Seb Goes Nowhere

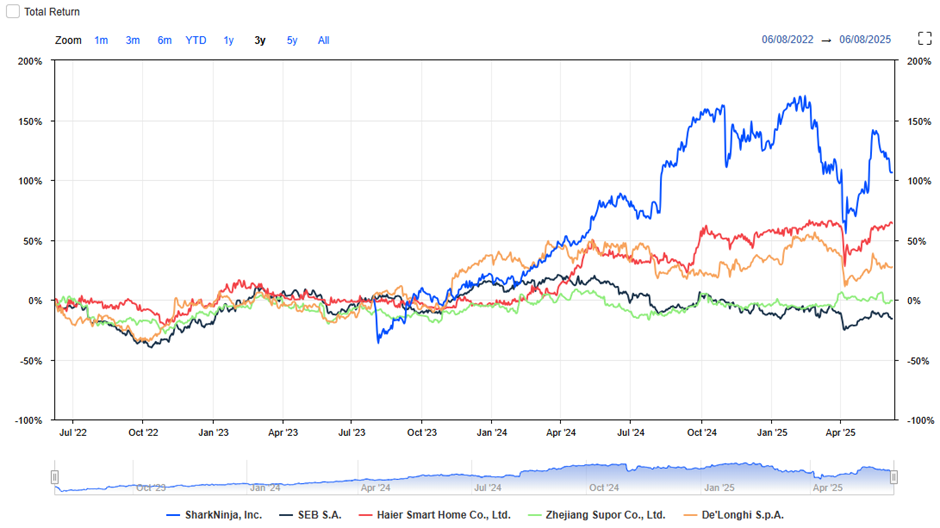

Over the last 5 years Seb SA (Buy; France) has gone nowhere compared with the competition and notably next to SharkNinja, the daredevil of the electrical appliances industry which is now worth $13bn whereas Seb has been stuck at below €5bn for the past 5 years. Seb’s listed Chinese operation, Supor, worth 40% of Seb’s GAV, hasn't been much help.

Seb’s depressing total return (in black) - 3 years. Supor in green

These days, Seb’s businesses - as part of Consumer Durables - are having to contend with weak consumption across several Western European countries, the Chinese economy continues to show signs of fragility despite targeted government subsidies to boost consumer goods consumption, and US import tariffs pose an additional risk to global trade flows.

This has translated into a sharp year-to-date underperformance of -10.2% for Consumer Durables, one of the worst. In contrast, Seb has outperformed the sector (-0.5%) but not its closest peers (SharkNinja, Haier, De’Longhi).

So what has gone wrong?

Pretty little as of late, actually. At its Q1 2025 update, Seb delivered encouraging guidance for the year, forecasting around +5% organic sales growth and an increase for its operating result from activity although no specific figure has been disclosed. The group expects to mitigate higher tariffs through selective price increases.

Despite this confidence, the stock continues to trade at depressed valuation levels, with 2025 EV/EBIT and PE multiples of 10x – a level not seen since the 2008-09 financial crisis.

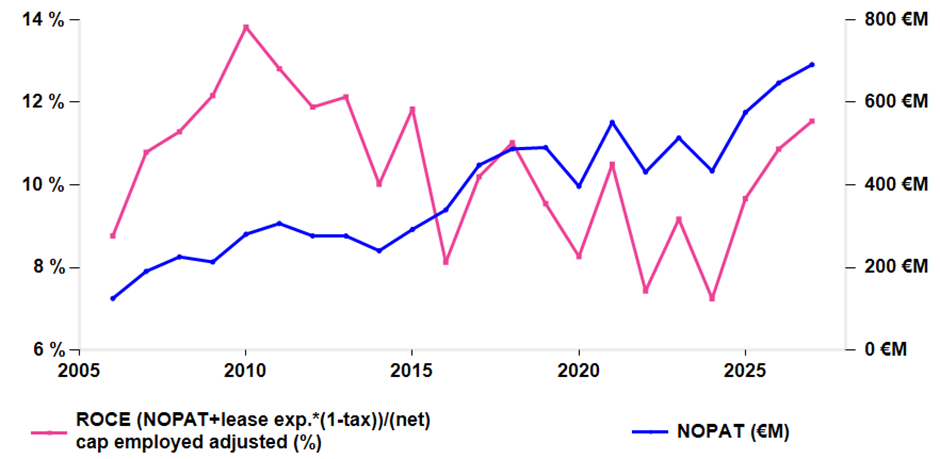

The reasons might be deeper seated when we take a closer look at Seb’s ROCEs

ROCE impacted by acquisition and working capital swings

Seb’s ROCE has experienced a structural decline in spite of Seb’s NOPAT showing a gradual upward trend, supported by a resilient operating performance despite temporary headwinds between 2020 and 2024, such as supply chain disruptions.

The villain has been pricey external growth which inflated goodwill and intangible assets, when the group decided to go ‘professional’ 8 years ago. Addressing professional markets with ad-hoc coffee machines led to a doubling in capital employed. Then throw in a serving of volatility in working capital within the Consumer business. In 2024, inventory levels rose due to disruptions in the Red Sea and longer ocean transit times. Looking ahead, our estimates point to a gradual improvement in ROCE at the constant perimeter.

Seb has a sound financial position with the group adjusted net debt-to-EBITDA ratio at 2.15x but its financial performance has been marred by the fact that its Professional arm has not been made to sweat enough.

Nopat and ROCE diverge, courtesy of external growth

The above improvement of Seb’s ROCE over 2025-27 is a combination of profitable growth in Consumers (88% of sales) thanks to steady innovation and hopefully better returns on assets on the Professional side (12% of sales). Too many acquisitions in coffee machines (WMF, Wilbur Curtis, La San Marco) and culinary equipment (Pacojet, Sofilac, La Brigade de Buyer among others) are not a growth guarantee as contract-based sales, with large orders, are volatile. Seb is not finished with Professional investments as it rightly sees a case to operate its first professional equipment hub in Shaoxing, currently under construction, which will include R&D, purchasing and manufacturing capabilities. This is certainly a wise move to compete effectively with the local players as Seb has managed to do on the consumer side with Chinese-listed and majority-controlled Supor.

Supor vs. SharkNinja: questions for Seb’s management

The 2-year-old listing of SharkNinja, a fast-moving ‘US & Canada focused Seb,’ with manufacturing in China and Asia has raised questions about Seb’s industrial effectiveness. 82%-owned Supor, seeing it to be a great asset to speak in Chinese to Chinese consumers, has proven a laggard relative to SharkNinja or even Haier. SharkNinja should reach a 22% ROCE vs. 10% at Seb (21% at Haier). As Supor’s own ROCE is closer to 30%, that of Seb excluding Supor is implied to be remarkably low.

Such gaps raise questions about Seb’s governance. This was recently addressed in depth in an AlphaBlunt! report that found that Seb still drives Supor as a stand-alone unit contributing substantial dividends while the Supor management is not represented within Seb’s senior management committee in France, 18 years after its acquisition. To what extent Supor has underinvested in its Chinese growth while it has funded Seb’s European acquisition strategy is an interesting question.

Seb needs to better integrate its Chinese assets. It would be better off with headquarters in China rather than nearby Lyons if it ever wants to face SharkNinja. In-fighting between Seb’s founding families does not help decision making anyway.

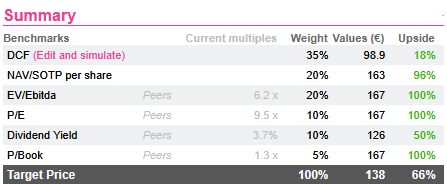

Significant upside of 66%

The substantial upside potential is derived from all the valuation metrics and reflects the value trap profile that has developed as the management does things essentially right but not quickly enough, and may have taken a wrong turn by doubling up on Professional with little to show 8 years down the road.

At the current levels, the stock trades at undemanding multiples, with 2025E EV/EBIT and PE ratios of 10x, well its below historical averages of 13x and 15x, respectively over the period 2006-24. Attractive but short of a trigger at the governance level.

Seb’s depressing total return (in black) - 3 years. Supor in green

These days, Seb’s businesses - as part of Consumer Durables - are having to contend with weak consumption across several Western European countries, the Chinese economy continues to show signs of fragility despite targeted government subsidies to boost consumer goods consumption, and US import tariffs pose an additional risk to global trade flows.

This has translated into a sharp year-to-date underperformance of -10.2% for Consumer Durables, one of the worst. In contrast, Seb has outperformed the sector (-0.5%) but not its closest peers (SharkNinja, Haier, De’Longhi).

So what has gone wrong?

Pretty little as of late, actually. At its Q1 2025 update, Seb delivered encouraging guidance for the year, forecasting around +5% organic sales growth and an increase for its operating result from activity although no specific figure has been disclosed. The group expects to mitigate higher tariffs through selective price increases.

Despite this confidence, the stock continues to trade at depressed valuation levels, with 2025 EV/EBIT and PE multiples of 10x – a level not seen since the 2008-09 financial crisis.

The reasons might be deeper seated when we take a closer look at Seb’s ROCEs

ROCE impacted by acquisition and working capital swings

Seb’s ROCE has experienced a structural decline in spite of Seb’s NOPAT showing a gradual upward trend, supported by a resilient operating performance despite temporary headwinds between 2020 and 2024, such as supply chain disruptions.

The villain has been pricey external growth which inflated goodwill and intangible assets, when the group decided to go ‘professional’ 8 years ago. Addressing professional markets with ad-hoc coffee machines led to a doubling in capital employed. Then throw in a serving of volatility in working capital within the Consumer business. In 2024, inventory levels rose due to disruptions in the Red Sea and longer ocean transit times. Looking ahead, our estimates point to a gradual improvement in ROCE at the constant perimeter.

Seb has a sound financial position with the group adjusted net debt-to-EBITDA ratio at 2.15x but its financial performance has been marred by the fact that its Professional arm has not been made to sweat enough.

Nopat and ROCE diverge, courtesy of external growth

The above improvement of Seb’s ROCE over 2025-27 is a combination of profitable growth in Consumers (88% of sales) thanks to steady innovation and hopefully better returns on assets on the Professional side (12% of sales). Too many acquisitions in coffee machines (WMF, Wilbur Curtis, La San Marco) and culinary equipment (Pacojet, Sofilac, La Brigade de Buyer among others) are not a growth guarantee as contract-based sales, with large orders, are volatile. Seb is not finished with Professional investments as it rightly sees a case to operate its first professional equipment hub in Shaoxing, currently under construction, which will include R&D, purchasing and manufacturing capabilities. This is certainly a wise move to compete effectively with the local players as Seb has managed to do on the consumer side with Chinese-listed and majority-controlled Supor.

Supor vs. SharkNinja: questions for Seb’s management

The 2-year-old listing of SharkNinja, a fast-moving ‘US & Canada focused Seb,’ with manufacturing in China and Asia has raised questions about Seb’s industrial effectiveness. 82%-owned Supor, seeing it to be a great asset to speak in Chinese to Chinese consumers, has proven a laggard relative to SharkNinja or even Haier. SharkNinja should reach a 22% ROCE vs. 10% at Seb (21% at Haier). As Supor’s own ROCE is closer to 30%, that of Seb excluding Supor is implied to be remarkably low.

Such gaps raise questions about Seb’s governance. This was recently addressed in depth in an AlphaBlunt! report that found that Seb still drives Supor as a stand-alone unit contributing substantial dividends while the Supor management is not represented within Seb’s senior management committee in France, 18 years after its acquisition. To what extent Supor has underinvested in its Chinese growth while it has funded Seb’s European acquisition strategy is an interesting question.

Seb needs to better integrate its Chinese assets. It would be better off with headquarters in China rather than nearby Lyons if it ever wants to face SharkNinja. In-fighting between Seb’s founding families does not help decision making anyway.

Significant upside of 66%

The substantial upside potential is derived from all the valuation metrics and reflects the value trap profile that has developed as the management does things essentially right but not quickly enough, and may have taken a wrong turn by doubling up on Professional with little to show 8 years down the road.

At the current levels, the stock trades at undemanding multiples, with 2025E EV/EBIT and PE ratios of 10x, well its below historical averages of 13x and 15x, respectively over the period 2006-24. Attractive but short of a trigger at the governance level.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...