Trends Ahead Of The H1 2025 Reporting Season

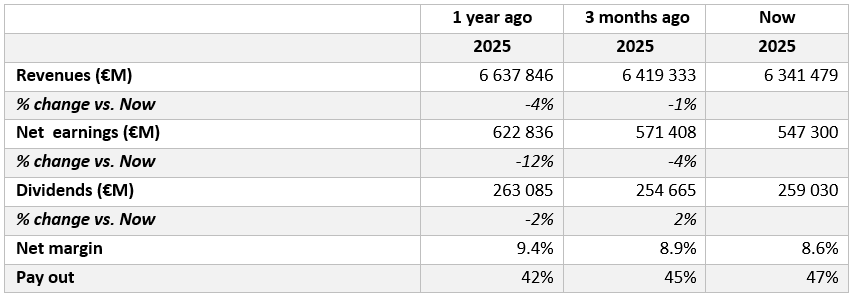

About 6 weeks ahead of the first wave of H1 earnings releases, we have taken a look at the ongoing earnings dynamics across the AlphaValue coverage expressed as revisions for 2025.

This has been computed excluding Financials, Oils and Metals & Mining as their top lines are not really under their control (not to mention the IFRS 17 impact on insurers’ top-line reporting).

Over the last 12 months, the message is clear: 2025 sales expectations have been trimmed by 4% and earnings by 12%. The X3 multiplier – a well-established connection - between the two lines seems to be confirmed.

2025 earnings momentum is less than convincing

Over the last 3 months, the downgrades to sales seem to have slowed down a bit. Net margins have been steadily slipping … but, and this is a big but,...at 8.6%, remain at their highs for the last 20 years (excluding 2021 on post Covid rebound). We are clearly not done with this paradox whereby corporates fail to clearly signal the deep negatives of the trade war(s). Of course the Middle East and further Trump shenanigans are likely to add to the pain.

The poorly-discounted elephant in the room is the $ erosion. The $ has lost 12% ytd vs. the € and around 8% over the last 12 months. Based on a rough guess that European groups derive 30% of their revenues in greenbacks, this implies that sales have been automatically trimmed by nearly 3.6%. How much of this is already baked in to the current 12-month cut to revenues remains a question mark. We would highlight the fact that Autos forecasts currently reflect a 10% sales contraction and that this figure is -9% for Semiconductors. Both effectively have significant $ exposure. Utilities and Consumer Durables sales have to date been trimmed by 7%, the former owing to lower energy prices (up until the Iran events) while the latter may be expecting too much from price increases.

Corporates have failed to communicate proactively on their tariff risks. We are no longer sure that they will do so as they move into this H2. That would be a shame. The trimming in earnings is unlikely to bottom out.

This has been computed excluding Financials, Oils and Metals & Mining as their top lines are not really under their control (not to mention the IFRS 17 impact on insurers’ top-line reporting).

Over the last 12 months, the message is clear: 2025 sales expectations have been trimmed by 4% and earnings by 12%. The X3 multiplier – a well-established connection - between the two lines seems to be confirmed.

2025 earnings momentum is less than convincing

Over the last 3 months, the downgrades to sales seem to have slowed down a bit. Net margins have been steadily slipping … but, and this is a big but,...at 8.6%, remain at their highs for the last 20 years (excluding 2021 on post Covid rebound). We are clearly not done with this paradox whereby corporates fail to clearly signal the deep negatives of the trade war(s). Of course the Middle East and further Trump shenanigans are likely to add to the pain.

The poorly-discounted elephant in the room is the $ erosion. The $ has lost 12% ytd vs. the € and around 8% over the last 12 months. Based on a rough guess that European groups derive 30% of their revenues in greenbacks, this implies that sales have been automatically trimmed by nearly 3.6%. How much of this is already baked in to the current 12-month cut to revenues remains a question mark. We would highlight the fact that Autos forecasts currently reflect a 10% sales contraction and that this figure is -9% for Semiconductors. Both effectively have significant $ exposure. Utilities and Consumer Durables sales have to date been trimmed by 7%, the former owing to lower energy prices (up until the Iran events) while the latter may be expecting too much from price increases.

Corporates have failed to communicate proactively on their tariff risks. We are no longer sure that they will do so as they move into this H2. That would be a shame. The trimming in earnings is unlikely to bottom out.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...