AI Capex, An Accident Waiting To Happen But Not Just Yet

Lately, the hype around the AI trade has reached a new peak. Even central bankers have coalesced to call it a bubble. It is one of course but the FOMO fun is only beginning as corporates themselves have been amazed by the flow of orders as AI competitors ramp up their compute capacity toward some senseless ‘singularity’. Egos run this bubble which means it may well have a way to go yet.

Tens of billions of USD in capex plans are being announced almost every week. This is percolating down to even minor companies, including those not sitting in the USA. European capex suppliers are delighted.

Of course no one can say how much will be actually invested but since much of these investments are for datacentres, a few numbers help illustrate the ongoing momentum:

• McKinsey estimates that by 2030, data centers equipped to handle AI processing loads will require USD 5.2 trillion in capex, and a further USD 1.5 trillion for traditional IT workloads (i.e. c. USD 6.7 trillion in total).

• GPUs and custom AI accelerators are likely to account for roughly two-thirds of total data center capex based on these projections.

• JP Morgan contends that, in the first half of 2025, AI-related capital expenditures alone contributed 1.1% to U.S. GDP growth. That is presumably the most striking figure.

• Microsoft plans to spend c. $80bn in FY2025 on AI-enabled data centers & infrastructure while OpenAI has dominated the news with its mind blowing $1Tn ‘plan’. What is in it and who pays is not that clear.

These numbers are absolutely mind blowing and so was the stock market reaction. Unfortunately for European equity markets, the AI game remains overwhelmingly dominated by the US with China emerging as a strong contender.

European stocks that benefit from the AI trade

European companies are global players and will benefit from capex plans abroad. While the amounts announced in Europe for AI-related projects are dwarfed by U.S. plans, they are still substantial. Hyperscalers (Microsoft, Google, AWS) have announced several large-scale investments in Europe. That adds to the demand addressed to local capital goods providers.

We identify three categories of potential beneficiaries among listed European names:

• The companies producing chips that are enabling AI (none are European; TSMC, Intel, Samsung, Hynix as well as SMIC and Cambricon in China come to mind ) as well as those manufacturing the gear necessary to the production of said chips (ASM Int., ASML, VAT, Besi, etc.)

• The companies that are directly providing building and electrical items for datacenters (Schneider and Legrand or companies like Swiss Belimo) or those that provide the grid solutions necessary to connect those datacenters to the grid and power them (Siemens Energy notably). We count 24 issuers in the 550-strong AlphaValue coverage with a combined market cap of €1.1tn. As even the Saint Gobains of this world are saying that they see growth in AI, it is a fair bet that every corporate will be in this list soon enough.

• Electricity producers that will ultimately benefit from a rising price of electricity. That plays at the margin for European utilities as so far only US local power markets are impacted.

Hype and bubble: What could derail the fairy tale?

For now return on capital employed (ROCE) for AI investments looks inexistent, with paying end-demand insufficient to justify the absurd spending. A case of massive capital misallocation looks to be in the pipe line, leading to asset write-offs and excess processing capacity for a long while.

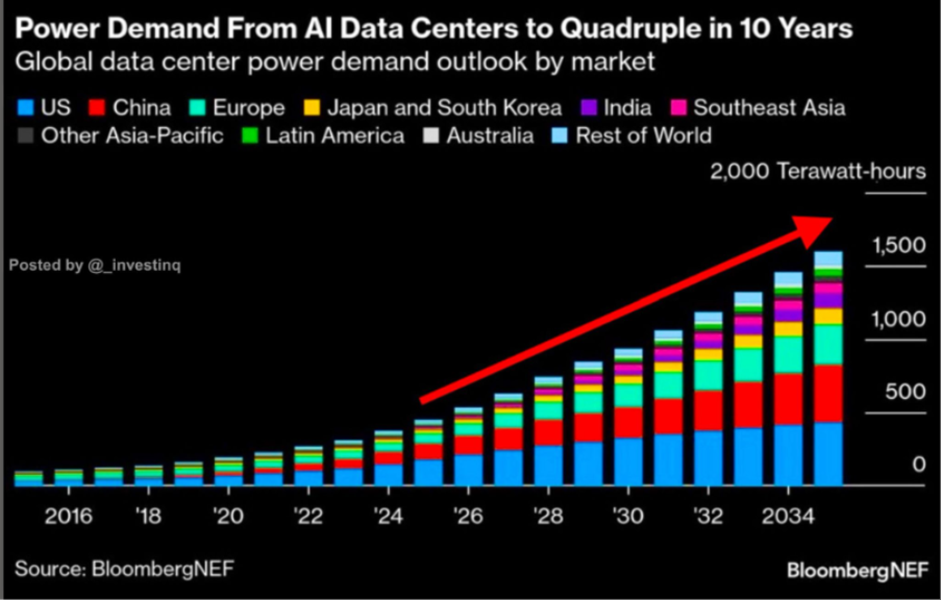

Assuming genuine end-demand emerges (meaning consumers’ willingness to pay, not mere curiosity) the next binding constraint may well be power. AI’s energy consumption is likely to be staggering: by 2035, AI-related data centres could demand 1,600 TWh or roughly four times today’s levels.

This implies that electricity demand will very likely far outpace supply, triggering further price increases. Every chat with an AI model, every image generated, every line of code produced consumes energy. Even if demand exists, the cost of meeting it could far exceed the current assumptions.

Tens of billions of USD in capex plans are being announced almost every week. This is percolating down to even minor companies, including those not sitting in the USA. European capex suppliers are delighted.

Of course no one can say how much will be actually invested but since much of these investments are for datacentres, a few numbers help illustrate the ongoing momentum:

• McKinsey estimates that by 2030, data centers equipped to handle AI processing loads will require USD 5.2 trillion in capex, and a further USD 1.5 trillion for traditional IT workloads (i.e. c. USD 6.7 trillion in total).

• GPUs and custom AI accelerators are likely to account for roughly two-thirds of total data center capex based on these projections.

• JP Morgan contends that, in the first half of 2025, AI-related capital expenditures alone contributed 1.1% to U.S. GDP growth. That is presumably the most striking figure.

• Microsoft plans to spend c. $80bn in FY2025 on AI-enabled data centers & infrastructure while OpenAI has dominated the news with its mind blowing $1Tn ‘plan’. What is in it and who pays is not that clear.

These numbers are absolutely mind blowing and so was the stock market reaction. Unfortunately for European equity markets, the AI game remains overwhelmingly dominated by the US with China emerging as a strong contender.

European stocks that benefit from the AI trade

European companies are global players and will benefit from capex plans abroad. While the amounts announced in Europe for AI-related projects are dwarfed by U.S. plans, they are still substantial. Hyperscalers (Microsoft, Google, AWS) have announced several large-scale investments in Europe. That adds to the demand addressed to local capital goods providers.

We identify three categories of potential beneficiaries among listed European names:

• The companies producing chips that are enabling AI (none are European; TSMC, Intel, Samsung, Hynix as well as SMIC and Cambricon in China come to mind ) as well as those manufacturing the gear necessary to the production of said chips (ASM Int., ASML, VAT, Besi, etc.)

• The companies that are directly providing building and electrical items for datacenters (Schneider and Legrand or companies like Swiss Belimo) or those that provide the grid solutions necessary to connect those datacenters to the grid and power them (Siemens Energy notably). We count 24 issuers in the 550-strong AlphaValue coverage with a combined market cap of €1.1tn. As even the Saint Gobains of this world are saying that they see growth in AI, it is a fair bet that every corporate will be in this list soon enough.

• Electricity producers that will ultimately benefit from a rising price of electricity. That plays at the margin for European utilities as so far only US local power markets are impacted.

Hype and bubble: What could derail the fairy tale?

For now return on capital employed (ROCE) for AI investments looks inexistent, with paying end-demand insufficient to justify the absurd spending. A case of massive capital misallocation looks to be in the pipe line, leading to asset write-offs and excess processing capacity for a long while.

Assuming genuine end-demand emerges (meaning consumers’ willingness to pay, not mere curiosity) the next binding constraint may well be power. AI’s energy consumption is likely to be staggering: by 2035, AI-related data centres could demand 1,600 TWh or roughly four times today’s levels.

This implies that electricity demand will very likely far outpace supply, triggering further price increases. Every chat with an AI model, every image generated, every line of code produced consumes energy. Even if demand exists, the cost of meeting it could far exceed the current assumptions.

So there is no lack of operating obstacles

Another party pooper is more likely to be the weird turn taken by the financing of AI projects at least those of OpenAI. Circular and incestuous come to mind.

Nvidia is pumping cash into OpenAI which raises debt funding and pumps cash into AMD, an Nvidia competitor of tomorrow, while private debt funds rush to fund data centers against securities in the shape of GPUs whose obsolescence is precipitated by the competition around Nvidia. In other words, retail investors in private instruments look set to be left holding the hot potato. While Gafam players essentially fund the AI craze through their abundant cash flows, the ecosystem around OpenAI looks very leveraged.

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...