LVMH

Note: This is a daily stock update and the information stands true as of 15/04/25, 09:00 CET.

Company Update:

Expert Opinion:

Our expert is significantly more cautious. He doesn’t see any catalyst for the stock to bounce in the short term (besides valuation but LVMH still trades at PE25 of 19.2x down to 16.5x for 27). Furthermore the comp base will not be easier in Q2 but starts improving in Q3 and Q4. He'd rather stay on the side and wait for either an actual sign of improvement in consumer demand (be it in China or in the US) or a valuation that marks a significant discount to the pre-pandemic period.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

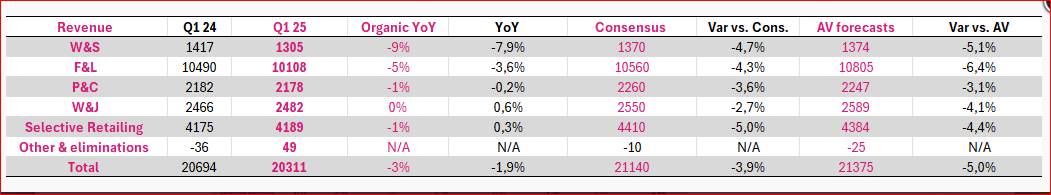

LVMH reported Q1 25 sales that fell short of consensus and our expectations. Q1 25 group sales declined by 3% YoY organically (-2% as reported) to €20.3bn.

The group’s performance was primarily impacted by unpredictable consumer behavior in China (Asia excl. Japan: -11%), the slowdown in beauty and Cognac products in the US (-3%), and Japan (-1% YoY), which suffered from a high comparison base.

Tariffs Impact

The US contributed 24% of the group’s revenue in Q1 25. The potential new US tariffs could be partially passed on to the US end consumer. Furthermore LV has 3 production facilities in the US and could supply 1/3 of US demand.

Our analyst will cut her estimates for the year but she sticks to her positive view as she believes the derating is excessive and believes thanks to its wide range of brands, LVMH will benefit from better resilience than peers going forward.

Our expert is significantly more cautious. He doesn’t see any catalyst for the stock to bounce in the short term (besides valuation but LVMH still trades at PE25 of 19.2x down to 16.5x for 27). Furthermore the comp base will not be easier in Q2 but starts improving in Q3 and Q4. He'd rather stay on the side and wait for either an actual sign of improvement in consumer demand (be it in China or in the US) or a valuation that marks a significant discount to the pre-pandemic period.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog