State intervention is not limited to AF-KLM

The French government attempting to explain to the Dutch administration why the latter acted unfairly in daring to buy 14% of Air France-KLM is a disgrace. Not only is there no basis for challenging the Dutch government’s sovereign right to buy into a listed business but the history of French government interventions involving the equity of listed companies constitutes a long list of useless, ill-timed and politically-ill-advised initiatives.

The only credit to said government is that it chose not to buy into the equity of the French banks to prop them up in the middle of the financial crisis. Other European states fell into that trap.

At AlphaValue, we try and keep track of weird ownership structures. Yesterday we mentioned the contradiction in terms involving staff ownerships (please see: “Staff owned? What for?). Today we can’t resist highlighting the many instances of governments showing a liberal face but acting differently.

Excluding Norway-owned Norges Bank which is in effect a fund for future generations, there are a few tough observations to be made (only through the prism of the AlphaValue coverage).

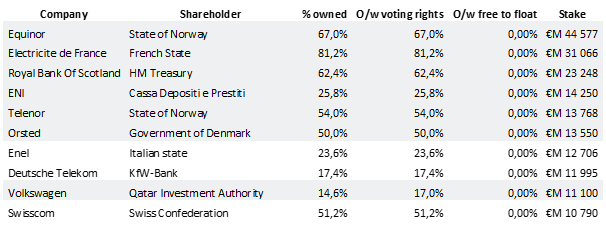

Let us start with the largest holdings in value terms (more than €10bn). Every single European government has a finger in businesses which do not merit it (note that the State of Lower Saxony “only” owns 12% of VolksWagen, less than QIA). It may be worth pointing out that Finland has only slightly less than €10bn invested in Neste.

Big “state” holdings (more than €10bn worth on 27-02-2019)

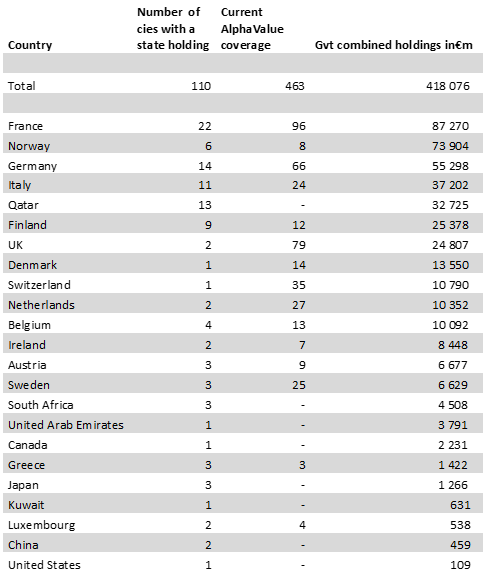

The above table shows that the disease is widespread. We summed up the Euro value of the governmental holdings (across the AlphaValue coverage) and matched this with the number of different companies in which governments have a stake, as well as with the current number of stocks tracked by AlphaValue.

There are some interesting observations

The above table shows that the disease is widespread. We summed up the Euro value of the governmental holdings (across the AlphaValue coverage) and matched this with the number of different companies in which governments have a stake, as well as with the current number of stocks tracked by AlphaValue.

There are some interesting observations

The detailed list of 110 names is available on request.

Learn more on www.alphavalue.com

The detailed list of 110 names is available on request.

Learn more on www.alphavalue.com

- A quarter or so of the coverage is “experiencing” a degree of State ownership.

- Put together, State ownership accounts for c.4% of the market cap of the AlphaValue coverage universe. The 4% becomes 23% of the market cap of the companies concerned…

- France is no worse than Germany (in % of coverage) when it comes to State intervention (even if the State in Germany is frequently a Land).

- Some governments are pretty adept at maintaining a State hand on the tiller (Norway, Finland, Italy).

- The UK knows how to keep its distance.

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.