AlphaValue Europea Equities Strategy Meeting: Key Takeaways

Every quarter, Pierre-Yves GAUTHIER, AlphaValue's head of strategy, leads a strategy meeting to discuss the latest developments in the equity markets. These meetings primarily focus on reviewing sectors, including valuations, earnings trends, industry insights, and impressive profitability.

During the most recent strategy meeting, a crucial question loomed on the agenda: Can the current three-year period of excessive profits persist? In this dynamic era, we find ourselves in a world where Nestlé boldly raises its prices by 20% in just six months. Simultaneously, banks are experiencing their highest Return on Equity (ROE) since 2007, while the signals of an impending recession oscillate between cautious red and hopeful green within a single day. The key highlights of this review centered around sectors such as Automotive, Banking, Real Estate & Holding companies, Insurance, Mining, Capital Goods, and Health (excluding Pharmaceuticals).

Sudden Change of Regime in European Earnings

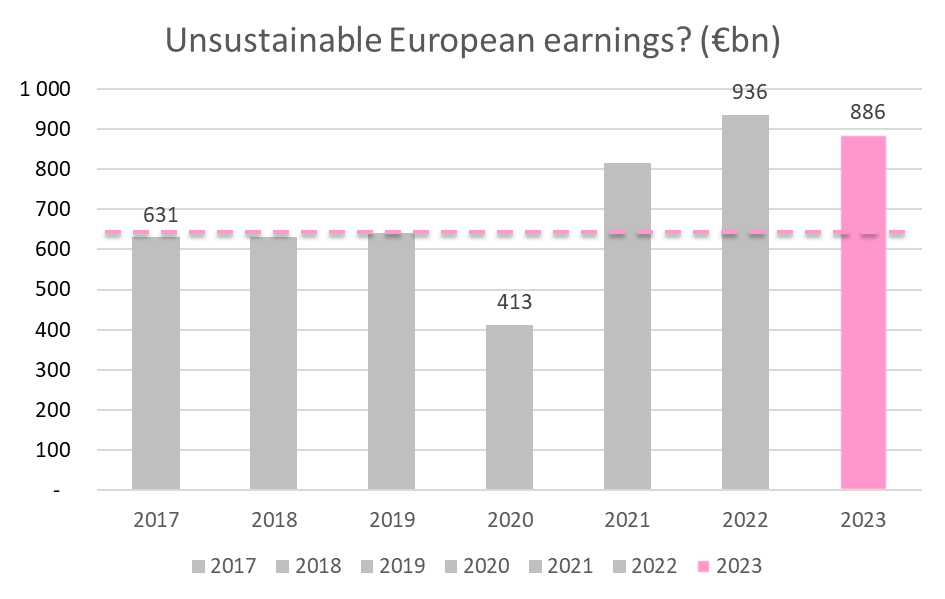

We are talking about the companies in the AlphaValue coverage. The profit run-rate had been around 600 billion until 2019, but it jumped to c. 900 billion in 2021 and 2022 on a combination of free money and margin widening top line inflation. We believe that such a significant increase is not sustainable.

Excess Returns Last Longer

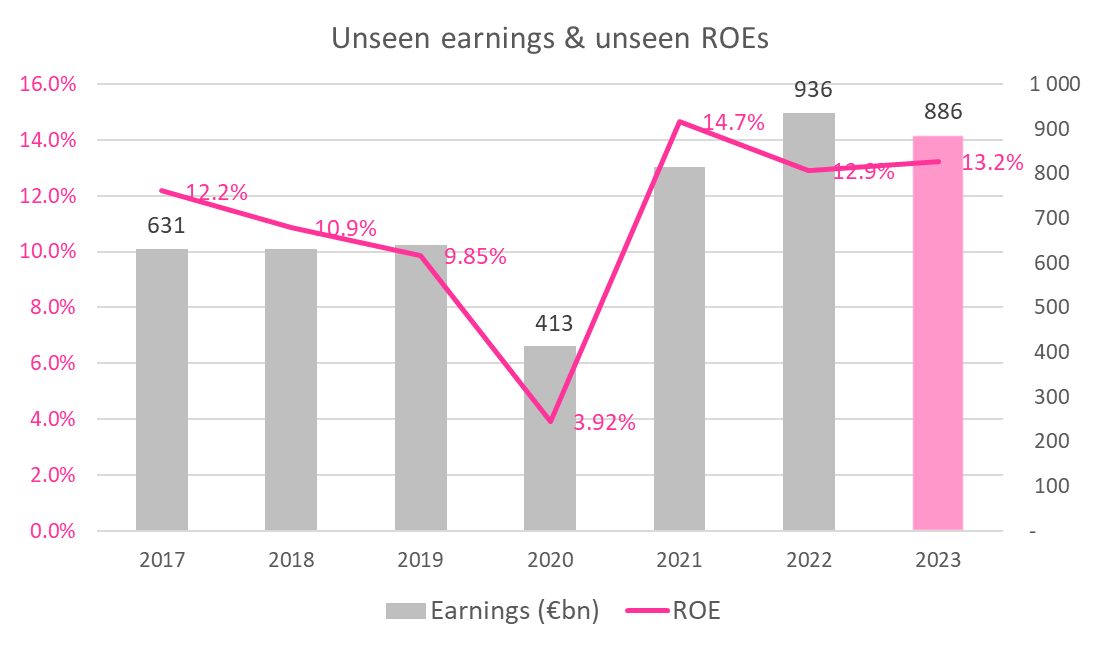

Within the AlphaValue universe, the current expected return on equity surpasses even the highest level ever recorded in 2017. 2017 was marked by robust earnings in Europe, fueled by global demand, creating a favorable and healthy environment.

However, the narrative takes a completely different turn in 2022 and 2023. It is surprising to witness such elevated returns when the macroeconomic landscape is distinctly more than that of 2017. The contextual differences raise questions about the sustainability of these high returns in the current scenario.

Amazing EBIT Margin Resilience – Ex Financials and Deep Cyclicals

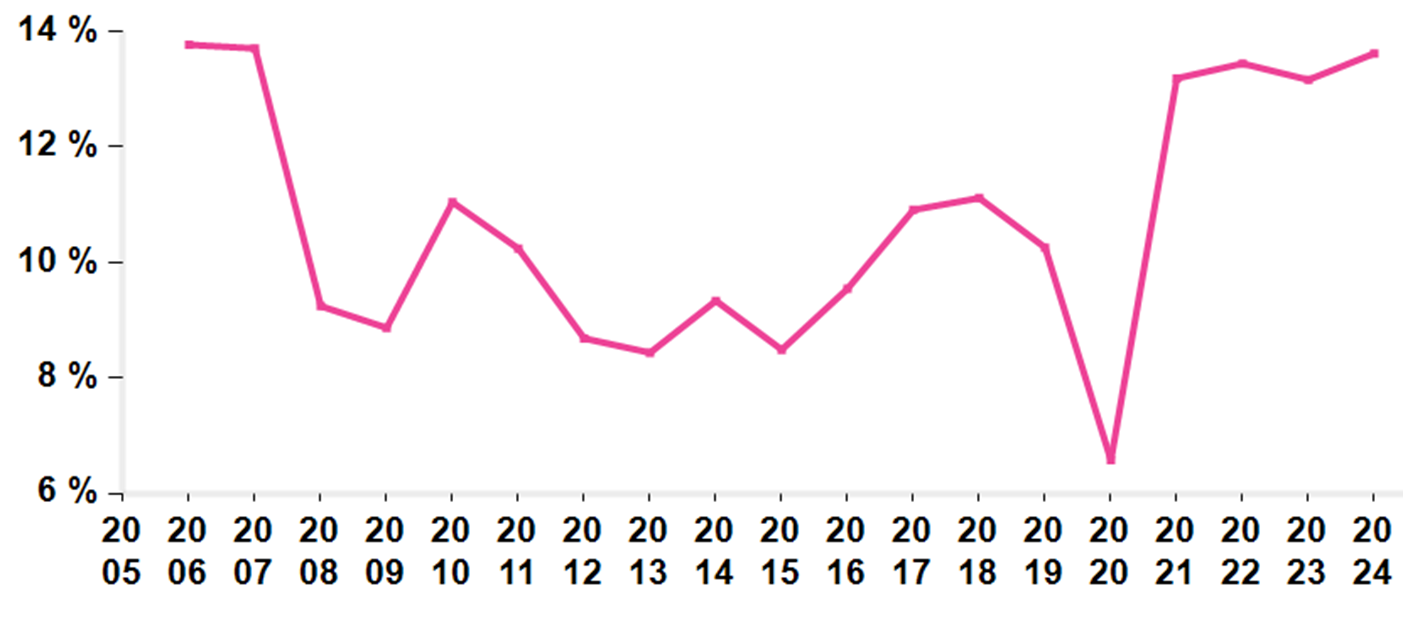

Until 2021, we observed a consistent and stable run rate in terms of EBIT margin, ranging between 10.5% and 11%. However, in 2021, there was a sudden deviation from this trend. It is important to exclude deep cyclicals and financials from this analysis, as the EBIT margin for these sectors does not provide meaningful insights. The abrupt change in 2021 can be attributed to the availability of easy money.

Where are 2023 Earnings coming from?

The insurance sector is expected to be the largest contributor to new earnings in 2023, while the oil sector is anticipated to have the weakest performance. When considering all sectors combined a decrease of €49 billion Euros is in the pipeline. Notably, the swing in the insurance sector can be attributed to reinsurance, which is not expected to incur significant net losses as it did in 2022. On a positive note, the capital goods, utilities, and pharmaceutical sectors are performing well.

The full replay, along with the other topics discussed, are available on Alphavalue.eu

During the most recent strategy meeting, a crucial question loomed on the agenda: Can the current three-year period of excessive profits persist? In this dynamic era, we find ourselves in a world where Nestlé boldly raises its prices by 20% in just six months. Simultaneously, banks are experiencing their highest Return on Equity (ROE) since 2007, while the signals of an impending recession oscillate between cautious red and hopeful green within a single day. The key highlights of this review centered around sectors such as Automotive, Banking, Real Estate & Holding companies, Insurance, Mining, Capital Goods, and Health (excluding Pharmaceuticals).

Sudden Change of Regime in European Earnings

We are talking about the companies in the AlphaValue coverage. The profit run-rate had been around 600 billion until 2019, but it jumped to c. 900 billion in 2021 and 2022 on a combination of free money and margin widening top line inflation. We believe that such a significant increase is not sustainable.

Excess Returns Last Longer

Within the AlphaValue universe, the current expected return on equity surpasses even the highest level ever recorded in 2017. 2017 was marked by robust earnings in Europe, fueled by global demand, creating a favorable and healthy environment.

However, the narrative takes a completely different turn in 2022 and 2023. It is surprising to witness such elevated returns when the macroeconomic landscape is distinctly more than that of 2017. The contextual differences raise questions about the sustainability of these high returns in the current scenario.

Amazing EBIT Margin Resilience – Ex Financials and Deep Cyclicals

Until 2021, we observed a consistent and stable run rate in terms of EBIT margin, ranging between 10.5% and 11%. However, in 2021, there was a sudden deviation from this trend. It is important to exclude deep cyclicals and financials from this analysis, as the EBIT margin for these sectors does not provide meaningful insights. The abrupt change in 2021 can be attributed to the availability of easy money.

Where are 2023 Earnings coming from?

| |

Adjusted attrib. net profit |

Deltas | |||

| Sector (in €bn) |

2021 |

2022 |

2023 |

2022 vs. 2021 |

2023 vs. 2022 |

| Insurance |

44 |

40 |

51 |

-4 |

12 |

| Capital Goods |

25 |

21 |

29 |

-4 |

8 |

| Utilities |

35 |

35 |

41 |

-1 |

7 |

| Pharma |

56 |

64 |

70 |

8 |

6 |

| Other Financials |

49 |

27 |

33 |

-22* |

6 |

| Consumer Durables |

27 |

29 |

33 |

2 |

4 |

| Semiconductors |

11 |

13 |

17 |

2 |

4 |

| Hotel, Catering & Leisure |

-1 |

4 |

7 |

5 |

3 |

| Aerospace-Defence |

9 |

10 |

13 |

1 |

2 |

| Health |

14 |

13 |

15 |

-1 |

2 |

| Software |

10 |

7 |

9 |

-3 |

2 |

| Telecoms |

26 |

27 |

28 |

1 |

2 |

| Food & Beverages |

43 |

48 |

50 |

5 |

1 |

| Chemicals |

31 |

24 |

25 |

-6 |

1 |

| Households |

18 |

18 |

19 |

0 |

1 |

| IT Services |

1 |

3 |

4 |

2 |

1 |

| Infrastructure |

4 |

7 |

8 |

3 |

1 |

| Food Retail |

7 |

7 |

7 |

0 |

1 |

| Media |

9 |

10 |

10 |

1 |

1 |

| Non-Food Retail |

9 |

9 |

10 |

0 |

1 |

| Support Services |

5 |

5 |

5 |

0 |

0 |

| IT Hardware |

5 |

5 |

5 |

0 |

0 |

| Building Prod. & Materials |

13 |

14 |

13 |

2 |

-1 |

| Paper & Packaging |

4 |

5 |

3 |

1 |

-2 |

| Real Estate |

11 |

10 |

6 |

-2 |

-4 |

| Autos |

62 |

74 |

68 |

13 |

-6 |

| Banks |

125 |

137 |

130 |

11 |

-7 |

| Metals & Mining |

86 |

80 |

59 |

-6 |

-21 |

| Transport |

14 |

39 |

15 |

25 |

-24 |

| Oils |

64 |

151 |

102 |

88 |

-50 |

| Total |

816 |

936 |

886 |

120 |

-49 |

The insurance sector is expected to be the largest contributor to new earnings in 2023, while the oil sector is anticipated to have the weakest performance. When considering all sectors combined a decrease of €49 billion Euros is in the pipeline. Notably, the swing in the insurance sector can be attributed to reinsurance, which is not expected to incur significant net losses as it did in 2022. On a positive note, the capital goods, utilities, and pharmaceutical sectors are performing well.

The full replay, along with the other topics discussed, are available on Alphavalue.eu

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...