigger a need to keep inventories in more geographies.

It is quite striking to observe that a more digital world cannot really do away with more inventories, as if risks were building up relentlessly. Business models can be construed as getting trickier, requiring more of an insurance policy, namely inventories.

Who needs bigger inventories?

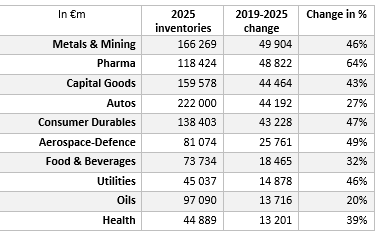

In absolute terms, Miners, Pharmas, Capital Goods, Autos, Consumer Durables seem to have been ramping up their inventories steadily over 2019-2025. This warrants more granular investigation, notably as far as Pharmas are concerned. More digging time is needed though.

Sectors tying up more capital in inventories

We address the subject below with the observation that total inventories in the coverage universe have risen by €500bn between 2020 and 2025, and that as a proportion of capital employed, this is a regime change vs. earlier years, as inventories jumped to 18% of capital employed from 2020 vs. 16% before. 1% of capital employed is worth c. €80bn these days for the total coverage ex Financials.

What are rising inventories telling us?

Piling up inventories is an indication of limited confidence … and low cost of capital and/or speculative dispositions about future prices/costs.

The first part of the proposition matters most. Corporates will accumulate pre-emptively when visibility collapses. That was the Covid-19 outcome. Interestingly 2020 shortage fears have not entirely disappeared /have morphed into speculative stances about prices/costs, while inflation went through the roof in 2022. Subsequent higher rates did not seem to kill this taste for more current assets. Still high 2025 inventories as a proportion of capital employed, may be explained by pre-emptive stockpiling as Trump went tariff berserk.

Rising inventories – absolute and relative – match lasting concerns about operating conditions at large. Remember too that firms under review are very large (average market cap at €30bn), and are ever more global. More geographic exposures presumably trigger a need to keep inventories in more geographies.

It is quite striking to observe that a more digital world cannot really do away with more inventories, as if risks were building up relentlessly. Business models can be construed as getting trickier, requiring more of an insurance policy, namely inventories.

Who needs bigger inventories?

In absolute terms, Miners, Pharmas, Capital Goods, Autos, Consumer Durables seem to have been ramping up their inventories steadily over 2019-2025. This warrants more granular investigation, notably as far as Pharmas are concerned. More digging time is needed though.

Sectors tying up more capital in inventories

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.