LVMH

Note: This is a daily stock update and the information stands true as of 15/10/25, 09:00 CET.

Company Update:

Expert Opinion:

The recovery in China and in the US is definitely encouraging. On the back of our numbers, valuation is attractive again for LVMH with PE25 at 26.5x down to 18.8x in 2027 (and 20.3x in 2026). Our expert expects luxury will be back in favor. The X read is positive for all luxury stocks. But LVMH offers the most compelling equity story at this stage with "relatively soft" valuation ratios and good prospects going forward. Conversely, he would switch out of Kering where the paly on the recovery linked to Luca de Meo played very well. We are now entering in a phase where actual progress will need to be demonstrated in order to achieve further progress.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

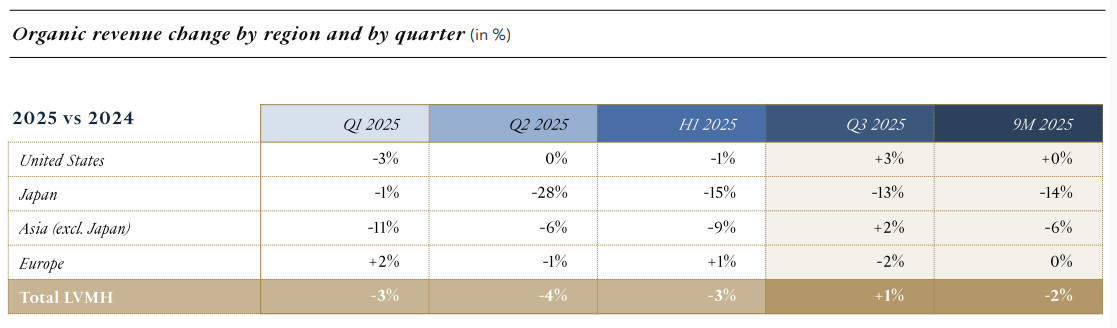

Q3 25 sales came in ahead of consensus and our expectations, with all divisions slightly above. Overall organic growth stood at 1%, ahead of the consensus (-0.5%).

All regions improved sequentially since the start of the year, except Europe. Asia showed notable progress in Q3, with China back on a positive trajectory. The US accelerated despite a volatile macro backdrop, supported by healthy demand for luxury.

Asia strengthened, with China back to growth. Brand desirability is reactivated through focused initiatives and investment at key houses, supporting traffic and mix despite persistent macro volatility.

We remain constructive and see LVMH as best placed to capture a gradual sector recovery.

The recovery in China and in the US is definitely encouraging. On the back of our numbers, valuation is attractive again for LVMH with PE25 at 26.5x down to 18.8x in 2027 (and 20.3x in 2026). Our expert expects luxury will be back in favor. The X read is positive for all luxury stocks. But LVMH offers the most compelling equity story at this stage with "relatively soft" valuation ratios and good prospects going forward. Conversely, he would switch out of Kering where the paly on the recovery linked to Luca de Meo played very well. We are now entering in a phase where actual progress will need to be demonstrated in order to achieve further progress.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog