When is Old too Old for the Boardroom?

At 75, Mr Tronchetti Provera is in fighting form as, in his capacity as vice Chairman of Pirelli, he is pushing back Sinochem's efforts to effectively run the company. This is a good introduction to the unrelenting issue of corporate board gerontocracy.

AlphaValue was started as an ESG first equity research provider in 2007. AlphaValue’s 17-year history of collecting governance data helps churn the interesting following chart of aging board members. As age implies competence, they collect more on average. Obviously the following chart is not rocket science as board members rotate and corporates come and go. But it is as intellectually honest as possible using data sets where all parts are moving.

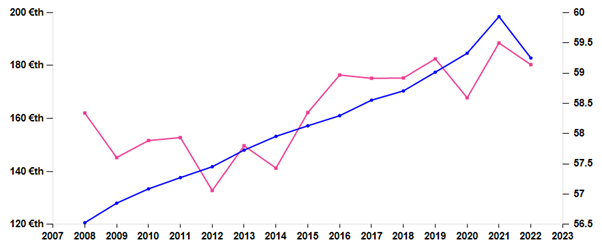

Average age of board members * (blue line, rhs) vs. average fees (pink, lhs)

Between 2008 and 2022, board members gained nearly 3 years to reach 59 by 2022 but will be mechanically at 60 by 2024. Unless that is, there is an unheard off reshuffling in the governance of the 500-odd corporates that populate the AlphaValue coverage. Incidentally the drop in average age in 2022 is partly owed to women now occupying 35% of the positions: they are 4 years younger. Thank you to them and to the lawmakers that twisted corporate arms on that matter.

Whilst board members paid a heavy price for their inability to foresee the Great Financial Crisis, they are back in the money but rather modestly so. Which is an intriguing thought and may imply more competition for jobs than we had thought. These average fees are heavily skewed by the high indemnities collected by Swiss and UK board members. French headquartered board members make do with €30k.

Wiser but slower

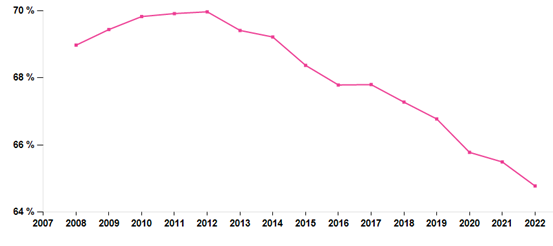

Does the aging of boards matter? Yes as the business models of every single corporate are moving faster than aging boards’ ability to comprehend what is at stake. As AI percolates into the daily routine of businesses, it would help to have more ex CTOs at board level than university chums. Boards have been pretty much handicapped by their monoculture. This is indirectly highlighted by the slowly-falling proportion of board members whose passports are the same as that of the headquarters. Foreigners only account for a third of boards. It is likely that the proportion of women and men with the required knowledge to address the AI shock will be minimal for some time to come.

‘Domestic density’ of European corporate boards (local passports/total board)

The implied outcome is that board crises will multiply and be deeper. If the OpenAI governance saga is any indication, these are bound to be testing times as they will require more than just wisdom.

AlphaValue was started as an ESG first equity research provider in 2007. AlphaValue’s 17-year history of collecting governance data helps churn the interesting following chart of aging board members. As age implies competence, they collect more on average. Obviously the following chart is not rocket science as board members rotate and corporates come and go. But it is as intellectually honest as possible using data sets where all parts are moving.

Average age of board members * (blue line, rhs) vs. average fees (pink, lhs)

Between 2008 and 2022, board members gained nearly 3 years to reach 59 by 2022 but will be mechanically at 60 by 2024. Unless that is, there is an unheard off reshuffling in the governance of the 500-odd corporates that populate the AlphaValue coverage. Incidentally the drop in average age in 2022 is partly owed to women now occupying 35% of the positions: they are 4 years younger. Thank you to them and to the lawmakers that twisted corporate arms on that matter.

Whilst board members paid a heavy price for their inability to foresee the Great Financial Crisis, they are back in the money but rather modestly so. Which is an intriguing thought and may imply more competition for jobs than we had thought. These average fees are heavily skewed by the high indemnities collected by Swiss and UK board members. French headquartered board members make do with €30k.

Wiser but slower

Does the aging of boards matter? Yes as the business models of every single corporate are moving faster than aging boards’ ability to comprehend what is at stake. As AI percolates into the daily routine of businesses, it would help to have more ex CTOs at board level than university chums. Boards have been pretty much handicapped by their monoculture. This is indirectly highlighted by the slowly-falling proportion of board members whose passports are the same as that of the headquarters. Foreigners only account for a third of boards. It is likely that the proportion of women and men with the required knowledge to address the AI shock will be minimal for some time to come.

‘Domestic density’ of European corporate boards (local passports/total board)

The implied outcome is that board crises will multiply and be deeper. If the OpenAI governance saga is any indication, these are bound to be testing times as they will require more than just wisdom.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.