AXA is on the move and uniquely cheap

When AXA presented two years ago its "Ambition 2020" plan, it was considered as rather ambitious indeed, and, when a refreshed management team took the helm, reaching targets became even more of a question mark.

Halfway through, we suddenly discover that Thomas Buberl, its young CEO, has the merit of bringing a new vision without fully challenging the course set by its predecessor. Even with the 5 March big news about the XL Group $15bn acquisition, targets have been confirmed.

Investors voted with their feet apparently on doubts about the financing pattern of the transaction. We see no issue there, a 29% upside potential, and would certainly buy on this dip.

Capital increase not required

The primary reason for the drop in the AXA share price is doubts about its funding scheme for that all cash €12.3bn: €3.5bn coming from cash at hand, €6.0bn stemming from the planned IPO of US assets and related transactions and €3bn by way of subordinated debt.

As a reminder, the 33% premium paid for XL leads to a 15x which is about twice the 8x of AXA. The borrowing costs of AXA at well below 5% makes a cash financing a no-brainer.

There is no cause for worry. About cash generation, the insurer delivered €6.3bn in 2016. The insurer benefited from the strong cash remittance from its subsidiaries while it was not active, until yesterday, in the M&A market.

The €3bn in subordinated debt would push total subordinated debt to c. €13bn against equity of €72bn by the end of 2018 on our initial computations.

The risk obviously lies in the US IPO and its €6bn expected proceeds. It is a good intent for the time being. Given the profile of AXA Equitable Holdings (Individual Retirement, Group Retirement, Investment Management & Research, Protection solutions), we hold the view that it should be an easy call, markets willing.

Should there be a hiccup, AXA has assets at hand that should help avoid a capital increase. In the very near term, AXA has a €9bn back-up bridge financing in place.

Dividend not at risk

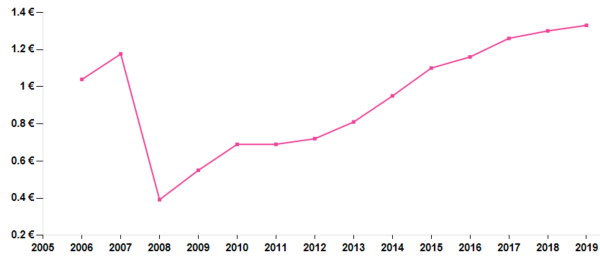

Another possible case for disappointment would be that the €2bn of net positive position after the US IPO is not paid out. Well, but for its 2008 plunge, AXA has a history of being a steady payer (see chart) with a pay-out guidance of 45-55% until 2020. Conversely, it has no taste for buy-backs.

Dividends at insurers are not “funded” by FCF only, as this is a difficult to handle metric. It is nevertheless odd that AXA made a mention of cash remittances from its subsidiaries which reached €4.9bn in 2017, more than covering its own dividend as if it had a need to convince on that perspective.

Capital increase not required

The primary reason for the drop in the AXA share price is doubts about its funding scheme for that all cash €12.3bn: €3.5bn coming from cash at hand, €6.0bn stemming from the planned IPO of US assets and related transactions and €3bn by way of subordinated debt.

As a reminder, the 33% premium paid for XL leads to a 15x which is about twice the 8x of AXA. The borrowing costs of AXA at well below 5% makes a cash financing a no-brainer.

There is no cause for worry. About cash generation, the insurer delivered €6.3bn in 2016. The insurer benefited from the strong cash remittance from its subsidiaries while it was not active, until yesterday, in the M&A market.

The €3bn in subordinated debt would push total subordinated debt to c. €13bn against equity of €72bn by the end of 2018 on our initial computations.

The risk obviously lies in the US IPO and its €6bn expected proceeds. It is a good intent for the time being. Given the profile of AXA Equitable Holdings (Individual Retirement, Group Retirement, Investment Management & Research, Protection solutions), we hold the view that it should be an easy call, markets willing.

Should there be a hiccup, AXA has assets at hand that should help avoid a capital increase. In the very near term, AXA has a €9bn back-up bridge financing in place.

Dividend not at risk

Another possible case for disappointment would be that the €2bn of net positive position after the US IPO is not paid out. Well, but for its 2008 plunge, AXA has a history of being a steady payer (see chart) with a pay-out guidance of 45-55% until 2020. Conversely, it has no taste for buy-backs.

Dividends at insurers are not “funded” by FCF only, as this is a difficult to handle metric. It is nevertheless odd that AXA made a mention of cash remittances from its subsidiaries which reached €4.9bn in 2017, more than covering its own dividend as if it had a need to convince on that perspective.

Another scenario contemplated by markets was the acquisition of an asset manager. Only a few months ago, the insurer was reviewing a merger or a JV for its European asset management unit (AXA IM) and its €746bn of AuM, only to conclude that it regards the business as a strategic one.

Going for scale may have more restructuring costs than it is worth. Still the size bug may reappear anytime in this industry.

The untold plan: go P&C

In one fell swoop, AXA shifted from a Life & Savings operator battling for ever-more size to a P&C play. Among all big insurers, AXA is unique in managing this conversion. It made an early start over the last two years by ridding itself from its important guaranteed annuity business in key markets (Switzerland, Germany, Italy, and Asia) and focusing instead on unit-linked products.

The need for additional capital to fund the in-force business dropped and freed resources to strategic priorities (Health, P&C Commercial lines and Protection).

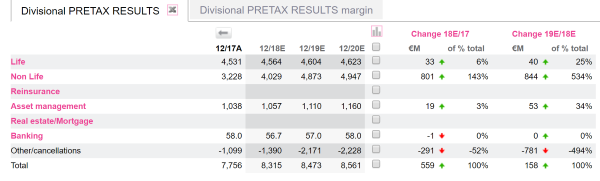

Mechanically, P&C will have become the largest contributor to earnings. P&C is a business with low margins, supposedly at risk from the digital revolution that brings pricing transparency and a decline in insurable acts, but it is inherently more stable. Scale is important.

Another scenario contemplated by markets was the acquisition of an asset manager. Only a few months ago, the insurer was reviewing a merger or a JV for its European asset management unit (AXA IM) and its €746bn of AuM, only to conclude that it regards the business as a strategic one.

Going for scale may have more restructuring costs than it is worth. Still the size bug may reappear anytime in this industry.

The untold plan: go P&C

In one fell swoop, AXA shifted from a Life & Savings operator battling for ever-more size to a P&C play. Among all big insurers, AXA is unique in managing this conversion. It made an early start over the last two years by ridding itself from its important guaranteed annuity business in key markets (Switzerland, Germany, Italy, and Asia) and focusing instead on unit-linked products.

The need for additional capital to fund the in-force business dropped and freed resources to strategic priorities (Health, P&C Commercial lines and Protection).

Mechanically, P&C will have become the largest contributor to earnings. P&C is a business with low margins, supposedly at risk from the digital revolution that brings pricing transparency and a decline in insurable acts, but it is inherently more stable. Scale is important.

Dip buying

The big change in valuation will concern AXA’s NAV. Its P&C business is to become the main contributor to its SOTP. All valuation metrics are deeply in the black after investors took a negative view of the deal.

The high target price implied by its book value is a reflection on the ridiculously high levels at Prudential which is still regarded as a peer.

This may not be really relevant. Just as well with more of a P&C profile, EmbV-based valuations lose in terms of pertinence but are still worth having. The point is that AXA is on the move and uniquely cheap.

Dip buying

The big change in valuation will concern AXA’s NAV. Its P&C business is to become the main contributor to its SOTP. All valuation metrics are deeply in the black after investors took a negative view of the deal.

The high target price implied by its book value is a reflection on the ridiculously high levels at Prudential which is still regarded as a peer.

This may not be really relevant. Just as well with more of a P&C profile, EmbV-based valuations lose in terms of pertinence but are still worth having. The point is that AXA is on the move and uniquely cheap.

AXA’s dividend history, no wrong step since 2008

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...