Atlantia is not Italian

Atlantia is your typical concession company, meaning a robust business model and recurrent cash flows. It diversified into Airport concessions in 2013 and two of its motorway concessions held by 88%-owned Autostrade were prolonged in April 2018 by four years.

Atlantia post Abertis acquisition’s EM significant exposure (9% EBITDA from Brazil, 9% from Chile, 4% from Puerto Rico) means significant FX risk, while its average maturity of gross debt below nine years vs average concessions maturity at c. 22 years result in an obvious ALM mismatch and rate risks. Both are more important than the Genoa dramatic event.

Risks are, however, fully offset by a uniquely balanced portfolio of concession assets that turn Atlantia into a rare investment proposition. The Morandi/Genoa disaster offers a unique entry point.

Morandi bridge: a human disaster, not a financial one

As a reminder, Autostrade, 88%-controlled by Atlantia, is the concessionaire of the A10 motorway whose Morandi bridge in Genoa collapsed on 14 August, killing 43 people. The Morandi bridge event triggered a wave of political uncertainties. The financial cost for rebuilding and paying indemnities to families’ victims has been estimated by the company at €500m.

For good measure, we doubled that amount for the purpose of projecting the costs to Atlantia's 2018 consolidated accounts. There will be indirect effects and it is a fact that big jobs such as this bridge repair tend to overshoot their budgets. But even this €1bn provision only accounts for less than 5% of the market capitalisation pre-disaster and c.1.5% of the EV post Abertis acquisition versus a stock-price collapse of close to 30%.

Populism is back and with it bureaucratic burble

Even before an inquiry was completed, enlightened politicians explained that the collapse was due to a lack of maintenance works.

Then Luigi Di Maio, deputy prime minister and Five Star leader, announced that the next step was to nationalise Autostrade (and all motorways managed by private companies). The reality of a €15bn tag for the equity alone did not sink in immediately.

Nor the fact that the Italian state would have to book an extra €10bn in debt. As a matter of fact, according to Gioavanni Castellucci, Chief Executive of Atlantia and Autostrade, an agreement signed in 2007 prevents the government from revoking the licence without a severe financial penalty computed as the NPV of profits expected up until the end of the concession.

Populist politicians have tried to turn the voters’ ire against the Benetton family (30% owners of Atlantia) and the 1999 political establishment that led to the privatisation of Autostrade.

The privatisation process is now said to have been unclear. This amounts to much ado with little practical traction.

In the background, any silly move against Atlantia is a case of putting even more at risk the signature of the Italian state, while the 2019 budgeting exercise is already a tight-rope exercise.

Battling against the Benettons on political grounds is not worth a 50bp increase in sovereign spreads.

The last hurdle to the Italian coalition posturing is the late discovery that China’s Silk Road Fund holds a 5% stake in Autostrade per l’Italia, controlled by Atlantia.

That is the true insurance policy of Atlantia shareholders: the Italian government will be hard pressed to treat Autostrade’s shareholders differently.

The Morandi tree hides an infrastructure forest

The one positive thing that should push the Morandi/Autostrade issue firmly in the background is the successful acquisition of Abertis (jointly with ACS) a value-creative deal in terms of ROCE and EPS in the first year of full consolidation. Atlantia emerges as the biggest toll roads operator in the world.

Should the Italian government ever find a way to nationalise parts of Autostrade against NPV-ed future profits, it would endow Atlantia with the funds to diversify further out of Italy and put the light on what Atlantia truly is: an infrastructure fund with a remarkable balance of assets geographically speaking.

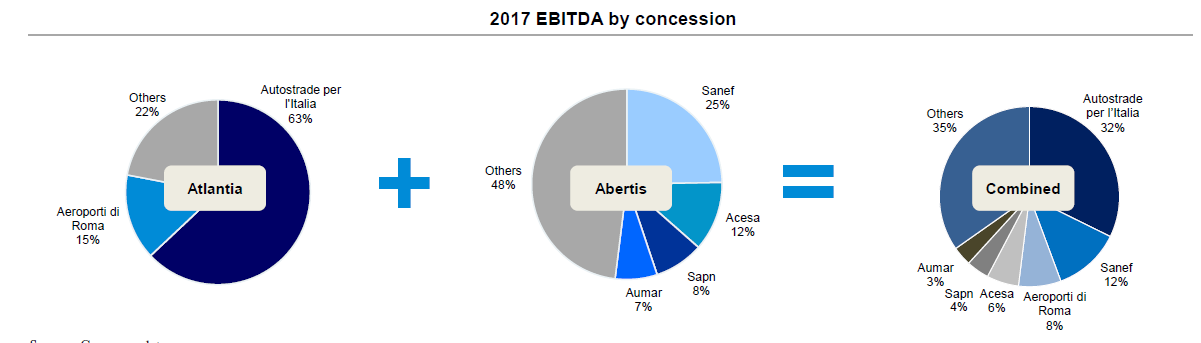

Here is a company-provided balance of its concessions post merger:

Post merger assets

Morandi bridge: a human disaster, not a financial one

As a reminder, Autostrade, 88%-controlled by Atlantia, is the concessionaire of the A10 motorway whose Morandi bridge in Genoa collapsed on 14 August, killing 43 people. The Morandi bridge event triggered a wave of political uncertainties. The financial cost for rebuilding and paying indemnities to families’ victims has been estimated by the company at €500m.

For good measure, we doubled that amount for the purpose of projecting the costs to Atlantia's 2018 consolidated accounts. There will be indirect effects and it is a fact that big jobs such as this bridge repair tend to overshoot their budgets. But even this €1bn provision only accounts for less than 5% of the market capitalisation pre-disaster and c.1.5% of the EV post Abertis acquisition versus a stock-price collapse of close to 30%.

Populism is back and with it bureaucratic burble

Even before an inquiry was completed, enlightened politicians explained that the collapse was due to a lack of maintenance works.

Then Luigi Di Maio, deputy prime minister and Five Star leader, announced that the next step was to nationalise Autostrade (and all motorways managed by private companies). The reality of a €15bn tag for the equity alone did not sink in immediately.

Nor the fact that the Italian state would have to book an extra €10bn in debt. As a matter of fact, according to Gioavanni Castellucci, Chief Executive of Atlantia and Autostrade, an agreement signed in 2007 prevents the government from revoking the licence without a severe financial penalty computed as the NPV of profits expected up until the end of the concession.

Populist politicians have tried to turn the voters’ ire against the Benetton family (30% owners of Atlantia) and the 1999 political establishment that led to the privatisation of Autostrade.

The privatisation process is now said to have been unclear. This amounts to much ado with little practical traction.

In the background, any silly move against Atlantia is a case of putting even more at risk the signature of the Italian state, while the 2019 budgeting exercise is already a tight-rope exercise.

Battling against the Benettons on political grounds is not worth a 50bp increase in sovereign spreads.

The last hurdle to the Italian coalition posturing is the late discovery that China’s Silk Road Fund holds a 5% stake in Autostrade per l’Italia, controlled by Atlantia.

That is the true insurance policy of Atlantia shareholders: the Italian government will be hard pressed to treat Autostrade’s shareholders differently.

The Morandi tree hides an infrastructure forest

The one positive thing that should push the Morandi/Autostrade issue firmly in the background is the successful acquisition of Abertis (jointly with ACS) a value-creative deal in terms of ROCE and EPS in the first year of full consolidation. Atlantia emerges as the biggest toll roads operator in the world.

Should the Italian government ever find a way to nationalise parts of Autostrade against NPV-ed future profits, it would endow Atlantia with the funds to diversify further out of Italy and put the light on what Atlantia truly is: an infrastructure fund with a remarkable balance of assets geographically speaking.

Here is a company-provided balance of its concessions post merger:

Post merger assets

Infrastructure has attracted possibly too much money of late starting with pension funds looking for long duration assets. Plenty of this money has been invested in mediocre projects with a poor understanding of what operating those assets truly costs.

Atlantia has the experience and a unique asset base so that long money should go for paper concessions at a discount rather than bid for the real thing at a premium. This is precisely what Atlantia tries to do as it bid $1.2bn for concessions assets from failed IL&FS (India). Atlantia shareholders should think along the same line.

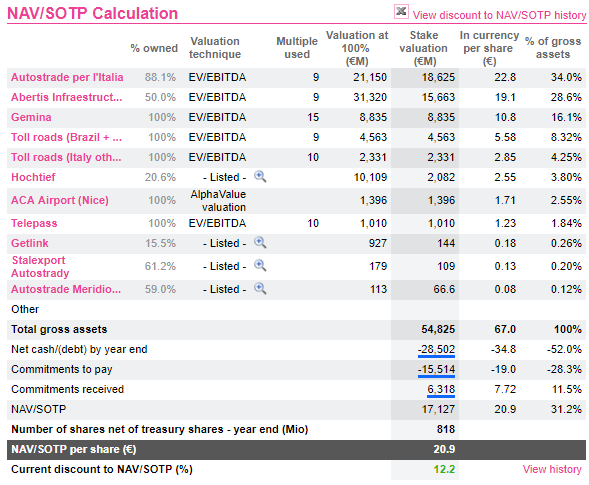

The following is a breakdown of Atlantia’s NAV. It cuts a long story short. We have allowed for the fact that IFRS12 provisions are effectively disgorged (part of the €15bn logged as “commitments to pay”).

Infrastructure has attracted possibly too much money of late starting with pension funds looking for long duration assets. Plenty of this money has been invested in mediocre projects with a poor understanding of what operating those assets truly costs.

Atlantia has the experience and a unique asset base so that long money should go for paper concessions at a discount rather than bid for the real thing at a premium. This is precisely what Atlantia tries to do as it bid $1.2bn for concessions assets from failed IL&FS (India). Atlantia shareholders should think along the same line.

The following is a breakdown of Atlantia’s NAV. It cuts a long story short. We have allowed for the fact that IFRS12 provisions are effectively disgorged (part of the €15bn logged as “commitments to pay”).

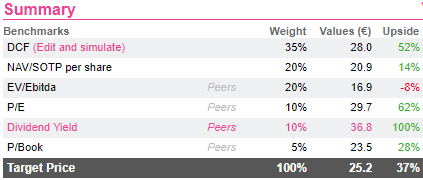

The various AlphaValue metrics do point to a 37% upside potential.

The various AlphaValue metrics do point to a 37% upside potential.

Full fundamental analysis available on www.alphavalue.com

Full fundamental analysis available on www.alphavalue.com

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...