Quantum Leap Works Wonder in Insurance

Accounting amounts to an attempt to instil a shared fixed point in financial matters. For insurers, one particularly key financial fixed point - shareholders funds - has been revisited (shift from IFRS 4 to IFRS 17) to lower levels meaning that another essential financial anchor, RoE, now reflects a new, much-more-attractive reality. Same firm, same business, two different realities and no way to explain this quantum leap beyond a few circles of experts. The issue is that there is no telling which reality is ‘right’. Markets are telling us that the new reality is much appreciated.

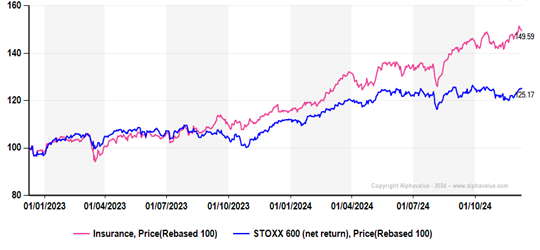

The insurance universe of AlphaValue (22 stocks, €620bn market cap) has outperformed the Stoxx600 by c. 20% over the last two years with most of the gain in 2024 when the first 2023 accounts under IFRS 17 became available and accepted.

Has IFRS17 injected new life into Insurers?

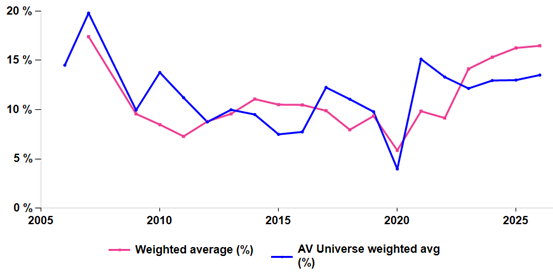

The following ROE chart helps measure whether the new reality might be dysfunctional. It sets the ROEs of insurers (in pink) vs. the ROEs of the whole AlphaValue coverage. Both universes bounce from their Covid-marred 2020 lows but the slippage in the insurance sector ROE between 2006 and 2022 then transforms into an impressive surge from 2023 and continuing. This is made clear by the 2023-2026 insurers ROE trend when set against that of the wider market.

Insurers ROEs (pink) vs. market ROEs. 2006-2026

The above chart voluntarily overlooks the 2008 ROE of the insurance industry. At -12% it reflected massive losses. The reported losses for the then 15 stocks under coverage was €-26bn. The AlphaValue adjusted 2008 earnings were at … +€8bn. Here again reality is a relative concept.

Does this matter? Quite possibly.

The following PE chart – a metric not related to shareholders equity – shows the Insurance sector PE relative to that of the wider market. The Insurance PE is going up steadily, i.e. confidence is on the rise. Better not disappoint.

Insurance PE (pink) relative to market PE (blue): 2006-2024 (ex 2008)

The insurance universe of AlphaValue (22 stocks, €620bn market cap) has outperformed the Stoxx600 by c. 20% over the last two years with most of the gain in 2024 when the first 2023 accounts under IFRS 17 became available and accepted.

Has IFRS17 injected new life into Insurers?

The following ROE chart helps measure whether the new reality might be dysfunctional. It sets the ROEs of insurers (in pink) vs. the ROEs of the whole AlphaValue coverage. Both universes bounce from their Covid-marred 2020 lows but the slippage in the insurance sector ROE between 2006 and 2022 then transforms into an impressive surge from 2023 and continuing. This is made clear by the 2023-2026 insurers ROE trend when set against that of the wider market.

Insurers ROEs (pink) vs. market ROEs. 2006-2026

The above chart voluntarily overlooks the 2008 ROE of the insurance industry. At -12% it reflected massive losses. The reported losses for the then 15 stocks under coverage was €-26bn. The AlphaValue adjusted 2008 earnings were at … +€8bn. Here again reality is a relative concept.

Does this matter? Quite possibly.

The following PE chart – a metric not related to shareholders equity – shows the Insurance sector PE relative to that of the wider market. The Insurance PE is going up steadily, i.e. confidence is on the rise. Better not disappoint.

Insurance PE (pink) relative to market PE (blue): 2006-2024 (ex 2008)

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...