Novo Nordisk

Note: This is a daily stock update and the information stands true as of 23/06/25, 09:00 CET.

Company Update:

The pill version of amycretin had produced 13.1% weight-loss (on its highest dose) in 12 weeks in an early-stage trial, which means even the pill version could prove to be as effective as the subcutaneous version if taken for a longer duration. As a comparison, Eli Lilly’s new oral weight-loss candidate, orforglipron, had produced 14.7% weight-loss (highest dose) over 36 weeks in phase II trial.

Expert Opinion:

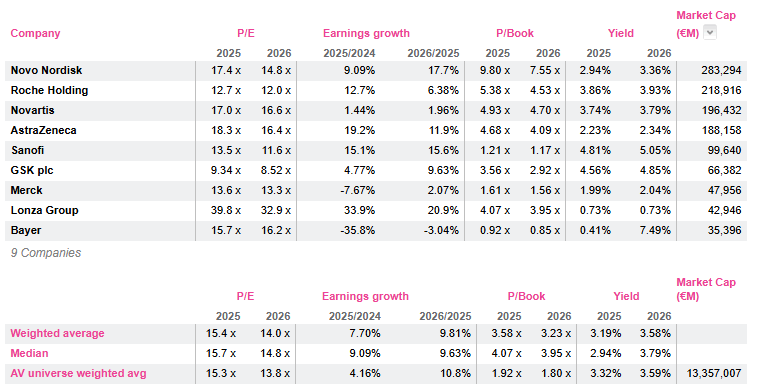

Novo Nordisk remains in our expert's opinion the most interesting stock within large pharmas. While it now trades with a slight premium to the sector average of large pharmas (see table below), it offers very strong prospects of earnings growth. We are still positive on the overweight/ obesity markets and despite the competition from Eli Lily and potential newcomers, we believe Novo Nordisk will retain a very significant share of this huge market. The risk-reward profile remains skewed to the upside.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Novo Nordisk’s new investigational weight-loss drug, amycretin’s (now advanced into phase III trials) subcutaneous version produced 24.3% weight-loss (with its highest dose of 60mg) vs. 1.1% for placebo in 36 weeks in an early-stage trial. This weight loss efficacy, if sustained through phase III trials, could be better than the currently available options, i.e., Zepbound (22.5%) and Wegovy (c.15%).

The pill version of amycretin had produced 13.1% weight-loss (on its highest dose) in 12 weeks in an early-stage trial, which means even the pill version could prove to be as effective as the subcutaneous version if taken for a longer duration. As a comparison, Eli Lilly’s new oral weight-loss candidate, orforglipron, had produced 14.7% weight-loss (highest dose) over 36 weeks in phase II trial.

Interestingly, amycretin is a single molecule targeting two proteins, GLP-1 and amylin, and it implies that manufacturing this drug at scale may not pose many challenges. Amycretin could enter the market by late 2028 or 2029, provided it clears all the hurdles.

Expert Opinion:

Novo Nordisk remains in our expert's opinion the most interesting stock within large pharmas. While it now trades with a slight premium to the sector average of large pharmas (see table below), it offers very strong prospects of earnings growth. We are still positive on the overweight/ obesity markets and despite the competition from Eli Lily and potential newcomers, we believe Novo Nordisk will retain a very significant share of this huge market. The risk-reward profile remains skewed to the upside.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog