ACS and its Abertis bet

The three-party acquisition of Abertis was a clever move from ACS and Atlantia, as it did away with the risk of overbidding for Abertis' assets, allowed ACS partly to replicate Vinci's business model as well as hopefully capture market share in the growing PPP sector. It finally allowed Atlantia (the leader in that transaction) to diversify away from Italy (from 82% of EBITDA to 45%).

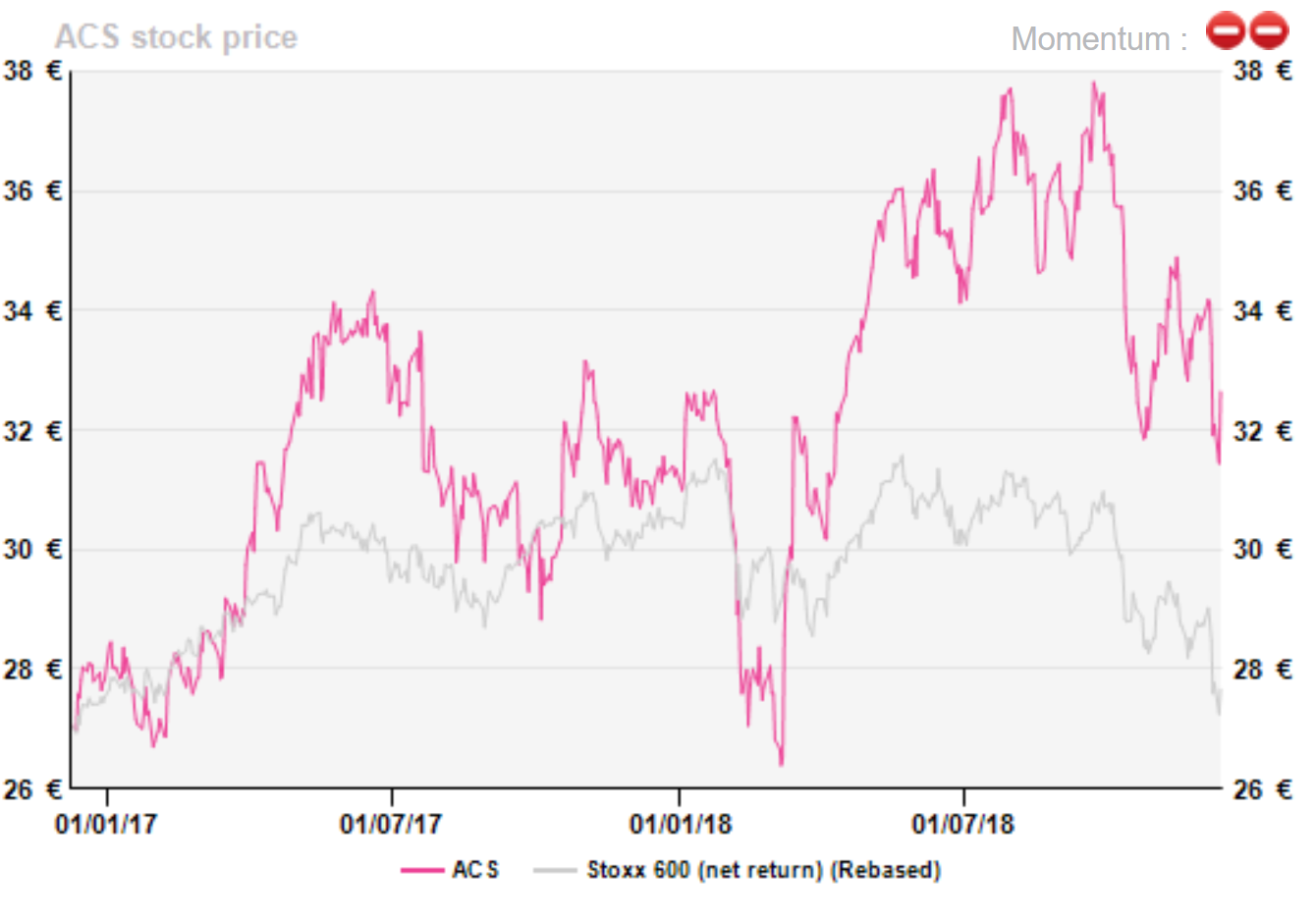

Moreover, by increasing the payout ratio of Abertis to 90% as soon as possible, both companies will extract cash, mainly generated by Spanish and French concessions' assets (65% of Abertis' EBITDA) in order to fund new projects in other countries. It is a fact that the market has reacted rather positively to the complex transaction that took place in March 2018. Complexity is a background issue for a stock in which we currently see a 24% upside potential.

Was the deal at risk because of the Genoa bridge collapse?

With Atlantia bidding for 50% + one share of Abertis, there were worries that the deal would not go through as Atlantia has been made fragile (at least politically) by the Genoa bridge collapse. Such fears eventually proved wrong as the closing of the transaction took place at the end of October at the price of a lower Atlantia dividend payment for FY18 onwards. The provision taken for the bridge collapse was cut down from €500m in a first assessment to €350m for reconstruction and indemnities to family victims and this is before any potential insurance cover.

Does the ACS-Hochtief-Atlantia acquisition of Abertis pave the way for a further consolidation?

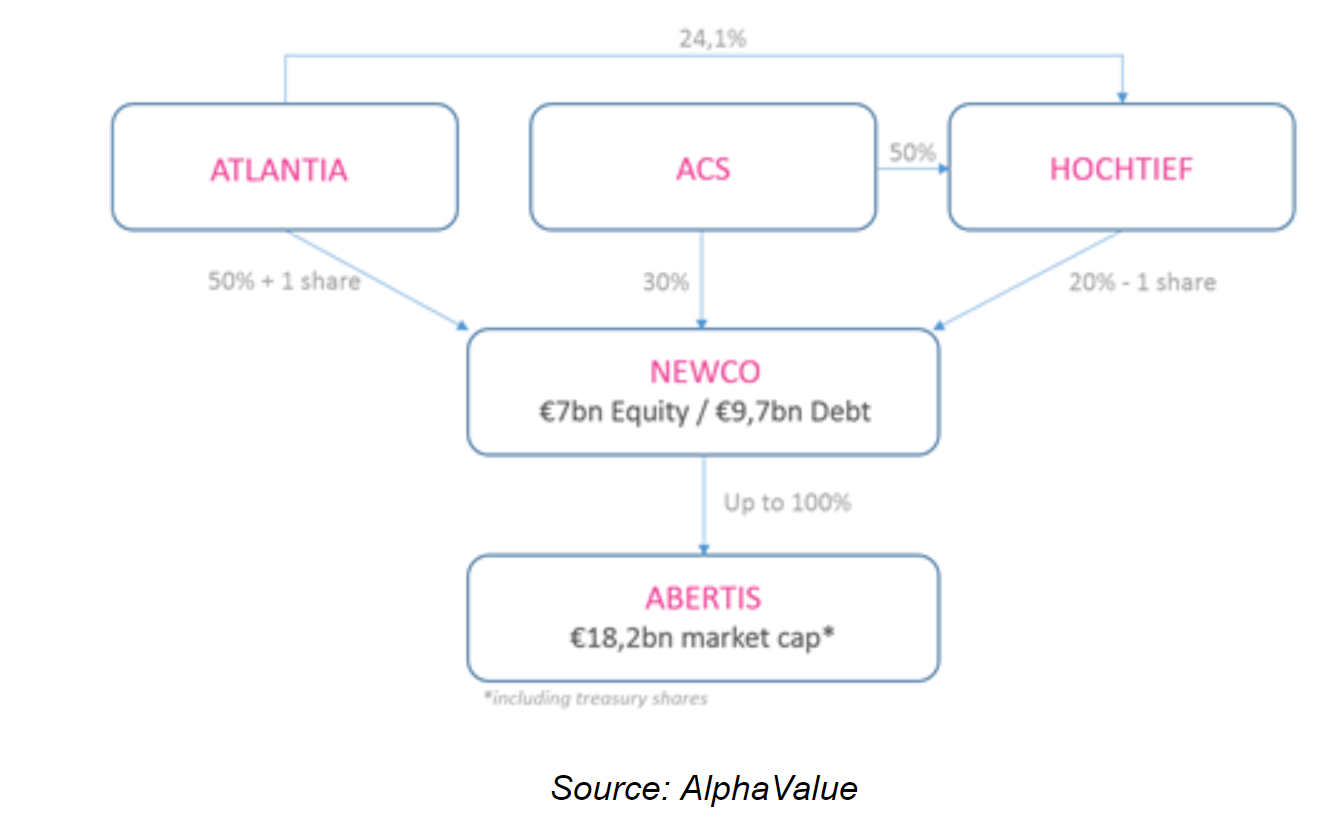

One question that arises is whether there is a case for further consolidation between these three players? Indeed ACS never hid the fact that it was eyeing a full consolidation of listed Hochtief. As a reminder, ACS used Hochtief as an acquisition currency to fund its 30% direct investment in Abertis and 20% indirect investment through Hochtief so that its stake is now 50%, from 74%, while Atlantia owns 24% of Hochtief (see chart). We believe that the smart financial engineering for the purpose of the acquisition is a transitory one and a brake to FCF generation so that there must be phase II once Atlantia has a clearer view of the Genoa bridge implications.

Was the deal at risk because of the Genoa bridge collapse?

With Atlantia bidding for 50% + one share of Abertis, there were worries that the deal would not go through as Atlantia has been made fragile (at least politically) by the Genoa bridge collapse. Such fears eventually proved wrong as the closing of the transaction took place at the end of October at the price of a lower Atlantia dividend payment for FY18 onwards. The provision taken for the bridge collapse was cut down from €500m in a first assessment to €350m for reconstruction and indemnities to family victims and this is before any potential insurance cover.

Does the ACS-Hochtief-Atlantia acquisition of Abertis pave the way for a further consolidation?

One question that arises is whether there is a case for further consolidation between these three players? Indeed ACS never hid the fact that it was eyeing a full consolidation of listed Hochtief. As a reminder, ACS used Hochtief as an acquisition currency to fund its 30% direct investment in Abertis and 20% indirect investment through Hochtief so that its stake is now 50%, from 74%, while Atlantia owns 24% of Hochtief (see chart). We believe that the smart financial engineering for the purpose of the acquisition is a transitory one and a brake to FCF generation so that there must be phase II once Atlantia has a clearer view of the Genoa bridge implications.

While we regard as likely a regular build-up of ACS stake in Hochtief, we however don’t anticipate in the medium term a merger between ACS and Atlantia, as the two companies have clearly different business models and corporate cultures. It is not so long ago that ACS sold its remaining stake in Abertis to concentrate on construction after all.

Atlantia is an asset aggregator as it keeps concession assets on its balance sheet, whereas ACS appears more keen to develop through greenfield concession-type investments and sell when they mature to finance new ones.

Solid 9m18 vs. access to cash

As befits a group not averse to financial engineering, there is a growing discrepancy between the reported cash flow generation and real inter-group companies' cash which is limited to dividends. This is the holding company profile of ACS. It is nothing new as far as Hochtief's contribution is concerned (but remember that it will decline as ACS’s stake in Hochtief contracts to 50% from 74%), while the Abertis contribution is also a dividend-only one (at least initially, see next section).

Putting this in perspective, Hochtief would be expected to pay out €200m or so in 2019 dividends to ACS, while Abertis may contribute another €240m (AV's forecast before Abertis changed hands) of which most will go to service the acquisition's debt interest bill (say €150m). That is good to have but at some distance of consolidated free cash flows of both firms.

While the deal has to convince markets of its eventual industrial benefits, it is fair to say that the ACS price is resisting in a context of a general decline of equity indices. This likely hinges on the strong performance from the construction division. Indeed, the 9m 18 results were solid and management expects to reach an EBITDA of €2.4bn and net profit of over €900m for FY18, a bottom-line level last seen in 2011.

Moreover, the solid backlog growth, up by 10.2% on a FX-adjusted basis, bodes well for FY2019 onwards. As ACS has a strong reputation when it comes to pricing and controlling work in progress, its robust order book is likely to percolate to the bottom line. This is presumably what markets pay for, while the Abertis stake has optional industrial value.

Longer term : go for concessions?

The purpose of the Abertis acquisition for ACS is to access a significantly larger share of expanding PPP investment opportunities in the high-growth developed markets of the US, Canada, Australia, as well as Europe. The greenfield PPP tender pipeline identified for the period 2018-21 is up from €200bn to c.€230bn, and ACS’s success/bid ratio is up from c.30% in the past to 45% recently, meaning that even before closing the Abertis transaction, ACS is becoming more successful and delivers sales synergies. The unanswered main question, as the final agreement has not been reached yet, is whether Abertis will be confined to brownfield investments or will it also be represented in greenfield ones? Investors are eager to hear from managements of ACS and Atlantia about the new strategy of Abertis. This should be disclosed over the release of FY18 results.

Strong upside anyway

Consolidated metrics imperfectly reflect the real cash flow generation but do point toward good value when used in traditional valuation ratios. The consistency of the valuation metrics suggests that it is worth going for but ACS will have to explain rapidly how the Abertis investment becomes cash in excess of dividends.

To get the full report : click here

While we regard as likely a regular build-up of ACS stake in Hochtief, we however don’t anticipate in the medium term a merger between ACS and Atlantia, as the two companies have clearly different business models and corporate cultures. It is not so long ago that ACS sold its remaining stake in Abertis to concentrate on construction after all.

Atlantia is an asset aggregator as it keeps concession assets on its balance sheet, whereas ACS appears more keen to develop through greenfield concession-type investments and sell when they mature to finance new ones.

Solid 9m18 vs. access to cash

As befits a group not averse to financial engineering, there is a growing discrepancy between the reported cash flow generation and real inter-group companies' cash which is limited to dividends. This is the holding company profile of ACS. It is nothing new as far as Hochtief's contribution is concerned (but remember that it will decline as ACS’s stake in Hochtief contracts to 50% from 74%), while the Abertis contribution is also a dividend-only one (at least initially, see next section).

Putting this in perspective, Hochtief would be expected to pay out €200m or so in 2019 dividends to ACS, while Abertis may contribute another €240m (AV's forecast before Abertis changed hands) of which most will go to service the acquisition's debt interest bill (say €150m). That is good to have but at some distance of consolidated free cash flows of both firms.

While the deal has to convince markets of its eventual industrial benefits, it is fair to say that the ACS price is resisting in a context of a general decline of equity indices. This likely hinges on the strong performance from the construction division. Indeed, the 9m 18 results were solid and management expects to reach an EBITDA of €2.4bn and net profit of over €900m for FY18, a bottom-line level last seen in 2011.

Moreover, the solid backlog growth, up by 10.2% on a FX-adjusted basis, bodes well for FY2019 onwards. As ACS has a strong reputation when it comes to pricing and controlling work in progress, its robust order book is likely to percolate to the bottom line. This is presumably what markets pay for, while the Abertis stake has optional industrial value.

Longer term : go for concessions?

The purpose of the Abertis acquisition for ACS is to access a significantly larger share of expanding PPP investment opportunities in the high-growth developed markets of the US, Canada, Australia, as well as Europe. The greenfield PPP tender pipeline identified for the period 2018-21 is up from €200bn to c.€230bn, and ACS’s success/bid ratio is up from c.30% in the past to 45% recently, meaning that even before closing the Abertis transaction, ACS is becoming more successful and delivers sales synergies. The unanswered main question, as the final agreement has not been reached yet, is whether Abertis will be confined to brownfield investments or will it also be represented in greenfield ones? Investors are eager to hear from managements of ACS and Atlantia about the new strategy of Abertis. This should be disclosed over the release of FY18 results.

Strong upside anyway

Consolidated metrics imperfectly reflect the real cash flow generation but do point toward good value when used in traditional valuation ratios. The consistency of the valuation metrics suggests that it is worth going for but ACS will have to explain rapidly how the Abertis investment becomes cash in excess of dividends.

To get the full report : click here

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?