Paris Teeters On the Brink

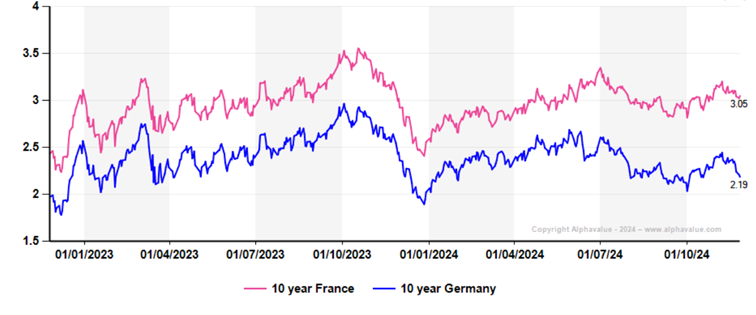

France’s impossible cohabitation is being told to behave with long rates now on a par with those of Greece (3.02%) and an 85bp spread over the Bund, a high since last June's general elections.

As the following chart shows, that spread has also widened because German long rates have contracted. Ergo French corporates may suffer from a higher marginal borrowing cost than their Euro based peers. Admittedly French interest rates are not that much higher than two years ago meaning that French corporates have yet to suffer a real increase in their interest bills (please read also ‘Real life debt is about to cost more). But markets never wait to sanction an opportunity cost. This is ongoing with worse to come as the bond market messaging seems to be falling on deaf political ears.

From June 2025, markets require a premium to hold French sovereigns

Worse to come could be a set of no-confidence votes over the next two weeks, a government collapse, an extension of the 2024 budget into 2025 and thus a wider deficit than even the 6% of 2024. The next big political date would be the option of fresh general elections from June 2025 or seven months of rot.

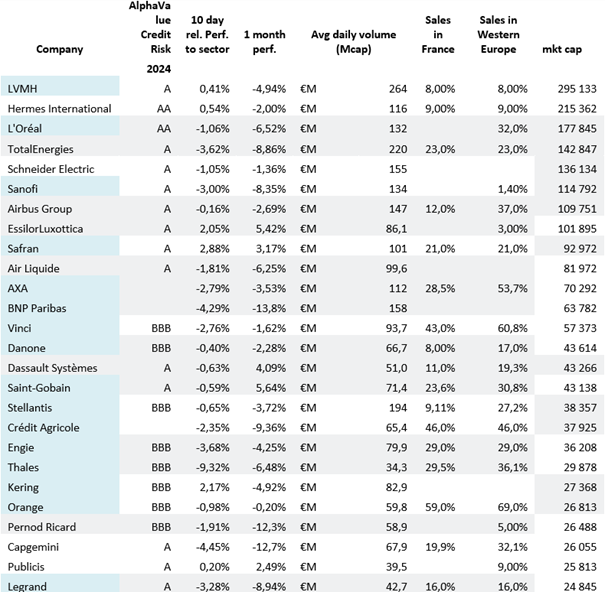

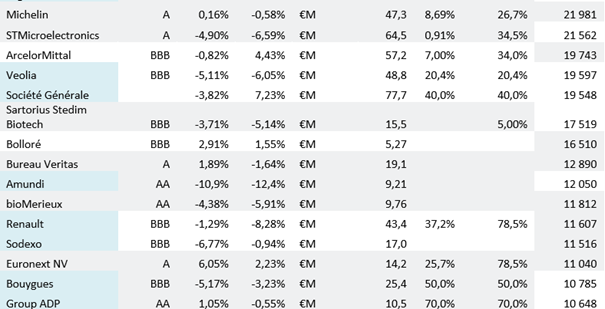

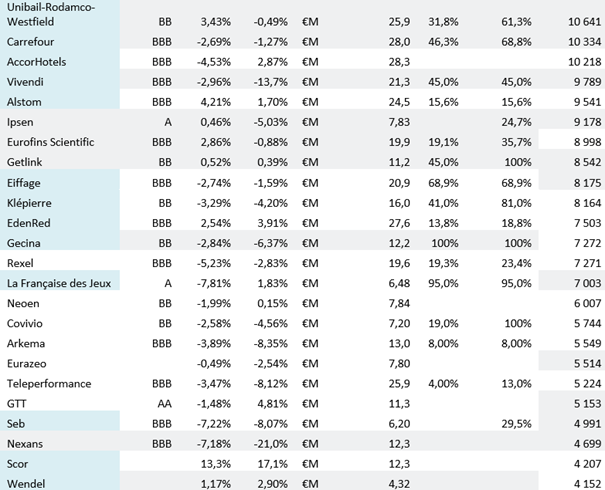

The French flag is bound to suffer further and will hit the respectability of stocks regarded as good French proxies. The proxy concept will encompass firms with a strong reliance on France as a domestic market (say banks) as well as highly liquid stocks regarded as perennially French (say LVMH).

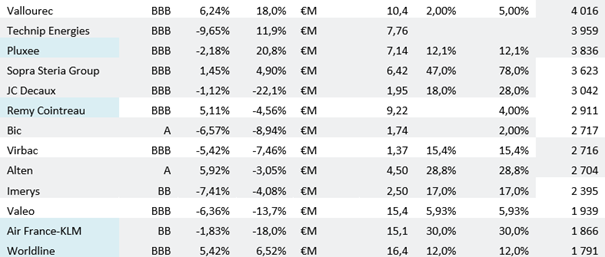

The following table goes through the stocks (light blue) that show some connection to France mostly through headquarters and tries to select the most likely to suffer from the political background. The universe is narrowed down to €1.8bn + market caps.

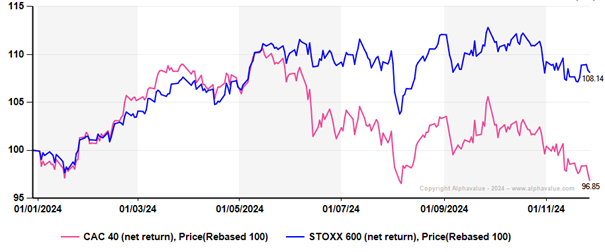

Obviously the 10% ytd underperformance of the CAC40 vs. the Stoxx600 is set to continue (last chart).

Poor CAC40

As the following chart shows, that spread has also widened because German long rates have contracted. Ergo French corporates may suffer from a higher marginal borrowing cost than their Euro based peers. Admittedly French interest rates are not that much higher than two years ago meaning that French corporates have yet to suffer a real increase in their interest bills (please read also ‘Real life debt is about to cost more). But markets never wait to sanction an opportunity cost. This is ongoing with worse to come as the bond market messaging seems to be falling on deaf political ears.

From June 2025, markets require a premium to hold French sovereigns

Worse to come could be a set of no-confidence votes over the next two weeks, a government collapse, an extension of the 2024 budget into 2025 and thus a wider deficit than even the 6% of 2024. The next big political date would be the option of fresh general elections from June 2025 or seven months of rot.

The French flag is bound to suffer further and will hit the respectability of stocks regarded as good French proxies. The proxy concept will encompass firms with a strong reliance on France as a domestic market (say banks) as well as highly liquid stocks regarded as perennially French (say LVMH).

The following table goes through the stocks (light blue) that show some connection to France mostly through headquarters and tries to select the most likely to suffer from the political background. The universe is narrowed down to €1.8bn + market caps.

Obviously the 10% ytd underperformance of the CAC40 vs. the Stoxx600 is set to continue (last chart).

Poor CAC40

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...