Acs adds complexity

[dropcap]H[/dropcap]ochtief (72% controlled by ACS) is expected to launch a takeover bid for Abertis.

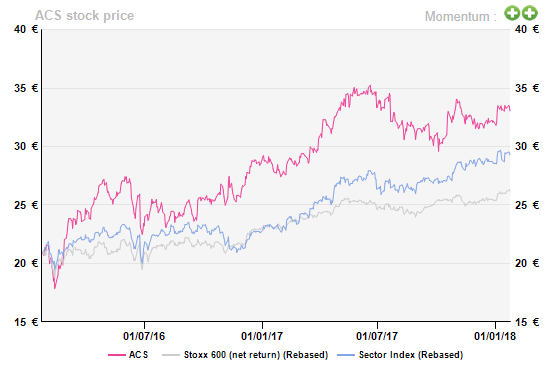

This ACS initiated move would be supported by the “relevant” geographical footprint of the combined company, the strong capital structure of Hochtief and the fact that ACS/Hochtief would preserve the investment grade rating in both companies. At first sight, the industrial basis of this mega deal makes sense but, after a bit of digging, it looks pretty risky, complex and lacking in visibility financially speaking. This has been discounted meaning that ACS can surprise positively either because the deal does not happen or because synergies not yet taken on board by analysts waiting for greenlights will have to be allowed for. Not an easy call though which is the counterpart of the 37% upside potential.

In future, the ROCE will tank as a result of an increase in capital employed, but the operational and financial risks may be lower with less volatility in motorway-type results. Hopefully the ROCE should remain above the Wacc by some distance.

In future, the ROCE will tank as a result of an increase in capital employed, but the operational and financial risks may be lower with less volatility in motorway-type results. Hopefully the ROCE should remain above the Wacc by some distance.

Full analysis is available on Alphavalue’s research platform : www.alphavalue.com

Full analysis is available on Alphavalue’s research platform : www.alphavalue.com

Creating a “Deutsche” Vinci?

The ACS management has suggested that it is replicating Vinci – Ferrovial’s strategy with an Anglo-Saxon twist on top (growth coming from the US, Canada, Australia). Because of its weaker balance sheet, ACS can’t really afford to invest more than €100-200m per year in PPP. The acquisition of Abertis would be a game changer as ACS would be in a position to invest €1bn in PPP per year in greenfield projects. This would be the core of the value proposition in this transaction, as greenfield projects yield double-digit returns, whereas brownfield projects yield mid-single digit returns. Fingers crossed obviously. Then the figures, as posted by ACS, may be too good or too analytical to be true. The value creation of the integrated business would have an estimated Net Present Value (NPV) on synergies of €6-8bn. The current ACS market cap ACS is €10bn while that of Hochtief is €9.7bn. This gives a sense of the ambition. Such projections are mainly driven by accessing a significantly larger share of expanding PPP investment opportunities (NPV of greenfield projects of c.€4-6bn) in the high-growth developed markets of the US, Canada, Australia, as well as Europe (greenfield PPP tender pipeline identified for the period 2018-2021 of c.€200bn and a success ratio of c.30% in the past). These are mostly sales synergies. We all know how difficult it is to deliver on that count but we give credit to the management’s ability to generate them. Synergies also come from cost optimisation (NPV of c.€1bn) and expanding the brownfield business (NPV of c.€1bn). The NPV of all the potential synergies represents c.20-30% of Hochtief and Abertis’ combined market cap, which is huge and may imply that ACS could raise its offer by more than 20% should Atlantia launch a counter bid.Complexity means a discount

The structure of the deal is complex as the final leverage will depend on the choice made by Abertis’ shareholders between cash and new shares in Hochtief. Indeed, the consideration offered to Abertis shareholders will consist of €18.76 per Abertis share or 0.1281 Hochtief shares for 1 Abertis. The limit is 32m new Hochtief shares meaning that, of the €17.1bn, only €4.7bn is equity financed at best. This implies raising €12.4bn in debt financing to complete the deal. Knowing that Abertis has net debt of €15.1bn, the leverage of Hochtief, which currently is cash positive to the tune of c.€1bn, would be c.6× EBITDA pro forma post deal pre disposals. To get back to a 4.8x pro-forma leverage as disclosed by management for the end of 2017, Hochtief would have to dispose of Hispasat, Cellnex and minority positions in some concessions to raise roughly €4bn. The combined company should retain an investment grade rating according to management despite leverage of 4.8x at the closing of the deal post disposals. Management expects to reduce the leverage to 3.7x by 2019, notably through EBITDA growth, namely €5.5bn of EBITDA for the combined entity. Using the target leverage of 3.7x EBITDA, this implies a net debt of €20.3bn, i.e. a deleveraging through cash generation of €2.2bn in roughly two years despite a 90% payout ratio. This seems quite a stretch. This is the reason why management is discussing another solution, namely introducing a hybrid structure.And now a holding discount on top?

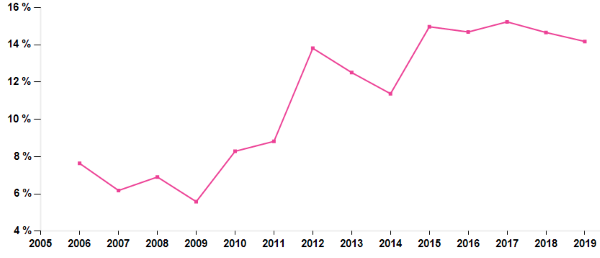

As a consequence of the structure of the deal, Hochtief would be deconsolidated from ACS. This looks like a happy turn of events as the new Hochtief becomes a financial holding company and its mega debt would not nominal ACS debt ratios. ACS would be narrowed down to domestic cash flows while hitherto it has made every effort to look global by way of the Hochtief full consolidation. Spanish operations plus a big controlling stake in Hochtief would turn ACS into even more of a holding company than it is currently. Should the deal be completed, this could turn the complexity discount of the deal into a holding company discount, which would be much lower although the discounts are likely to add up if execution is weak. Moving away from a construction profile into a holding company one is a shame as ACS performs well as a construction stock. As a construction company, ACS is a value creating proposition (c.15% ROCE in 2017E vs c.7% for the sector), especially since 2012, a year during which significant disposals took place (including the sale of the remaining stake in … Abertis in which it held 26% until 2010) in order to lighten its capital employed (from €14.5bn in 2011 to €10.5bn in 2012). The following years (2014-2016) saw a reduction in working capital, which further enhanced the ROCE.ACS’ ROCE development

37% to go

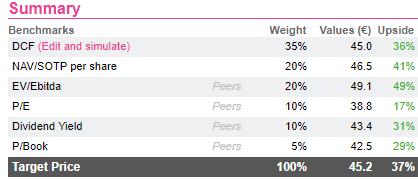

The stock is undervalued on all metrics because ACS has cornered itself into a strategic mess with no control over the time table. Except for the P/E, the valuation metrics converge toward a target price of €43-49 per share, despite a 20% discount to peers. If Abertis is bagged, earnings will have to be reviewed to allow for synergies and complex changes to the consolidation scope. This uncertainty is presumably why investors have been tempted to remain on the side-line.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...