Ebitda Dreams Cont’d

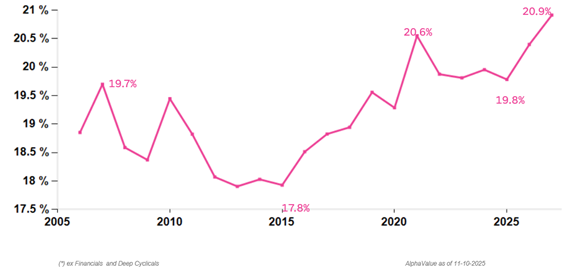

AlphaValue resuscitated its 20-year Ebitda margin chart (ex Banks and Deep Cyclicals) and continues to scratch its head about the ever-rosy European equities profitability outlook. Consider the following: since 2021 Ebitda margins, realised or expected, have always been above the pre Great Financial Crisis highs. US tariffs, wars, $ weakness, Chinese restrictions will not slow down enthusiasm. In addition, this strength is in sharp contrast with the observation that growth departed European shores long ago.

Cloudless European stocks

Of note: Historical Ebitda margins are consistent with post IFRS 16 margins

Here are a few potential explanations:

- Bigger firms are de facto oligopolies whatever the sector. This was an inference of 2021, when margins suddenly shot up through higher prices which stuck. Competition never surfaced, which is a result of oligopolies forming in highly regulated industries: incumbents cannot be dislodged. It takes a Chinese state backed effort to dislodge car manufacturers for instance, when no new firm has emerged in Europe over the last century.

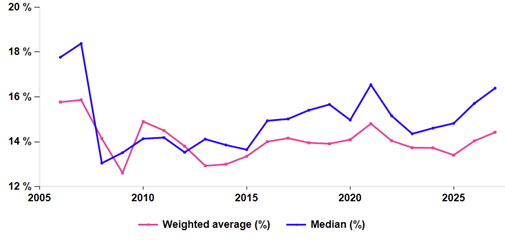

- The oligopoly angle is backed by the following chart of average and median Ebitda margins for the lower third of the coverage by market cap (below c. €5bn). Say that the 19%-20% become 14%-15%.

Ebitda margins of stocks worth less than €5bn (as of 16-10-2025)

- Ebitda is a management reporting tool. It is designed to reflect a pleasing performance through all sorts of sometimes common-sense insulting adjustments, not to mention a total disconnect with gross cash generation. As corporates pressure analysts to fall in line with their communication, it may be that not such clean Ebitda gains in proportion of the total.

Sadly it is very difficult to gauge how much of the Ebitda ‘abuse’ does not percolate into free cash flow and net earnings. As far as FCF is concerned, a cut in inventories has helped release extra resources that helped pay remarkable dividends.

Stay tuned.

Cloudless European stocks

Of note: Historical Ebitda margins are consistent with post IFRS 16 margins

Here are a few potential explanations:

- Bigger firms are de facto oligopolies whatever the sector. This was an inference of 2021, when margins suddenly shot up through higher prices which stuck. Competition never surfaced, which is a result of oligopolies forming in highly regulated industries: incumbents cannot be dislodged. It takes a Chinese state backed effort to dislodge car manufacturers for instance, when no new firm has emerged in Europe over the last century.

- The oligopoly angle is backed by the following chart of average and median Ebitda margins for the lower third of the coverage by market cap (below c. €5bn). Say that the 19%-20% become 14%-15%.

Ebitda margins of stocks worth less than €5bn (as of 16-10-2025)

- Ebitda is a management reporting tool. It is designed to reflect a pleasing performance through all sorts of sometimes common-sense insulting adjustments, not to mention a total disconnect with gross cash generation. As corporates pressure analysts to fall in line with their communication, it may be that not such clean Ebitda gains in proportion of the total.

Sadly it is very difficult to gauge how much of the Ebitda ‘abuse’ does not percolate into free cash flow and net earnings. As far as FCF is concerned, a cut in inventories has helped release extra resources that helped pay remarkable dividends.

Stay tuned.

Subscribe to our blog

Alphavalue Morning Market Tip

Weight loss pill cleared by FDA in January: A game changer in perception.

As contrarian born market participants, what would we buy into this quality universe with closed eye?