Barclays: An open letter to Mr Bramson

We do not know each other but I am taking the liberty of writing to you to wish you all the best in your attempt to boost Barclays' valuation. Even if I know that you are driven by the interests of your turnaround fund “Sherborne Investors”, we are in the same boat and your success would help me wash the shame off of having underperformed the sector with a misplaced Buy recommendation.

You will tell me that one does not die of shame. Maybe not but it is painful.

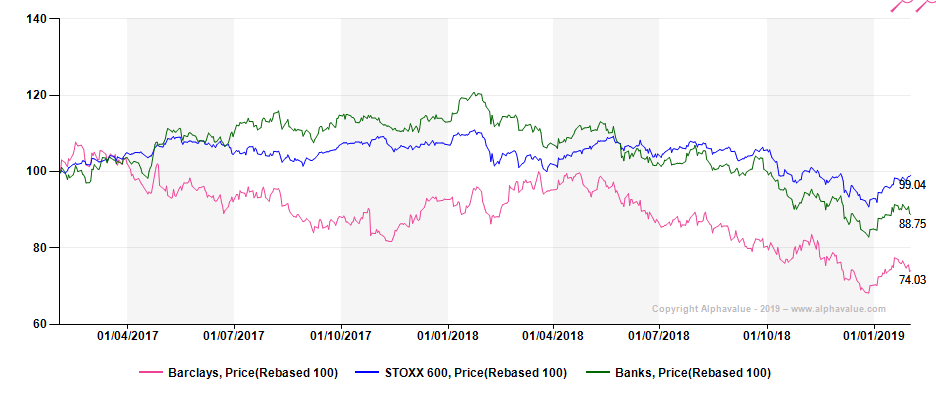

Barclays vs sector and market

Source: AlphaValue

If I am correct, your fund has built up a 5.5% stake in Barclays in early 2018 and since then you have campaigned to get a seat on the Board in order to have a say on the strategy. Indeed, you are not the sort to count only on the market’s mispricing and management’s actions to get a higher return than the one provided by the invisible hand.

According to the FT, you have identified the issue that prevents Barclays’ stock from trading at par with its book value per share: the investment bank division. I imagine that you consider that the division’s return is not commensurate with the additional risk it creates for the group as a whole and that invested capital would be better employed in the group’s other activities. In that context, your plan is straightforward: it consists in scaling back and optimising the investment banking division.

The reason I am writing to you is that I am wondering if your diagnosis is correct.

First of all, it is worth remembering that the issue of the profitability drag of universal banks’ CIB divisions is not new. Hence, I remember that in the late 90s, when I was a junior analyst in charge of French banks (at that time the quintessence of universal banking with German private banks), my comments were already largely focused on the equity value trapped in unprofitable bloated CIB divisions. If the solution is so obvious, one can wonder why it has not been implemented earlier. Maybe because the profitability optimisation issue is not the only dimension that governs a company’s decisions. What is the objective of a company? Like any living system, survival. Profitability is a prerequisite but not the only condition to meet that objective. Diversification (be it from a business or geographical standpoint) is key in achieving that goal even if it will be not rewarded by the market via a lower cost of capital as investors are not ready to pay for something they can implement by themselves.

Secondly, as opposed to you, I am not convinced that the valuation discount reflects an un-proper risk-reward.

Your opinion is based on the idea that investment banking revenues are more volatile, making this business riskier than others and requesting a higher cost of capital. Lots of articles have already commented on this major misconception about risk. Volatility and accessorily uncertainty are not risk. Risk is a permanent and above all certain loss. In other words, risk relates to default, that is to say the death of the company. Do universal banks have a higher probability of default than say commercial banks? This is not what agencies’ ratings or history tell us. If the Great Financial Crisis was initiated by US investment banks, it is worth remembering that troubled institutions were specialised broker dealers with no banking licence. In Europe, a large if not the largest portion of failed banks (I consider nationalisation as a failure) belonged to the commercial banking segment.

In that context, it is hard to say that Barclays’ CIB division, which generated an annualised 10% RoTE over the first nine months, destroys value. Such a return compares favourably with the likes of BNP or SocGen, and is in line with the average return expected on the sector as a whole. In other words, nothing brilliant but nothing abnormal which deserves such a discount to the book value.

Of course, this compares unfavourably with the group’s two other business, namely UK commercial banking and the Consumer, Cards & Payments divisions which both generated an annualised +20% RoTE in the first nine months.

However, these returns were largely inflated by benign costs of risks (respectively 37bp and 170bp), significantly below across-the-cycle levels (respectively 70bp and 300bp based on historical averages). When normalised, these returns fall below 15%.

And last, one cannot expect to move equity from investment banking to commercial banking with a simple magic wand. In mature markets, such a move could not be performed without a terrible impact on margins and risk.

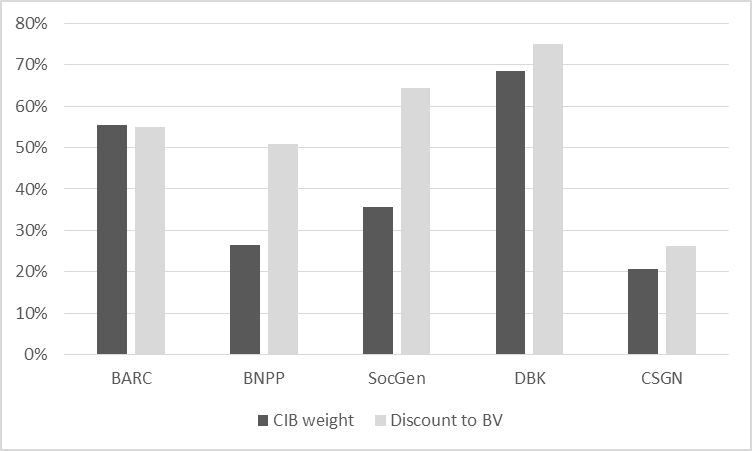

What is the rationale behind the valuation discount if the latter is not primarily driven by an un-proper risk reward? I believe it just reflects market’s scepticism about the viability of investment banking activities in Europe. An idea officially supported by UCG’s CEO, Mr Mustier (see our Latest “CIB is dead, longlive commercial banking”) who recently stated that he believes that EU banks have definitely lost the battle for CIB in favour of US banks. Hence, it is striking to see that EU universal banks’ discounts to the book value largely correspond to the weighting of their CIB divisions within their allocated capital.

EU universal banks: CIB weight vs book value discount

Source: AlphaValue

If I am correct, your fund has built up a 5.5% stake in Barclays in early 2018 and since then you have campaigned to get a seat on the Board in order to have a say on the strategy. Indeed, you are not the sort to count only on the market’s mispricing and management’s actions to get a higher return than the one provided by the invisible hand.

According to the FT, you have identified the issue that prevents Barclays’ stock from trading at par with its book value per share: the investment bank division. I imagine that you consider that the division’s return is not commensurate with the additional risk it creates for the group as a whole and that invested capital would be better employed in the group’s other activities. In that context, your plan is straightforward: it consists in scaling back and optimising the investment banking division.

The reason I am writing to you is that I am wondering if your diagnosis is correct.

First of all, it is worth remembering that the issue of the profitability drag of universal banks’ CIB divisions is not new. Hence, I remember that in the late 90s, when I was a junior analyst in charge of French banks (at that time the quintessence of universal banking with German private banks), my comments were already largely focused on the equity value trapped in unprofitable bloated CIB divisions. If the solution is so obvious, one can wonder why it has not been implemented earlier. Maybe because the profitability optimisation issue is not the only dimension that governs a company’s decisions. What is the objective of a company? Like any living system, survival. Profitability is a prerequisite but not the only condition to meet that objective. Diversification (be it from a business or geographical standpoint) is key in achieving that goal even if it will be not rewarded by the market via a lower cost of capital as investors are not ready to pay for something they can implement by themselves.

Secondly, as opposed to you, I am not convinced that the valuation discount reflects an un-proper risk-reward.

Your opinion is based on the idea that investment banking revenues are more volatile, making this business riskier than others and requesting a higher cost of capital. Lots of articles have already commented on this major misconception about risk. Volatility and accessorily uncertainty are not risk. Risk is a permanent and above all certain loss. In other words, risk relates to default, that is to say the death of the company. Do universal banks have a higher probability of default than say commercial banks? This is not what agencies’ ratings or history tell us. If the Great Financial Crisis was initiated by US investment banks, it is worth remembering that troubled institutions were specialised broker dealers with no banking licence. In Europe, a large if not the largest portion of failed banks (I consider nationalisation as a failure) belonged to the commercial banking segment.

In that context, it is hard to say that Barclays’ CIB division, which generated an annualised 10% RoTE over the first nine months, destroys value. Such a return compares favourably with the likes of BNP or SocGen, and is in line with the average return expected on the sector as a whole. In other words, nothing brilliant but nothing abnormal which deserves such a discount to the book value.

Of course, this compares unfavourably with the group’s two other business, namely UK commercial banking and the Consumer, Cards & Payments divisions which both generated an annualised +20% RoTE in the first nine months.

However, these returns were largely inflated by benign costs of risks (respectively 37bp and 170bp), significantly below across-the-cycle levels (respectively 70bp and 300bp based on historical averages). When normalised, these returns fall below 15%.

And last, one cannot expect to move equity from investment banking to commercial banking with a simple magic wand. In mature markets, such a move could not be performed without a terrible impact on margins and risk.

What is the rationale behind the valuation discount if the latter is not primarily driven by an un-proper risk reward? I believe it just reflects market’s scepticism about the viability of investment banking activities in Europe. An idea officially supported by UCG’s CEO, Mr Mustier (see our Latest “CIB is dead, longlive commercial banking”) who recently stated that he believes that EU banks have definitely lost the battle for CIB in favour of US banks. Hence, it is striking to see that EU universal banks’ discounts to the book value largely correspond to the weighting of their CIB divisions within their allocated capital.

EU universal banks: CIB weight vs book value discount

Source: company data, AlphaValue

Putting a zero value on the allocated equity is probably excessive but the market is telling us that it would be definitely too optimistic to expect the release of the allocated equity if the business has to be closed shortly, as it would have to absorb the cost of liquidation. To give a sense of the potential losses, it is worth having in mind related operating expenses (almost £8bn) and non-derivative level 3 assets (around £10bn) which could prove optimistically priced if they have to be monetised rapidly.

But the radical approach of the market has a big advantage. It means that the current valuation provides investors with a free call option on the value of the CIB business. If one believes it is not worth zero, then it looks like a free lunch.

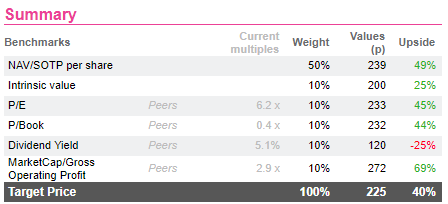

Best regards and attached below is a comforting valuation for your perusal.

Source: company data, AlphaValue

Putting a zero value on the allocated equity is probably excessive but the market is telling us that it would be definitely too optimistic to expect the release of the allocated equity if the business has to be closed shortly, as it would have to absorb the cost of liquidation. To give a sense of the potential losses, it is worth having in mind related operating expenses (almost £8bn) and non-derivative level 3 assets (around £10bn) which could prove optimistically priced if they have to be monetised rapidly.

But the radical approach of the market has a big advantage. It means that the current valuation provides investors with a free call option on the value of the CIB business. If one believes it is not worth zero, then it looks like a free lunch.

Best regards and attached below is a comforting valuation for your perusal.

Research report and analyst access : click here

Research report and analyst access : click here

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.