LVMH

Note: This is a daily stock update and the information stands true as of 25/07/25, 09:00 CET.

Company Update:

Expert Opinion:

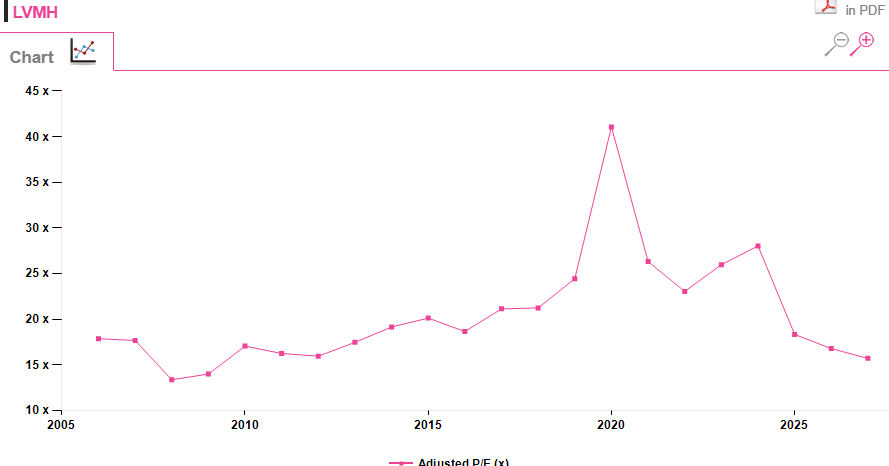

Visibility remains low but the sequential improvement in Chinese domestic demand is good news. A EU/US trade deal would also be good news. After a massive fall in share price, valuation is now back to a more palatable level as the company tades on PE 25 and 26 of 18.3x and 16.8x , roughly in line with their pre covid levels. Our expert would buy LVMH now and wait for a gradual rerating (even though he doubts we will soon see the more than 30x PE level).

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

LVMH delivered slightly better-than-feared results in H1 25, with group revenues broadly in line with consensus and operating profit ahead of market expectations. H1 25 sales declined 3% organically (-4% reported) to €39.8bn.

While most divisions showed sequential improvement, the key Fashion & Leather Goods segment deteriorated further, hit by weaker tourist flows, particularly in Japan. Positively, Chinese domestic demand showed signs of recovery.

Margin resilience confirms the group’s ability to manage cost discipline, but the trading environment remains challenging and visibility is low. Operating profit came in at €9.0bn, reflecting an operating margin of 22.6%, ahead of consensus.

Operating cash flow was up 28% yoy, marking a very strong management of cash.

Expert Opinion:

Visibility remains low but the sequential improvement in Chinese domestic demand is good news. A EU/US trade deal would also be good news. After a massive fall in share price, valuation is now back to a more palatable level as the company tades on PE 25 and 26 of 18.3x and 16.8x , roughly in line with their pre covid levels. Our expert would buy LVMH now and wait for a gradual rerating (even though he doubts we will soon see the more than 30x PE level).

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog