Tesco

Note: This is a daily stock update and the information stands true as of 02/10/25, 09:00 CET.

Company Update:

Expert Opinion:

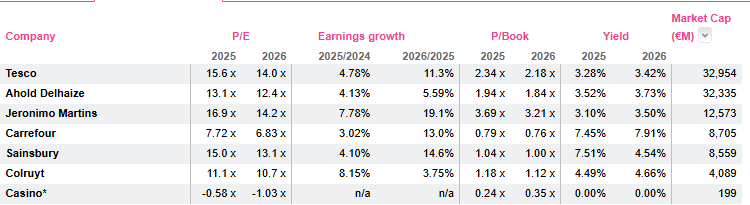

Tesco is the clear leader in the UK market and benefits from an environment where food inflation remains elevated. It is considered as a hedge against inflation. Valuation is now becoming somewhat expensive with a PE 26 (Feb 26) of 15.6x down to 13.1 in 2028 (feb) but market share gain is the name of the game in food retail and Tesco has been now consistently gaining market shares for years in an environment where others (Asda notably) were struggling.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Tesco H1 results came nicely ahead of expectations with a 10% beat at the EPS level.

LFL sale grew 4.3% at group level and +4.9% for the UK.

There was notably a strong performance of Tesco Finests and on its e-commerce platform with growth above 10%.

FY outlook was raised with EBIT now expected in the £2.9bn-3.1bn range vs £2.7bn-3.0bn previously. Note trhat the consensus is already around the £3.0bn mark.

Tesco is the clear leader in the UK market and benefits from an environment where food inflation remains elevated. It is considered as a hedge against inflation. Valuation is now becoming somewhat expensive with a PE 26 (Feb 26) of 15.6x down to 13.1 in 2028 (feb) but market share gain is the name of the game in food retail and Tesco has been now consistently gaining market shares for years in an environment where others (Asda notably) were struggling.

Our expert will not mention Carrefour again (even though he does) which remains massively discounted to the rest of the European sector. He still believes that Carrefour, at this price with a 7.5% dividend yield, is too good an opportunity to pass, but as mentioned the sole catalyst for rerating (expect for a takeover bid) would be substantial lfl market share gains. So far, the pressure from Leclerc and Intermarche remains elevated and any market share gain by Carrefour looks uncertain.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog