Auto's Self Inflicted Deepening Scars

Earnings trimming for Autos is in full swing. Even before being possibly swamped by Chinese EV imports, European car manufacturers have managed to shoot themselves in the foot as they compute that the cost of CAFE fines for failing to meet emission targets could be as high as €10-15bn for the industry. These fines are coming on top of rapidly contracting operating margins as prices do not stick and rise further. European car manufacturers just do not shift enough cars to digest the untold costs of going EV when the market is not ready to pay much more than €25k for a set of electric wheels.

The EC CAFE regulations will most probably be softened as European car makers have been prompt to push their agenda to their local politicians. But they cannot trash Brussels either as Brussels is pushing for tariffs high enough to contain the first wave of Chinese car imports. So far, Chinese cars are more a threat than a wave actually, partly because Chinese car manufacturers have good products, but not enough shipping capabilities and not much of a European commercial set up to sell and service those cars.

A mighty mess for now

The picture has also been made confused by the fact that western car makers are also importing from their Chinese manufacturing bases, with Tesla leading the way. Stellantis is working on knock down (CKDs) kits to assemble Chinese designed cars (from Leap Motors). Throw into that complexity the battery equation, a most central one as it is the single largest cost of an EV. Chinese battery suppliers will supply a working product with a high carbon content while European battery start-ups have green credentials but face ramp-up issues (NorthVolt). Whether to apply high tariffs on Chinese batteries is an industry-wide conundrum as it will make European manufacturing even less competitive. Besides using carbon border rights as an exclusion mechanism is bound to fail as Chinese battery suppliers are moving green very fast.

In short, the European car industry is a mess for its European activities.

Europeans' business in China looks beyond repair

For the Europeans acting in China to service the cut-throat Chinese car market, the word mess is to be replaced by disaster. There is no room left for non-Chinese players when the local offer combines good products, catering to Chinese taste, with a ‘digital/software’ paradigm where the product cycle is very short and incredibly innovative. Western players not only find it hard to adapt but have to make go with untold shackles such as legacy assets and political issues. Consider Volkswagen facing forced labour allegations and only lose-lose options when trying to come clean on the subject.

As China is keen to dominate the world car industry, it is tempting to conclude that European players’ Chinese positions as industrial players are as good as stranded assets. Selling another Ferrari shall not be an issue but selling another Volkswagen Passat is out of reach when a BYD or a Huawei Smart Car is available next door. Volkswagen is now considering closing down its Nanjing plant, part of its JV with SAIC. That speaks for itself.

In blunt terms, European car manufacturers are facing an impossible act at home and a wipe-out in China. Roughly a third of their value will be gone as China has no need for European (or US) car suppliers where volume matters.

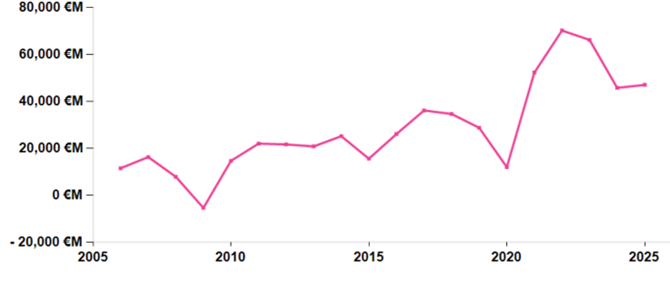

In spite of active trimming of its earnings expectations (€46bn today vs. €60bn six months ago, Porsche AG excluded to avoid double-counting with Volkswagen), one can see in the following chart that the potential for cuts is not negligible. It will take a few extra quarters to measure whether the European Autos' earnings run rate is not closer to €20bn.

European Autos earnings (ex Porsche AG)

The EC CAFE regulations will most probably be softened as European car makers have been prompt to push their agenda to their local politicians. But they cannot trash Brussels either as Brussels is pushing for tariffs high enough to contain the first wave of Chinese car imports. So far, Chinese cars are more a threat than a wave actually, partly because Chinese car manufacturers have good products, but not enough shipping capabilities and not much of a European commercial set up to sell and service those cars.

A mighty mess for now

The picture has also been made confused by the fact that western car makers are also importing from their Chinese manufacturing bases, with Tesla leading the way. Stellantis is working on knock down (CKDs) kits to assemble Chinese designed cars (from Leap Motors). Throw into that complexity the battery equation, a most central one as it is the single largest cost of an EV. Chinese battery suppliers will supply a working product with a high carbon content while European battery start-ups have green credentials but face ramp-up issues (NorthVolt). Whether to apply high tariffs on Chinese batteries is an industry-wide conundrum as it will make European manufacturing even less competitive. Besides using carbon border rights as an exclusion mechanism is bound to fail as Chinese battery suppliers are moving green very fast.

In short, the European car industry is a mess for its European activities.

Europeans' business in China looks beyond repair

For the Europeans acting in China to service the cut-throat Chinese car market, the word mess is to be replaced by disaster. There is no room left for non-Chinese players when the local offer combines good products, catering to Chinese taste, with a ‘digital/software’ paradigm where the product cycle is very short and incredibly innovative. Western players not only find it hard to adapt but have to make go with untold shackles such as legacy assets and political issues. Consider Volkswagen facing forced labour allegations and only lose-lose options when trying to come clean on the subject.

As China is keen to dominate the world car industry, it is tempting to conclude that European players’ Chinese positions as industrial players are as good as stranded assets. Selling another Ferrari shall not be an issue but selling another Volkswagen Passat is out of reach when a BYD or a Huawei Smart Car is available next door. Volkswagen is now considering closing down its Nanjing plant, part of its JV with SAIC. That speaks for itself.

In blunt terms, European car manufacturers are facing an impossible act at home and a wipe-out in China. Roughly a third of their value will be gone as China has no need for European (or US) car suppliers where volume matters.

In spite of active trimming of its earnings expectations (€46bn today vs. €60bn six months ago, Porsche AG excluded to avoid double-counting with Volkswagen), one can see in the following chart that the potential for cuts is not negligible. It will take a few extra quarters to measure whether the European Autos' earnings run rate is not closer to €20bn.

European Autos earnings (ex Porsche AG)

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...