2050 decarbonised Shell?

Shell thought its efforts to become greener were enough when it announced its ambition to reduce its relative Net Carbon Footprint (NCF) by 50% within three decades (2050). Activists pressed for more, saying the plan lacked in actionable steps, with the closest target as a 20% reduction by 2035. Management surrendered and came back with a more detailed planning.

The goal remains intact: reducing the volume of CO2 emitted divided by the amount of energy sold by 50% by 2050 (and by 20% by 2035). What is new is the implementation of specific short-term targets (three- or five-year period) from 2020 onwards.

Management will see their remuneration indexed to the progress made towards the energy transition. Finally, as part of the agreement is a set of processes designed to review progress. As a reminder, Shell defines its NCF as grams of CO2 equivalent per megajoule (including methane and greenhouse gas). (Reminder a megajoule is worth c. 277Wh.)

Breaking down a three-decade goal into up to ten three-year ones logically reinforces the probability of a successful transition (by successful we mean reducing the NCF). Future options are many and we list several observations that can help:

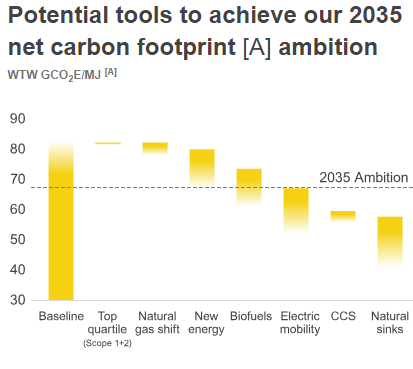

Source: company presentation

The above chart lists Shell's potential tools to reach its 2035 target. What is striking is that the top contributors are coming from new activities. We concur on the low contribution from internal processes' improvements (shown as "Top quartile") as eliminating flaring entirely would reduce the NCF by 1% according to our estimate. Therefore, Shell will need to offset its lucrative oil and gas business against greener activities.

The company does not provide a detailed computation of its NCF but we compute a close match with our estimate, at c.84g CO2/MJ. We estimate the current NCF of oil activities at c.88g CO2/MJ and natural gas at c.78g CO2/MJ. Therefore, growing the share of the production with natural gas is a tool, but one that could not bring down the NCF below 80 (the 2035 target is c.67g CO2/MJ).

Renewables too expensive to offset it all

What is interesting is that Shell has chosen to express its output in an energy unit (i.e. megajoule) and this helps the comparison with utilities. We estimate that the major provides the equivalent of five times the electricity consumption of a country like France.

Adding 25% in additional output (c. 65GW) with green energy would be too costly for the group at this stage (management targets yearly capex of $1-2bn in new energies). It would certainly change Shell's profile dramatically (e.g. Enel Green Power manages 43GW of wind farms, hydroelectric, geothermal, solar and biomass power plants).

Consider for instance, Shell's recent announcement on a 50/50 JV with EDF renewables on an offshore wind farm in New Jersey. Building 2.5GW in offshore wind could bring c.4.4TWh of additional output (taking a 40% energy yield) and could cost more than $2bn to Shell while reducing its current NCF by less than 1%.

In short, being hemmed in by detailed progress reporting is going to be a nightmare for RD/Shell as well as for the rest of the European oil industry as it is inconceivable that shareholders will not ask for similar tracking efforts at competitors.

Valuation

The challenge is huge and compounded by the fact that there are many moving parts. To name but a few: deflation of levelised cost of energy from renewable sources, innovation in biofuels, rate of adoption of electric cars, cost of reforestation projects, etc.

At this stage, electric mobility looks promising (and perhaps explains why several oil integrated companies rushed to acquire charging networks in 2018). This would allow the flowing of more energy (and increase the denominator in the NCF equation) without building more power capacity and use the downstream experience of Shell.

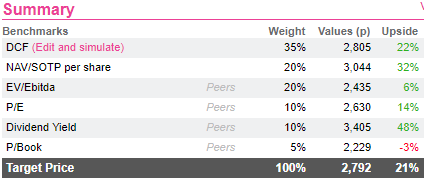

Future updates on how the group plans to meet its energy transition plan will help narrow down gauges. For the moment, our DCF shows a 22% upside with a yearly capex of $2bn into renewables. More would certainly bite. Except for the price to book ratio, all the other valuation indicators are also showing significant upsides, including against peers which ultimately face the same issues.

Being the first integrated to transition may give an edge to Shell as it should have more options in the market. How much that edge is worth may be irrelevant if the whole industry takes a bath as going green on scope 3 is tantamount to closing down the oil business.

Source: company presentation

The above chart lists Shell's potential tools to reach its 2035 target. What is striking is that the top contributors are coming from new activities. We concur on the low contribution from internal processes' improvements (shown as "Top quartile") as eliminating flaring entirely would reduce the NCF by 1% according to our estimate. Therefore, Shell will need to offset its lucrative oil and gas business against greener activities.

The company does not provide a detailed computation of its NCF but we compute a close match with our estimate, at c.84g CO2/MJ. We estimate the current NCF of oil activities at c.88g CO2/MJ and natural gas at c.78g CO2/MJ. Therefore, growing the share of the production with natural gas is a tool, but one that could not bring down the NCF below 80 (the 2035 target is c.67g CO2/MJ).

Renewables too expensive to offset it all

What is interesting is that Shell has chosen to express its output in an energy unit (i.e. megajoule) and this helps the comparison with utilities. We estimate that the major provides the equivalent of five times the electricity consumption of a country like France.

Adding 25% in additional output (c. 65GW) with green energy would be too costly for the group at this stage (management targets yearly capex of $1-2bn in new energies). It would certainly change Shell's profile dramatically (e.g. Enel Green Power manages 43GW of wind farms, hydroelectric, geothermal, solar and biomass power plants).

Consider for instance, Shell's recent announcement on a 50/50 JV with EDF renewables on an offshore wind farm in New Jersey. Building 2.5GW in offshore wind could bring c.4.4TWh of additional output (taking a 40% energy yield) and could cost more than $2bn to Shell while reducing its current NCF by less than 1%.

In short, being hemmed in by detailed progress reporting is going to be a nightmare for RD/Shell as well as for the rest of the European oil industry as it is inconceivable that shareholders will not ask for similar tracking efforts at competitors.

Valuation

The challenge is huge and compounded by the fact that there are many moving parts. To name but a few: deflation of levelised cost of energy from renewable sources, innovation in biofuels, rate of adoption of electric cars, cost of reforestation projects, etc.

At this stage, electric mobility looks promising (and perhaps explains why several oil integrated companies rushed to acquire charging networks in 2018). This would allow the flowing of more energy (and increase the denominator in the NCF equation) without building more power capacity and use the downstream experience of Shell.

Future updates on how the group plans to meet its energy transition plan will help narrow down gauges. For the moment, our DCF shows a 22% upside with a yearly capex of $2bn into renewables. More would certainly bite. Except for the price to book ratio, all the other valuation indicators are also showing significant upsides, including against peers which ultimately face the same issues.

Being the first integrated to transition may give an edge to Shell as it should have more options in the market. How much that edge is worth may be irrelevant if the whole industry takes a bath as going green on scope 3 is tantamount to closing down the oil business.

Access to the full investment case : click here

Access to the full investment case : click here

- The goal is to reduce the relative NCF, not an absolute number.

- Unsurprisingly, the challenge comes from scope 3 emissions. Scopes 1 and 2 are under Shell’s control and will only account for 16% of the total emissions. The vast majority of emissions are “downstream scope 3”, i.e. the use of Shell’s refined products and natural gas.

- Oil-refined products (gasoline, diesel, etc.) account for 52% of the total emissions.

- Petrochemicals, lubricants and bitumen are not included in the current scope 3. This is because the end user does not burn them (i.e. not considered a source of energy).

- Scopes 1 and 2 have been rather stable since 2008.

- Simply put, Shell needs either to increase its total energy output by 25% with renewables (for the 2035 target), reduce its CO2 emitted by 20% or a mix of both.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?