Food Retail Better Dispositions

In the age-old battle between Food Retail and Food & Beverages to capture the consumer dollar, grocers had been expected to be the winner as they are supposed to be closer to what people want. This has not been the case. F&B’s powerful brand names have helped sustain the margins of the food industry and the post-Covid inflation episode even helped it overcharge for a solid two years.

Listed grocers are a declining cohort meaning that their waning market cap is a self fulfilling negative loop. European Food Retail remains largely unlisted which in a way is a message about the difficulties of this industry. The coverage universe is down to 7 stocks with a combined market cap of less than €100bn. Of note, there are 29 European issuers with market caps that are over €100bn.

F&B is a far bigger morsel at €680bn and 19 stocks of which 8 with market caps of below €10bn. It pays however to look at the dynamic of the market caps for both sectors and compare Food Retail with that of F&B. For consistent universes we start this review in 2015. The following picture shows a clear comeback for grocers independently of the collapse of the F&B sector.

Market caps dynamics: F&B (pink) vs. Food Retail (Blue)

This surprising development has been backed by improving fundamentals, fundamentals here being the ROE. The relative outperformance of Food Retail has thus a degree of justification. It can be confirmed at the dividend level where Grocers have increased their dividend by 8% a year vs. zero for F&B.

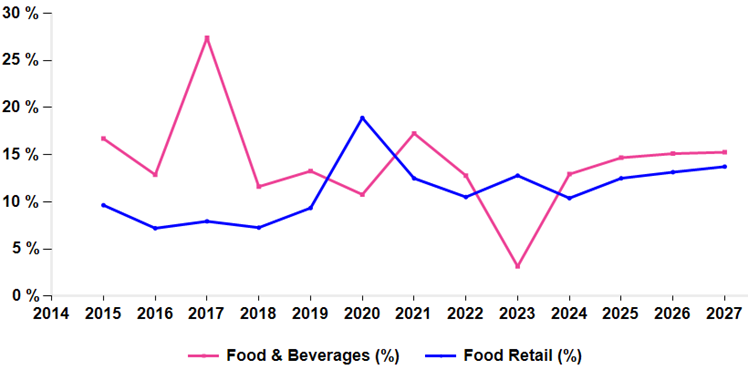

ROE of Food & Beverages (pink) vs. that of Food retail (blue)

So the discreet Food Retail sector may now be in decent shape after all its serial suffering (outdated formats, rear margins cancellations, online shift, difficult staffing, failed diversifications such as banking, telecom services etc., politics/inflation/government interference).

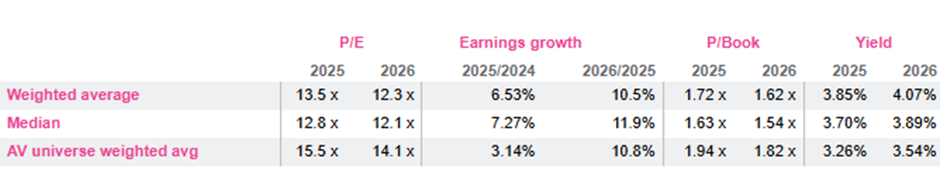

In decent shape and at an attractive price as it happens. The sector has modestly outperformed the index but remains excellent value. Its 13.5x 2025 PE is cheaper than that of the market but still offers 6.5% 2025 eps growth. That looks like an opportunity.

Food Retail attractive fundamentals

AlphaValue maintains its cautious stance when it comes to tariff friction costs on both sides of the pond. In this respect, a largish spoonful of exposure to grocers may turn out to be a good insurance policy.

Listed grocers are a declining cohort meaning that their waning market cap is a self fulfilling negative loop. European Food Retail remains largely unlisted which in a way is a message about the difficulties of this industry. The coverage universe is down to 7 stocks with a combined market cap of less than €100bn. Of note, there are 29 European issuers with market caps that are over €100bn.

F&B is a far bigger morsel at €680bn and 19 stocks of which 8 with market caps of below €10bn. It pays however to look at the dynamic of the market caps for both sectors and compare Food Retail with that of F&B. For consistent universes we start this review in 2015. The following picture shows a clear comeback for grocers independently of the collapse of the F&B sector.

Market caps dynamics: F&B (pink) vs. Food Retail (Blue)

This surprising development has been backed by improving fundamentals, fundamentals here being the ROE. The relative outperformance of Food Retail has thus a degree of justification. It can be confirmed at the dividend level where Grocers have increased their dividend by 8% a year vs. zero for F&B.

ROE of Food & Beverages (pink) vs. that of Food retail (blue)

So the discreet Food Retail sector may now be in decent shape after all its serial suffering (outdated formats, rear margins cancellations, online shift, difficult staffing, failed diversifications such as banking, telecom services etc., politics/inflation/government interference).

In decent shape and at an attractive price as it happens. The sector has modestly outperformed the index but remains excellent value. Its 13.5x 2025 PE is cheaper than that of the market but still offers 6.5% 2025 eps growth. That looks like an opportunity.

Food Retail attractive fundamentals

AlphaValue maintains its cautious stance when it comes to tariff friction costs on both sides of the pond. In this respect, a largish spoonful of exposure to grocers may turn out to be a good insurance policy.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.